Editor’s Note: Welcome to our weekly Reality Check column where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Last week was one of stunning victory and disappointing defeat. For those of you who read this column but do not follow baseball, the World Series went to the seventh game for the first time since 2011. Despite media reports that this would be the least-watched World Series, it wasn’t (Game 7 drew 23.5 million viewers and was Fox’s highest ratings outside of Super Bowl weekend). It was a run that few Royals fans will ever forget, and a testimony to the admonition to “never … ever … ever give up.” Kudos to the Giants on their third World Series victory in five years. Hopefully we will see you next year.

The Royals remind me a lot of T-Mobile US. For years, pundits tracked the decline of T-Mobile US as they slipped behind the market (the Royals lost 90 or more games for nine out of 11 seasons from 2002-2012). But then, the AT&T merger failed to transpire and T-Mobile US received cash, spectrum and a roaming agreement as a result. The “Challenger Strategy” was born.

While many (including myself) thought the Challenger Strategy was an attempt to market network expansion only, it ended up being more. Here were the original planks of the strategy:

–A $4 billion network modernization and LTE rollout

–Adding 1,000 direct salespeople to sell to businesses

–Increasing advertising

–Growing the mobile virtual network operator (wholesale wireless) channel

That was February 2012. There were 37,000 cell sites to upgrade and progress to track. This looked like a traditional upgrade network/grow data average revenue per user/find-a-way-to-survive-at-the-low-end of wireless model. T-Mobile US reported Q3 2012 earnings to little fanfare. Newly announced CEO John Legere promised that the proposed MetroPCS merger would be a transformative event, and that T-Mobile US would be the market leader in “bring-your-own-device.” T-Mobile US had a new manager (who publicly looked a lot like previous managers) with farm team promise.

Then came 2013. The “Un-carrier” strategy was launched and Challenger was jettisoned. The iPhone was introduced on T-Mobile US’ network. Simple Choice plans were introduced. JUMP (equipment exchange plan) was introduced. International roaming was included. Momentum built and T-Mobile US had a winning record (600,000-plus year-over-year postpaid subscriber growth) for the first time in recent memory. Unlike Royals manager Ned Yost, who is a man of few words, Legere spoke out at every moment possible, grabbing headlines like “A 10-gigabyte, five-device shared data plan, when Joe Schmoe Junior starts to watch porn on his phone, isn’t going to work.”

Like the Royals, the 2012-2013 season was a glimpse of what could be. T-Mobile US needed to build momentum, but also needed to be best in something. Their competitive advantage needed to translate into more wins to catapult them into the playoffs.

In 2014, T-Mobile US could have focused on being best in a metric (postpaid net adds) through a well-defined tablet strategy (it’s a part of their plan, but not the main source of postpaid net adds). They could have focused on dominating a particular segment like prepaid (they overtook Sprint in this category in the second quarter). While T-Mobile US is very good at serving this segment, it’s not as lucrative as postpaid and meeting Apple’s phone commitments would require a significant postpaid acquisition effort.

T-Mobile US decided to focus on the fan (customer) experience. Deliver what they want (lower ticket prices, better/unlimited food, a refurbished ballpark) and they will return with their friends. More fans equals more fun equals more wins equals more fans. It was a cycle that was worth a shot.

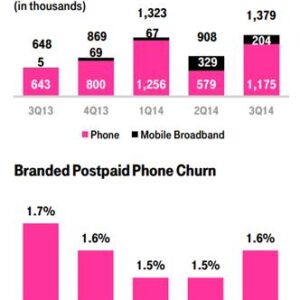

Both T-Mobile US and the Kansas City Royals entered their respective 2014 seasons with high hopes, but fairly low expectations (The Sporting News in March predicted that the Royals would make the playoffs, but would lose to the Yankees in the Wild Card game). In April, T-Mobile US set what now seems to be low expectations for the 2014 season of 2.8 million to 3.3 million net additions and $5.6 billion to $5.8 billion of operating cash flow (earnings before interest, taxes, depreciation and amortization). The new expectations are 4.3 million to 4.7 million net additions and $5.6 billion to $5.8 billion of operating cash flow (EBITDA).

