Argentina auctioned 10 bands of spectrum and raised about $2.23 billion. The bands auctioned were 850 MHz, 1900 MHz, 1.7/2.1 GHz and 700 MHz. The auction focused on increasing the country’s mobile Internet access, including LTE. Four pre-qualified companies bid in the auction: three market incumbents —Telefónica, Telecom Argentina and América Móvil, each of which holds about a third of the nation’s mobile market — and one new entrant, Arlink-owned MSO Supercanal. The government will announce the winners later in November.

Also, the government introduced the Argentine Digital Law, a bill that would allow every Information and Communications Technology service company, even public providers, to offer audiovisual communication services.

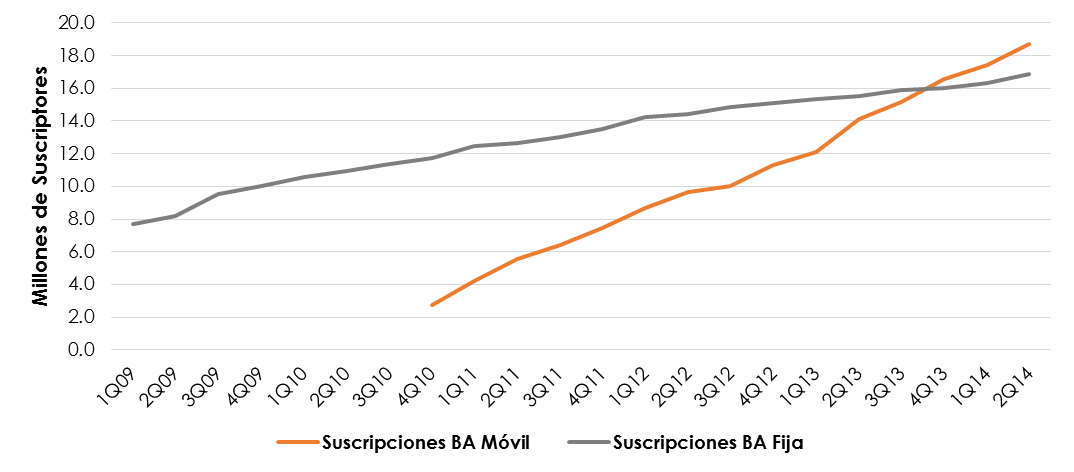

Mexico mobile broadband—About a year ago, the number of mobile broadband users surpassed fixed-line users in Mexico. Since then, the annual growth of mobile broadband has been increasing quarter after quarter. The graphic below shows how the service has developed in the country. Markets observers believe that Mexico will see a mass adoption of mobile broadband, leading to speculation over what role fixed-service should play.

Q3 highlights

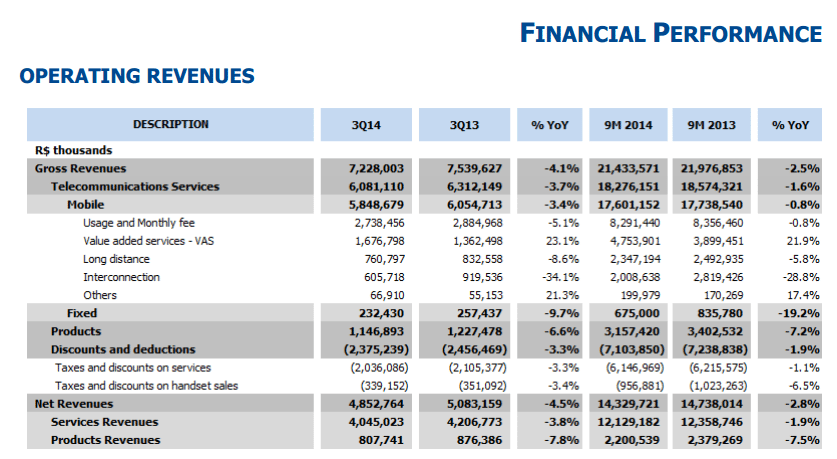

TIM ended the third quarter of 2014 with a 10.6% increase in its net income year-over-year (YoY) and a drop of 4.5% in revenue. During a conference call, TIM executives highlighted the growth in data users (+ 32% YoY), reaching 43% of its total base, with 3G users at 31.4 million in July 2014 (+68% YoY). As a consequence, gross data revenue increased to 23% YoY, accounting for 29% of mobile gross service revenue.

TIM’s subscriber base reached 74.7 million lines at the end of August, with 501,600 net additions in July and August.

The carrier said it remains focused on long-term strategy in search of broadband and digital service leadership, based on a robust infrastructure, an evolving portfolio and very efficient operations.

Rumors rose again during the last few weeks that Brazilian operator TIM would be split and sold to three Brazilian carriers (Telefónica’s Vivo, Claro and Oi). The reports were later dismissed by TIM and others.

Telecom Argentina reported a profit of $315.3 million for the nine months ended Sept. 30, 2014, up 13.7% from the same period last year, measured in local currency. However, the mobile unit Personal Argentina reduced its customer base by 100,000 to 19.8 million lines in September.

Chilean Entel’s net profit fell by 90% in the third quarter. The drop resulted from falling mobile service revenue in Chile and Peru. In Chile, the decline was mostly driven by a reduction in mobile service revenue, which fell 12% YOY, impacted by a 75% reduction in mobile termination rates.

More Latin American region news:

- Colombia’s regulatory commission set a resolution that obligates mobile carriers to provide simpler and more easily understood customer contracts. The government’s goal is for the general population to better understand what they are acquiring and what the plan rules are.

- Expansion: Britain-based Cable & Wireless Communications, the parent company of LIME, acquired Barbados-based peer Columbus International, a Jamaican fiber-based telecoms provider, for $1.85 billion. The goal is to boost its mobile, fixed-line, broadband and TV offer in the Caribbean.

- Brazil’s Telebras expects that a new underwater fiber optic cable connecting Fortaleza and Lisboa (Portugal) will be operating by mid-2016. The release of this new Atlantic cable has been under discussion for some time as a measure to protect Brazil from NSA espionage.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.