Will Sprint and T-Mobile US invest enough to have a minimally viable network (MVN?)

Several newcomers to my columns have pointedly asked me over the past week “What’s your angle? Why are you out to get [insert company or business leader name here]?” There is a thin line drawn at times between strong, fact-based opinion and vendetta. To some readers, last week’s column seemed to cross the line.

Those who express that opinion are shortsighted. I was equally harsh in my criticism of AT&T’s Nokia Lumia launch on Easter Sunday when most of the retail stores were closed (April 2012). Or of Verizon Communication’s decimation of cloud pioneer Teremark. Or Google’s shortsighted “cut and run” policy with respect to China. Or of the Federal Communications Commission’s policymakers confusion between the concepts of equal access and equal outcome with respect to the Internet.

For five years (225 total columns), we touched every rail and sacrificed every sacred cow. No one company is singled out – everyone gets his turn under the microscope. Enough said.

The minimally viable network

We are heading into a telecom storm driven by scalability requirements, not excess capacity. Sprint has done everything but fire the first missle in what could be a long and protracted price war. As we have discussed previously, while AT&T Mobility’s four line/10 gigabytes pooled data/unlimited everything else offer is aggressive, it is not a long-term margin-compressing move, but rather a means to an ultimate end: to acquire scale and ubiquity that stems the tide of SIM-card swaps to T-Mobile US and to enable wide-scale deployment of voice over LTE. T-Mobile US ended up raising prices on unlimited data plans in March and is now cracking down on selected “Unlimited” plan customer activities. These are all signs of a rational industry.

Sprint’s action this week could be very different. My guess is it will have surface impact only, and will not measure up to T-Mobile US’ early-termination fee buyout announcement in January and AT&T Mobility’s Mobile Share pricing change in February. Why? The answer is found in the first rule:

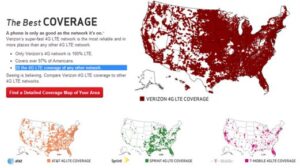

To set national market price, you have to have a minimally viable network. To have an MVN, you have to have a legacy of national network spending.

This is not to say that Sprint does not have an MVN (I used all of my 2 GB allotment of hot spot data in four days without watching Netflix or YouTube thanks to superior Sprint Spark coverage on Long Island and Charlotte). It does … in places. As Marcelo Claure said last week: “When you have a great network, you don’t have to compete on price. When your network is behind, unfortunately you have to compete on value and price.”

Using an extreme example, let’s assume Cincinnati Bell Wireless woke up tomorrow and decided to compete on price by offering a $40 plan that included unlimited voice, text and 5 GB of data nationwide (as well as similar family plans). That would certainly be a headline grabber, but would Verizon Wireless and AT&T Mobility customers outside of Cincinnati really care?

That’s the issue Sprint (and T-Mobile US face). The next 10 million to 20 million smartphone gross adds are evenly split between metro and secondary markets. That’s the population that makes up the interval between the 200th million population and the 300th million (re: Sprint is around 245 million potential customers covered with LTE; T-Mobile US at 235 million pops).

Let’s look at capital spending per average retail subscriber for the past 16 quarters to see who has legacy status. The following chart simply looks at the preceding four quarters of capital spending divided by the average retail subscribers (note: T-Mobile US machine-to-machine included in the retail count for comparability purposes. Also, to ensure consistency, we have included MetroPCS capital spending and MetroPCS average subscribers in the T-Mobile US figures).

![]()

There’s a lot to be gleaned from this table, and this will quantifiably validate for many of you many hypotheses you have had over the past several years.

First, to no one’s surprise, both T-Mobile US and Sprint went through a six-quarter capital spending trough. From 2010 through most of 2012 (and more than that for Sprint), network spending was held flat. Roughly speaking, Sprint and T-Mobile US each spent $1.8 billion to $2 billion annually for the 12 quarters beginning in 2010 and ending 2012. With slow (or even declining) customer growth, this equated to an annualized capital spend per average retail sub of $40 to $80. This number becomes even lower when you consider that Sprint’s spending is divided between its iDEN (Nextel) and CDMA (Sprint) networks.

