Greetings from Florida and the Midwest. Pictured is one of our newest finds in North Kansas City called the Iron District, a collection of shops and restaurants including the best sourdough in town (website here). We hope everyone is enjoying both NCAA tournaments this weekend, and, for the record (here), every men’s bracket was busted prior to the first tipoff yesterday.

We are quickly coming to the end of the first quarter, and, after a full market commentary, we will turn our attention to first quarter earnings. Deviating from our traditional “Questions we would ask” format, we are going to focus this week on cable’s response. We think this is the most important earnings season for the cable industry in some time and will offer our view on how we think they will respond (hint: while mobile is important, it’s not their only lever).

The fortnight that was

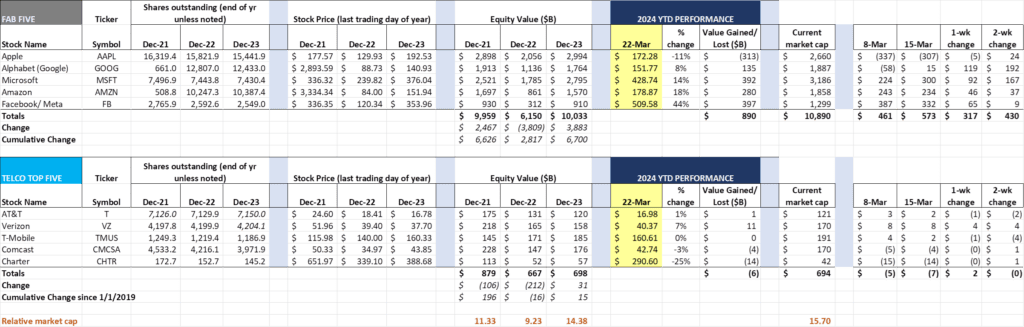

For all of the handwringing about the Depart of Justice’s lawsuit against Apple (more on that below), the Fab Five had a very good week (+$317 billion this week and +$430 billion over the last two). After the closing bell sounded on Friday, Apple was down a mere $5 billion or 0.19%, and even managed a small gain for the two-week period. Each of the remaining Fab Five stocks had a terrific week. The group is closing in on a cumulative $11 trillion valuation.

While the Fab Five rose this week, we cannot understate the enormity of this week’s DOJ action against Apple (coverage by the New York Times here and the Wall Street Journal here. You can read the actual lawsuit through a link from this Times website). We have read it and believe that, if successful, Apple will need to separate its application store and all other applications from its hardware and iOS operating system. This strikes at the heart of Apple’s product design which builds on vertical integration.

Being a global smartphone provider is an extremely complex task. Apple has accomplished a feat few thought possible – condensing the world’s telecommunications needs into no more than four models (see which countries match to which iPhone 15 model here). This is driven by country-specific network/spectrum and other requirements. In the link the four models correspond to a) the US and Puerto Rico; b) Japan, Canada, the US Virgin Islands, Guam, and Saudi Arabia; c) China, Hong Kong, and Macau, and d) Everywhere else. It’s remarkable, given 5G rollout schedules, spectrum policies (including satellite access), and other peculiarities of our global community, that Apple can condense it down to 4 Stock Keeping units or SKUs.

What we read in the lawsuit is that the DOJ wants the same accommodation for networks and cellular radios to be extended to additional functions (how we pay, how we game, how we stream, how we message). While this sounds good on its face, forcing the opening of these interfaces is neither cheap nor easy and it creates a lot of extra troubleshooting. If each credit card issuer now has to have the opportunity to be on the iPhone, how long will it take to release the iPhone 18 or 19? Will there need to be a US version with Bank of America’s wallet (alongside Apple Wallet)? Can a customer have two wallets? How about three?

This is not to excuse a spate of bad behavior on Apple’s part over the last 16 years. The approval process is clunky and frustrating, especially if it involves a telecom function (e.g., until the global telecom community forced their hand, Apple actively hindered the interrogation of the incoming phone number, delaying effective spam call prevention). All big companies (Microsoft, Google, Amazon included) are harder to work with than smaller companies. That reason alone should not drive the aggressive remedy described earlier.

