It’s been a week full of news, with the Federal Communications Commission’s Auction 97 almost ending, AT&T’s acquisition of Iusacell closing, rumors that the Verizon/AT&T/T-Mobile US Softcard mobile wallet venture will be sold to Google emerging, and Sprint bucking the trend with mild but real support of limited implementation of Title II regulations on the wireless industry (a real head scratcher, in my opinion. More on Sprint’s FCC filing in a future column).

This week, we will focus on Verizon Communications and AT&T’s pending quarter and year-end earnings announcements. Verizon kicks off the earnings parade with its announcement Thursday morning, with AT&T and other providers following the next week.

Verizon: We are not worried

Coincident with the Consumer Electronics Show was Citi’s beginning-of-the-year Global Internet, Media and Telecommunications Conference. Kicking off this year’s agenda was a “fireside chat” with Verizon CEO Lowell McAdam. While the early headlines were about profitability concerns (which had been communicated as early as the third quarter conference call) and AOL acquisition rumors (a likely partnership, but no acquisition in the offing), this interview succinctly provided a glimpse into the operations and strategies of the largest telecommunications provider in the United States.

One of McAdam’s first (and perhaps most interesting) statements was:

“Competition in the market has always been strong, in my view. Some of the names have changed.”

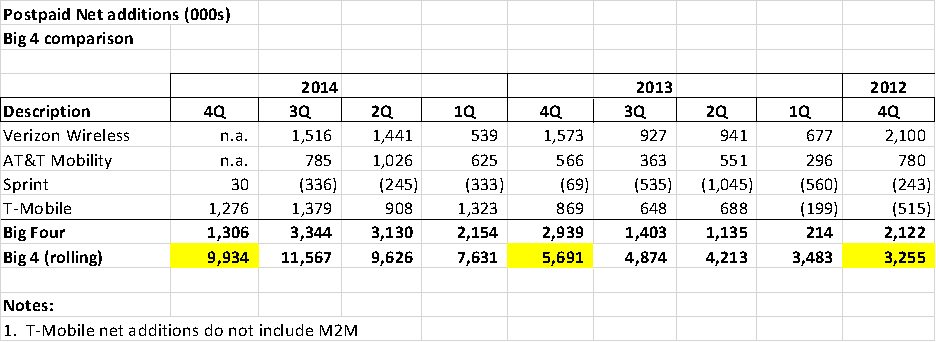

This was a shot at AT&T, not at Sprint (see net additions trend below). Verizon Wireless has changed their focus from AT&T to T-Mobile US. Why? Here’s the rolling postpaid net addition trends for the four largest carriers (note that T-Mobile US’ machine-to-machine count is not included in these net add figures):

Verizon Wireless has enjoyed very strong year-to-date net additions, but many have come through connected tablets, which typically yield less average revenue per user than smartphone gross additions. As we discussed last week, the vast majority of net additions for T-Mobile US (82% for 2014) came from smartphones, not tablets. For AT&T Mobility to keep up with T-Mobile US’ 2014 net additions they will need to post a whopping 2.5 million new customers in the fourth quarter , which is extremely unlikely. For Verizon Wireless to keep up with T-Mobile US, it will need to add 1.4 million new customers in Q4, a much more likely possibility.

McAdam did not stop there in talking about T-Mobile US (and Sprint). Here’s his take on T-Mobile US’ participation in the FCC spectrum auction and the likely effect it will have on its future pricing flexibility:

“… I know T-Mobile has been in the auction, so they will have some debt load associated with that … you have to generate cash and the only way you do that is by profitable growth.”

Simply put, McAdam said that to play at the high-rollers table, you need to be ready to ante up a lot. If McAdam’s intuition is correct, and T-Mobile US ends up capturing a good portion of the auction proceeds, it will have more debt and, even with parent company Deutsche Telekom’s backing, will not be able to borrow at the same rate as Verizon Wireless.

As we talked about last week, T-Mobile US posted its amazing results without the $100 for 10 gigabytes of data offer in the market. It was done entirely off of iPhone 6/6 Plus launch momentum, and my guess is that its share of the iPhone pie in Q4 surprised Verizon Wireless (and Sprint).

Verizon’s response has been surgical preemption. More from McAdam:

”We divide our base in actual basis points, so for every 1% of the base we’ve got a profile on how we go in and give them the offers that keep them – keep the high-value ones especially – with us. So while churn is up a bit and upgrades are probably, in the fourth quarter approaching 10%, those are very positive upgrades for us. And as I said, the churn is resulting in a higher quality customer that joins the base of Verizon, so as I said, we are very happy with the fourth quarter.”