When determining what level of capital spending needs to occur to be minimally viable, I kept coming back to $80 per average sub. Prolonged periods below $80 put national viability in question. Sprint and T-Mobile US each had that period and each paid mightly for it. (Note: in the future, as more data-only devices are activated, an $80 figure might be perfectly rational. Given the massive conversion from feature to smartphones for the period analyzed, however, a $65 or $75 figure is below the acceptable limit).

On the flip side, AT&T Mobility experienced some of its greatest growth challenges in 2011, when iPhone exclusivity was lost to Verizon Wireless (Feb.) and then Sprint (Oct.). Not only was AT&T Mobility spending capital to keep current iPhone subscribers happy, it also had to accommodate converting iPhone customers.

Then in 2012, AT&T Mobility made the decision to aggressively launch LTE (it began its first deployments in mid to late 2011, but acceleration did not come until Velocity IP was announced in November 2012). Specifically, AT&T’s VIP announcement cites its change to deploy LTE to 300 million pops as opposed to its previous announcement of 250 million pops (and additionally cites that VIP investment will lead to ubiquitous coverage across its 22-state local territory).

While high, the spending consistency for AT&T Mobility is remarkable. Even with iPhone launches at each of its competitors, growth of data consumption and deployment into less dense markets, AT&T Mobility has largely kept within $15 of annualized capital spending per average subscriber from the second quarter of 2010 to the second quarter of 2014 (spending $43.7 billion over the past 16 quarters on capital, but also growing 23.3 million connections over the same period).

AT&T Mobility’s growth figures seem very robust on the surface, but 10.5 million of the 23.3 million retail connections came from “connected devices.” More than 95% of connected devices (industrywide) generate less than $20 in retail average revenue per user (and more than 70% use less than 200 megabytes of monthly data). It would seem logical that as the percentage of connected devices increases as a percentage of the total base, total capital spending will fall.

It’s also important to note that the capital spending metric in the table does not include spectrum purchases or any acquisitions, which would have their own ongoing capital needs. Every carrier, but especially Verizon Wireless (1.7/2.1 GHz acquisition from cable companies) and AT&T (numerous private spectrum purchases) have had additional capital needs above the $81 billion they have spent on their respective wireless networks over the past four years (and their 700 MHz spectrum purchases in 2008).

Verizon Wireless has been more capital efficient than AT&T over the past four years ($37.3 billion in capital spending and an 18.5 million increase in connections since Q2 2010). Part of this stems from Verizon Wireless’ head start on LTE (spending started in 2009); inheriting a strong and operationally robust network from Alltel (acquired in early 2009); spectrum density (see earlier note that spectrum purchases are excluded from the total capital figure); and from Verizon Wireless’ market share in dense metro areas. It’s doubtful that the gap would be reduced significantly, but there’s some 2009 LTE spending for Verizon Wireless that is not reflected in the above table.

A history of capital spending is the primary defense against Sprint’s price war. While Sprint has spent more than $12 billion over the past eight quarters in a substantial “rip and replace” initiative, that may not be enough to put a dent in the fortresses Verizon Wireless and AT&T Mobility have created. The same argument can be made for T-Mobile US, which will likely need $6 billion to $8 billion or more in spending in 2015 just to keep up with demand (again, this excludes participation in the AWS-3 or 600 MHz spectrum auctions).

Next week, we’ll tackle the question “How important is marketing to the wireless industry over the next four years?” Bottom line: The next telecom CEO might be better off having a brand management pedigree than a network/technology background.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – Business Development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was President – Wholesale Services for Sprint and has a career that spans over twenty years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice.

Editor’s Note: Welcome to our weekly Reality Check column where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.