In last week’s note on capital spending, there was a slight to the table shown due to a spreadsheet error. This change raised the capex/average retail customer for T-Mobile US in earliest quarters shown. Apologies for the change – story stays the same. A link to the corrected spreadsheet can be found here.

We started and ended last week with some very big news from Sprint. At the beginning of the week, Sprint’s new CEO, Marcelo Claure, pulled the pricing lever, offering 20 gigabytes of pooled data for the same price that others are offering 10 GB. At the end of the week, Sprint introduced a $60 unlimited plan that T-Mobile US matched with a referral promotion offering unlimited data.

With the Sprint Family Share Pack offer, Sprint’s cost per line rate table looks like this (note: excludes 2 GB and free voice/text promotional offers):

The new plans represent a fundamental difference from both “Framily” and “Unlimited” plans of past years. First, they pool data. This seems small, but allows a more immediate comparison to AT&T Mobility and Verizon Wireless plans and positions T-Mobile US negatively as the remaining “un-pooled un-carrier.” When we looked at AT&T Mobility’s pricing structure in 2014, we saw a lot of value to pooling because of the widely varying (video viewing) habits of different family members. It’s very encouraging to see that Sprint has finally seen this light.

Second, for fewer than four lines, Sprint’s plans became more competitive. One of the many problems with Framily was getting to the $25 per-month promised land. The $55/$50/$45/$40 laddering was very hard to explain, and, for a family of four, competitively unjustifiable. To put it into perspective, Framily cost $52.50 per line for two lines and 2 GB of data and $50 per line for three lines and 3 GB of data (new rates are about 30% less).

However, as many analysts have pointed out, the new plans (excluding promotions) are not materially better or worse than T-Mobile US for two or three lines (also excluding promotions). A 3 GB per-user Simple Choice plan for T-Mobile US (which includes free streaming music) costs $120 for three lines ($40 per line). Sprint’s pooled data plan does not make sense for most of the scenarios (three lines, 8 GB pool would cost 20% more than T-Mobile US).

Even at the benchmark four line scenario, the situation is not materially better with T-Mobile US with a four line plan at $140 including 3 GB per line (again, streaming music not included). While a lot of the attention this week has been focused on the “merger partners now archrivals” theme, it’s clear that Sprint’s current plans are not aimed at T-Mobile US, but at AT&T Mobility and Verizon Wireless. Current promotions (including early termination fee buyouts) could stall the T-Mobile US train, but Sprint’s latest family plan volley will not stop T-Mobile US’ multi-quarter advances.

How Sprint could stop T-Mobile US: Better marketing and retention

Sprint’s pricing plans need to be accompanied with marketing efforts that reinforce a value image. Throughout the Framily plan launch, I was confused about how Framily reinforced the Sprint brand. Most consumers know what T-Mobile US stands for: wireless services that allow me to have more fun and to do more with my life. In the consumer market, what does Sprint stand for? How will Sprint create an association (e.g., the “Hyundai of wireless”) before their competitors create that association for them (e.g., the “Yugo of wireless”)?

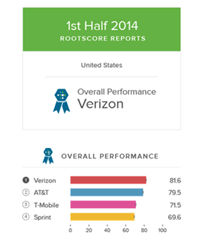

There are several areas that Sprint cannot legitimately claim, if the latest RootMetrics reports are accurate: largest footprint, fastest (Now) network and call performance are all areas where Sprint lags behind its competitors. Most improved in customer service reminds many former Sprint customers of previous issues. There are secondary considerations, like corporate stewardship and environmental consciousness, that will impact decisions, but Sprint has few options but to claim the “low price of the big four”segment.

How large this segment is and how willing AT&T Mobility and Verizon Wireless customers are to switch to Sprint is debatable. This is where marketing comes in. First, many who are looking at their current Verizon Wireless and AT&T Mobility bills are wondering: “When will our family exceed 10 GB of data?” Assuming the family is made up of two adult and two child phone users, it’s very likely that data usage rates are different — one uses 3 GB to 4 GB routinely while the rest of the family uses 4 GB to 5 GB in total. When the primary account owner receives “you are near your limit” messages for two consecutive months in a row, Sprint needs to be there with a compelling and relevant offer.