As we are learning about OpenAI (which is, in Elon Musk’s estimation, “a closed source, maximum-profit company effectively controlled by Microsoft”), the original mantra of an “Open” smartphone world was promulgated by Silicon Valley to get Verizon, AT&T, and Sprint to provide wide-ranging (and, in most cases, free) application interfaces. It worked for a few years, but, as we learned through the Google Maps spat in 2012 (here), Apple was not wild about having a competitive maps app in their store. Apple, because of their many brushes with corporate death, has a corporate paranoia that is unique.

What we find intriguing is that the DOJ is foisting a very complex remedy on Apple. Should Apple be required to have Facetime on Android? We aren’t so sure that’s a good solution. What is clear is that there will be a lot of legal fees. For extra context on the topic, please refer to Assistant Attorney General Jonathan Kanter’s interview with CNBC this week here and transcript here.

Against the backdrop of this lawsuit, Apple and Google are rumored to announce a partnership that would integrate Google’s Gemini Artificial Intelligence into Apple smartphones (New York Times article here). It is highly likely that they will introduce this product in the coming months. Will the DOJ intervene and force a competing AI product to launch at the same time as the Google Gemini solution? How will consumers clearly understand which version they are using (if they are both embedded into Siri)? Will this work like a SIM card where the consumer picks an AI engine, a wallet, and a messaging platform at the time of sale/ conversion? Can a customer change their AI provider at will?

More competition is essential to innovation – just ask the telco community of the 1960s, 1970s, and 1980s. But choice can be messy. There’s a reason why we cannot pick one battery maker over another for an electric vehicle, and why we cannot always select any competitive chipset for a Dell computer. This lawsuit will be about the minimum array of alternatives Apple must provide. We believe the DOJ will press for a wide array, and, under a second Biden term, will likely win.

Is it time for an RDOF and CAF II amnesty window? No.

A lot of questions have been raised concerning the possible default of Rural Development Opportunity Fund (RDOF) participants and the corresponding impact of still penalties on these companies and subsequent Broadband Equity Access and Deployment (BEAD) funding (see full coverage of the letter sent last month to the FCC on the topic from Light Reading here). The logic is straightforward: Creating an incentive for winning bidders to default now (because of a lower penalty) will increase the probability that more homes will be served through BEAD.

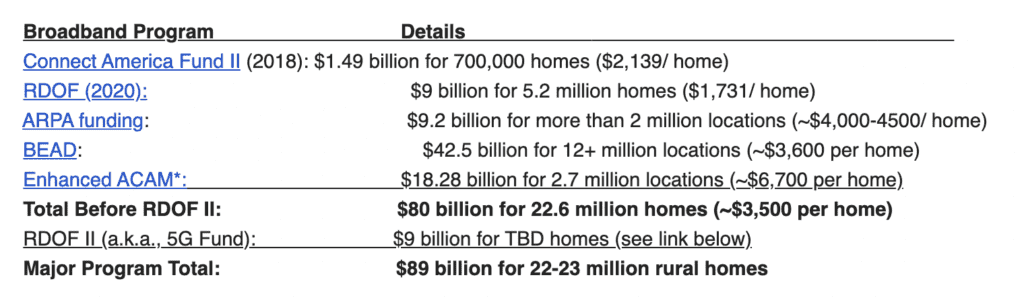

We have chronicled this previously, but here are the major rural broadband initiatives (and government funding amounts):

There are many issues with having a “special amnesty window.” Many bidders have already defaulted and paid the full penalty. Those who default in a special window will be rewarded for delaying the inevitable. Second, there appears to be no other penalty from the FCC (e.g., those who default on RDOF now should not be allowed to bid on BEAD or any other federal or state programs for the next 10 years). Finally, there does not appear to be an alternative considered to extend the timeframe to complete the buildouts (e.g., make the minimum build percentages lower and longer) as opposed to starting from scratch with a new bidder.

Coincidentally, FCC Chair Jessica Rosenworcel issued a statement last Wednesday (here) proposing that the FCC spend the remainder of their RDOF budget ($9 billion) on additional fill-in areas. For those of you who have not been following, the original RDOF bid was only intended to be “Part 1” as the BEAD funding had not been approved (see this January 2020 Telecompetitor article for a full explanation – $20.4 billion had already been set aside, and, including defaults from the first RDOF round, about $9 billion remains).

Why the hurry to spend the $9 billion prior to the allocation of the BEAD funding? Why not use this amount (with private company matches) to cover the remaining areas not served? Then the FCC could collect the entire penalty from the defaulting companies, the states could allocate monies (and return any excess), and a final “clean-up” round could be organized and administrated.

