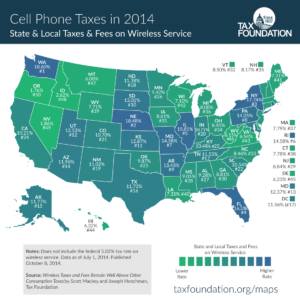

Washington state taxes its citizens the most when it comes to wireless services, with a new report from Tax Foundation showing a combined federal, state and local tax rate totaling 24.42%. That number just beat out the 24.31% posted by Nebraska and 23.56% recorded in New York.

At the other end of the scale was Washington’s southern neighbor Oregon, which clocked in with a wireless tax rate of just 7.59%. Joining Oregon in the sub-10% range were Nevada (7.69%) and Idaho (8.45%)

The findings noted that the average rate was 17.05%, which was down slightly from the 17.18% recorded in 2012. The figures all included a 5.82% federal universal services fund rate, with the difference made up of state and local taxes. The District of Columbia was also included on the list, coming it at No. 17.

1. Washington (24.42%)

2. Nebraska (24.31%)

3. New York (23.56%)

4. Florida (22.38%)

5. Illinois (21.63%)

6. Rhode Island (20.41%)

7. Missouri (20.4%)

8. Pennsylvania (19.87%)

9. Arkansas (19.26%)

10. South Dakota (18.84%)

41. Louisiana (13.17%)

42. Maine (13.14%)

43. Wisconsin (12.93%)

44. Virginia (12.36%)

45. Hawaii (12.14%)

46. Delaware (12.05%)

47. West Virginia (11.97%)

48. Montana (11.83%)

49. Idaho (8.45%)

50. Nevada (7.69%)

51. Oregon (7.59%)

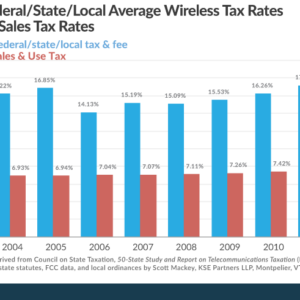

Tax Foundation also looked at the disparity between taxes charged for wireless services and a state’s general tax rate, with Nebraska showing the widest gulf at 11.48%. Washington was No. 2 in the disparity at 9.45% followed by Florida and New York at 9.3%. A handful of states came in with a lower tax rate for wireless services compared with its general tax rate, led by Nevada at 5.93% lower, Idaho at 3.38% lower and Louisiana at 1.65% lower.

Overall, the tax disparity declined from just over four percentage points to 3.7 percentage points in 2014.

1. Nebraska (11.48%)

2. Washington (9.45%)

3. Florida (9.3%)

4. New York (9.3%)

5. Alaska (9.27%)

6. New Hampshire (8.17%)

7. Rhode Island (7.58%)

8. Pennsylvania (7.05%)

9. South Dakota (7.02%)

10. Illinois (6.94%)

41. Connecticut (1.43%)

42. Oklahoma (1.42%)

43. Maine (1.31%)

44. Virginia (0.89%)

45. Georgia (0.81%)

46. Ohio (0.7%)

47. Alabama (-0.22%)

48. West Virginia (-0.6%)

49. Louisiana (-1.65%)

50. Idaho (-3.38%)

51. Nevada (-5.93%)

You can find more information on the list at taxfoundation.org.

Bored? Why not follow me on Twitter

Photo copyright: madmaxer / 123RF Stock Photo