At this point, the primary concern for many families is network and device comparability. Is Sprint’s Spark service in Orlando, Florida, really better than AT&T Mobility? Can Sprint deliver data to the device as quickly as AT&T Mobility can? How much will it cost to change over four GSM (AT&T Mobility network) devices to CDMA (Sprint network)? Should our family wait until the new iPhone is released in September? These are all relevant questions. And asking current Sprint customers may not generate the answers that Sprint wants to hear (unlike similar conversations with extremely happy T-Mobile US customers).

As mentioned earlier, Sprint must control its own rebranding message. One of the best ad campaigns of the decade thus far was Comcast’s “Slowsky” turtle campaign, which started in 2011. In spot after spot, Comcast used humor to create differences between cable and DSL. And, as we showed in the second quarter results analysis, Comcast has been winning — growing their consumer broadband base by 3.4 million subscribers during the past three years (Q3 2011 to Q2 2014) compared to 250,000 for AT&T. Is a T-Mobile US version of the Slowsky campaign far off?

Sprint’s marketing message also has to convince current customers to stay. Sprint’s Spark network would be a terrific thing to stick in the hands of its most loyal customers. Or, something as simple as including the $5 per month early upgrade option for former Sprint Premier (rewards program) customers. While Sprint plans do allow customers to move to Family Share plans, there has been no promotion to existing customers. (One of the reasons for AT&T Mobility’s extremely low postpaid churn in Q2 was its decision to allow current customers to upgrade to their pooled data plan).

Having a “black label” or premium mentality for the current customers is going to be critical. During the worst of the customer service transition, Sprint sent customers a coupon for 50% off of an accessory. It drove store traffic, but, more importantly, it started an in-store conversation about what things the customer liked about Sprint. With the network transition in full swing, that conversation needs to be restarted.

Associations and partnerships will also be critical. Here are a few that Sprint could implement tomorrow that would drive additional customer loyalty:

1. A Boingo relationship. Without a doubt, this would improve the customer experience with minimal network involvement. For those of you with short memories, Sprint actually sold seven airport Wi-Fi networks to Boingo in 2007. The relationship exists and the opportunity to grow the network is significant. Make it seamless and powerful, and existing as well as new customers will thank you.

2. A stronger Samsung relationship. Sprint and Samsung have a good relationship today, but it could get stronger with a few focused products and services. This relationship is not limited to devices, but could include network/small cell elements. This could be done without limiting Sprint’s initiative to enable lower cost handset providers in the United States (perhaps in conjunction with Google). While sales at Samsung are not at the Galaxy S3 stratospheric levels, Samsung continues to carry strong brand recognition.

3. A start-up relationship. Within the Supply Chain and Network organizations, setting a “business diversity” goal of 10%, 15% or 20% of new purchases from start-ups is bold and ambitious. It would help re-create a culture of “always better” that permeated Sprint in its beginning two decades.

4. A stronger and resonating music relationship. One of the “small print” items in the new Family Share Pack announcement was that all customers receive six months free of Spotify Premium services. However, the fee spikes to $8 to $10 per month after that period has ended. Sprint needs to think more deeply about music and the effects that it can have on acquisition and retention.

There are many more brand-building opportunities than these on the horizon. Sprint needs to understand that its next marketing move can have meaningful and long-lasting (positive and negative) brand implications. More sales will cure a lot of the quarter’s problems, but brand definition and reinforcement determine the long-term future of the company.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – Business Development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was President – Wholesale Services for Sprint and has a career that spans over twenty years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice.

Editor’s Note: Welcome to our weekly Reality Check column where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Reality Check: The future of telecom (Pt. 2) – Sprint on sale (SoS)

ABOUT AUTHOR