“Too many dollars chasing too few goods and services” is the classic definition of demand-pull inflation. If the goal is to create a long-term broadband cost structure that effectively serves the needs of rural America, why rush the process?

Q1 earnings preview – cable’s moment

This is going to be one of the most interesting quarterly earnings reports for telecom we have seen in a while. The iPhone 15 had its maximum impact in 4Q 2023 – there were minimal inventory carryovers into January (unlike 2021-2023). There are no new spectrum auctions on the horizon. There’s 6G, but many are still skeptical about 5G so the advance hype has been muted. That leaves us with business services, cable MVNO net additions, and cost/ capital reduction efforts (along with some company-specific situations like the level of T-Mobile’s stock buyback).

Here’s what we heard from Charter and Comcast in the latest analyst conferences:

Charter. CFO Jessica Fischer recently presented at Deutsche Bank’s 32nd Annual Media, Internet & Telecom Conference. First up was competition, and, while their rural passings will continue to grow (and their penetration and ARPU will exceed initial estimates), there wasn’t a lot of good news on the competitive front. For fixed wireless, “it’s too soon to tell sort of what happens or what results happen” from T-Mobile’s or Verizon’s price changes. For fiber overbuilders, “we haven’t yet seen a change in sort of the velocity of total fiber overbuild.” Neither of these statements signal a change in the direction of broadband net additions excluding rural.

Comcast. CFO Jason Armstrong recently spoke at the Morgan Stanley Technology, Media & Telecom Conference (transcript here). He addressed the competitive environment as follows: “It’s a competitive market… as competitive as it’s been in quite a while… we lost 34,000 customers in the fourth quarter and gave an outlook for the coming year and said I wouldn’t expect trends to improve off of that.

There’s no doubt that there will be additional gross and net add activity for cable in the first quarter (we expect more than 1 million net additions across Comcast, Cox, Altice, and Charter). It’s important to note, however, that much (most?) of this activity will come from traditional prepaid customers who have received their income tax refunds.

Cable also has not said a lot about their enterprise growth, but there is a reason why AT&T and Verizon are in decline. Comcast experienced over 5.8% growth in business services revenues in 4Q 2023 and their total 2023 growth was 4.9% (2022 growth was 9.5%). Comcast Business is now a $9.3 billion revenue stream generating $5.3 billion in EBITDA.

Charter’s growth was more muted in 2023 at 1.4% partially due to less wholesale revenues and they lack the benefits that Comcast’s Masergy acquisition delivered. But both Charter’s and Comcast’s revenues are nearly entirely wireline and are growing. Both companies have been in market for nearly two decades so nearly all growth is coming from increased market penetration and improvements in Average Revenue Per Account (ARPA).

Yet, with meaningful broadband market share, 1 million+ wireless net additions, and wireline business growth, the cable industry cannot seem to get a break. How can they get back on track?

- Parlay increased business growth into work-from-home growth. This seems like a no-brainer for cable to own (commercial-equivalent performance at home), but there’s not a lot of talk about it. There’s more than a few dormant lines that could be converted to dedicated work connections that generate incremental cash flow with minimal capital outlays.

- Add Peacock Premium and unlimited DVR to every mobile family offer – for life. With the Olympics coming up, there are opportunities to combine “must see” content, whether live or recorded, with smartphones. Make it attractive and charge a premium over the current premium prices. This will enhance Xumo, build scale on Peacock, and remove the largest YouTube TV barrier – unlimited DVR.

- Run a device insurance promotion (e.g., premium device insurance for the price of regular). There’s not a lot of wiggle room with smartphone payments beyond trade-in promotions, but device protection can lower overall costs and draw in families. An alternative would be to cap family device insurance premiums at $20/ mo. for up to four devices.

- Prove that network improvements are winning back customers in metropolitan areas. Cable has yet to prove that hi-split and DOCSIS 4.0 improvements result in regained market share. This is the quarter where we should start to see examples.

Bottom line: Cable has a good story to tell, and they need to do a better job of telling it. Also, there are levers other than price that can be pulled (see Verizon’s myPlan) to entice customers. Lower prices result in higher perceived value, but there are alternatives.

That’s it for this week. Thanks again for all of your support. In two weeks, we will conclude our multi-part preview of first quarter earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the website).

Until then, go Sporting KC, Kansas City Royals, and Davidson baseball!