Verizon Wireless could not be more clear – they did everything they could to keep the highest-value customers, and the rest – well, good luck.

Take a second look at the chart above – in Q4 2012, Verizon Wireless posted 2.1 million postpaid net adds – a record that still stands to this day. According to the earnings transcript from that quarter, there were 1.9 million net new smartphone additions, many of those Samsung Galaxy S3 and the Apple iPhone 5. Even when divided into smaller segments, that’s a large base to segment and maintain. It’s not hard to see why the upgrade ratio will be approaching 10% in Q4.

With tablet sales slowing (although connected tablets should become a higher percentage of what tablet additions remain), T-Mobile US’ LTE footprint growing to 300 million potential customers covered, and spectrum positions starting to overlap, Verizon Wireless must fight a two-pronged attack in 2015. Its response to T-Mobile US’ competitive advances will need to be closely watched.

AT&T’s broad strategy

AT&T is scheduled announce earnings next week. Unlike Verizon, AT&T is in horizontal acquisition mode with FCC approval of their $48.5 billion DirecTV purchase right around the corner and their Iusacell acquisition completed last week.

As we have discussed for the past several years (dating back to the initial Project VIP announcement in November 2012), AT&T approaches wireless differently than its peers. To sum it up, AT&T views wireless as a critical and important component to the overall communication needs of consumers and businesses. This is a very big and broad strategic difference from Verizon Wireless, T-Mobile US and Sprint.

Have a look at Ralph De La Vega’s CNBC interview from the CES show and his video from the AT&T Developer Summit. His focus is not on postpaid vs. prepaid, or even business vs. consumer. It’s on the secure global interface that connects businesses to their customers.

Here’s what’s on AT&T’s plate at the moment:

1. Its $48.5 billion acquisition of DirecTV, which increases the role of content distribution and management to millions of consumers throughout the Americas.

2. Its connected car efforts, which will likely be embedded in 50% of the new cars sold over the next five years (notably, the other 50% will be spread across Sprint and Verizon Wireless) – see more in this analysis. As seen in its third-quarter results, connected device net additions will consistently be greater with AT&T Mobility than their postpaid adds throughout 2015.

3. Its content development efforts through its $500 million Otter Media joint venture with The Chernin Group. See September’s announcement of the Fullscreen acquisition here, and the announcement of two new executive appointments here.

4. Its $2.5 billion expansion into Mexico through its acquisition of Iusacell, and its promotion of Thaddeus Arroyo to lead the new division.

5. Generating returns on the non-LTE portions of Project VIP – approximately $50 billion of the $120 billion spent on the soon-to-be-completed initiative. These infrastructure projects expanded AT&T’s bandwidth speeds to 45 (or 75) megabits per second for a very large portion of its footprint. Overall broadband levels have been flat, and its share of decisions for 25 Mbps and faster high-speed Internet connections has been frustratingly low. Also, small businesses were to benefit from improved wireless coverage and bandwidth, the effect of which has yet to be seen.

6. The company announced over $10 billion in noncash charges on Friday, primarily for pension obligations, but also for early copper retirement ($2.1 billion). While these do not have a direct impact on the current operating margins, the copper announcement signals that the effect of their current LTE trials in Alabama and Florida are probably greater than anyone expects.

7. The AWS-3 spectrum auction results, of which no one knows the real results. However, many analysts (including Craig Moffett of MoffettNathanson) estimate they could be on the hook for $15 billion to $20 billion in license payments in February. That will overhang a lot of AT&T’s decisions, particularly with respect to fiber-to-the-home deployments, this year.

There are many mouths to feed across multiple continents. None of the above figures include the effect of a resurgent Sprint, continued growth at T-Mobile US and a network-focused Verizon Wireless. Is the strategy too broad and is the company spread too thin? How will AT&T manage multiple complex changes to its network, customer base, growth areas and organization? How will AT&T improve wireline, wireless and satellite product integration and customer adoption? How will AT&T manage this expanded and growing developer and supplier ecosystem? Most importantly to shareholders, how will AT&T pay $70 billion in debt (likely $85 billion once the AWS-3 auction is complete) and another $85 billion in noncurrent liabilities (deferred taxes and pension obligations) and pay a 5 to 6% yielding dividend?

The differences between Verizon Wireless’ and AT&T’s strategies are striking, and the results of these diverging strategies should begin to emerge with next week’s earnings reports.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: Welcome to our weekly Reality Check column where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.