We are in the late innings of 2014. In baseball, we would call for the closer to notch the save and collect the win for the team. For those of you who have not followed the Royals this season, they reinvented the middle relief process with the “gradual” close – Herrera in the 7th, Davis in the 8th and Holland in the 9th to great success. It even prompted them to be featured in The Economist.

T-Mobile US is relying on a backlog of iPhone demand, increased network capacity and aggressive trade-in promotions to win the year. Unlike the Royals in Game 7, they have the lead going into the seventh inning, but their well-funded competitors have lots of hitting power.

The swings at T-Mobile US began to be felt in October. At the beginning of the month, division rival AT&T Mobility began to increase their higher-end data plans, introducing 30 gigabytes of shared data for $130. Sprint doubled the data offered in their plans to 60 GB of data for $130. For a family of four, this would involve consuming 500 megabytes of data per family member per calendar day. That’s a lot of video consumption and much higher than averages of 1.5 GB to 3 GB per month for each of the big four wireless carriers. (Note: a similar storyline is playing out in the commercial services wireless space between Sprint and AT&T/Verizon. More on this in a future column).

Starting Oct. 22, Sprint introduced a 1 GB plan for $20 per month — with unlimited voice and text, the cost would be $70 per month for a two-line plan sharing 1 GB of data. This is 20% less than AT&T Mobility’s $25 per month and 50% less than Verizon Wireless’ $40 per month.

Not many phones will share 1 GB of data, however. This is why AT&T Mobility increased its low-end family plan buckets from 2 GB to 3 GB ($40) and from 4 GB to 6 GB ($70). With unlimited voice and text, two people sharing a data pool would be charged $90 for 3 GB of shared data and $120 for 6 GB. Given their focus on the 10 GB family-plan users, this change was as inevitable as having the designated hitter swing on a 3-0 count. However, to those who have not been closely following the game, this action, and Verizon Wireless’ price reductions on higher pooled plans, seemed to indicate a price war.

As we have stated several times, AT&T Mobility’s plans represent a change-up. The comparable ARPU to traditional subsidy-based plans for the two-line shared examples would be $90 plus two smartphones times $21 per month. AT&T Mobility Next charge equals $131 per month equals $65.50 in ARPU (larger plan would be $161 and $80.50 respectively). If one goes back to AT&T’s Q4 2013 operating report, before their announcement of the 10 GB for $100, four lines for $160 plans, postpaid ARPUs were pretty steady in the $46 to $48 range for the previous two years.

Embedded in this $46 to $48 is some amount of subsidy (the vast majority of new AT&T Mobility gross adds in 2012 and 2013 were on subsidized and not monthly device payment plans). Analysts have spent a lot of time trying to determine the exact amount, but it is likely $9 or so (averaging in the cost of the latest iPhone/Galaxy with accounts who are no longer in the plan and therefore are not under subsidy). This leaves $37 to $39 per month to cover service costs.

In 2012 and 2013, average smartphone data consumption for AT&T Mobility and Verizon Wireless was less than 1 GB per user (lower in 2012 and growing in 2013 with the advent of the Galaxy 4 and iPhone 5/5c/5s). As these figures have grown, so has the nature of their networks — LTE is “three- to four-times more efficient” according to Verizon Wireless’ latest conference call transcript. Supporting 6 GB of data for $70 per month equates to $15 per gigabyte if the plan only uses 78% of their allotted data ($15 per gigabyte happens to be the overage charge for the 6 GB plan). And to get to 3 GB of data for two users, a customer needs to be either: a) streaming music; or b) watching video on a somewhat consistent basis. Even normal (teenage) Facebook or Instagram usage will not yield 3 GB of data.

The bottom line is that Sprint and AT&T Mobility are stepping up to the plate to battle T-Mobile US for its sweet-spot customers as 2014 comes to a close. At least AT&T can make money at these levels given their scale and LTE network density. We will discuss Sprint next week after they announce earnings.

T-Mobile US has good relief, but is it good enough for AT&T’s giant bats? Will T-Mobile US join Alex Gordon at 3rd base? They need a hit, and iPhone 6 backlog is not going to do the trick. Neither is the soft SIM card in the iPad (Legere’s explanation of this during his Re/Code interview this week is superb). Neither is free streaming music. All they need is a single (or a wild pitch). What will it be?

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – Wholesale Services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice.