SAO PAULO – While Brazilian carrier Oi’s future is uncertain, its new CEO, Bayard Gontijo, supports the consolidation of the telecom market in Brazil. Rival operators TIM and Oi have each looked into buying the other, and Oi faces cash problems related to its merger with the financially troubled Portugal Telecom. Speaking in his first official appearance at this week’s Futurecom event in São Paulo, Gontijo emphasized that market consolidation is needed and the market has an appetite for it. “But consolidation is not just Oi’s flag; it is inherent to all the players’ strategies,” he said.

The picture is a little different from the perspective of government and regulatory officials. Both Anatel’s João Rezende and communications minister Paulo Bernardo said that mergers and acquisitions are natural to any market, but their role is to make sure the rules are followed.

“The regulator will always promote competition. The greatest competition is the best for the country,” said Rezende during a panel discussion at Futurecom. Despite rumors of a TIM breakup, Rezende said that no telecom player has reached out to Anatel to discuss breaking TIM into separate parts to be sold to different carriers.

Bernardo said Oi faces a difficult moment, and the government is following the situation closely. “We can’t ignore what happened to Portugal Telecom,” he said, commenting on the defaulted debt owed to PT by Rioforte. A subsidiary of Espirito Santo International, Rioforte Investments failed to repay PT about $1.15 billion of short-term debt.

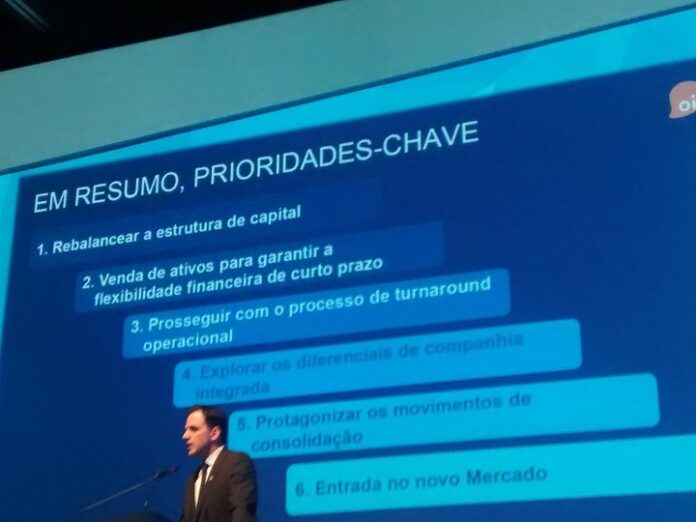

Oi’s CEO Gontijo used his speech to comment on the steps the company is taking to fix its finances and start growing again. Among those steps are asset sales. From April 2013 until June of this year, Oi has sold R$6.5 million ($2.71 million) in assets, including towers and its subsidiary GlobeNet, a submarine cable company. “There are still a number of other assets that can be sold here and in Portugal,” Gontijo said.

The goal is to start selling shares in the special category of Novo Mercado in the São Paulo stock bourse.

With respect to dropping out of the recent 700 MHz auction, the Gontijo said Oi has spectrum to deploy LTE in the 2.5 GHz and 1.8 GHz bands, which the company already owns. “Oi did not participate in the auction, but it has spectrum for 4G,” he said.

Gontijo also pointed out the positive aspects of the Brazilian market: the increase in telecom service penetration, a growing population with purchasing power and the rising use of telecom services. But he also stressed that the tax burden of 45.5% is one of the greatest challenges for the sector in the country.