The challenges faced by the connected car industry are not easy to solve. The confusion as to what a connected car is looms heavily over the excitement about what the concept has to offer. Studies show that the average consumer doesn’t fully understand the connected car, and even among the industry players there are differences in the definition of a connected car. Gartner just released statistics claiming that 58% of U.S. and 53% of German vehicle owners want tech firms such as Apple or Google, not car companies, to take the in-vehicle technology steering wheel. Adding yet another layer of possible confusion.

During the interview process for RCR’s upcoming feature report discussing the connected car industry landscape, the challenges beyond market awareness and consistent definitions were a key area of consideration. At the industry level there were a few themes that resonated across the organizations who participated:

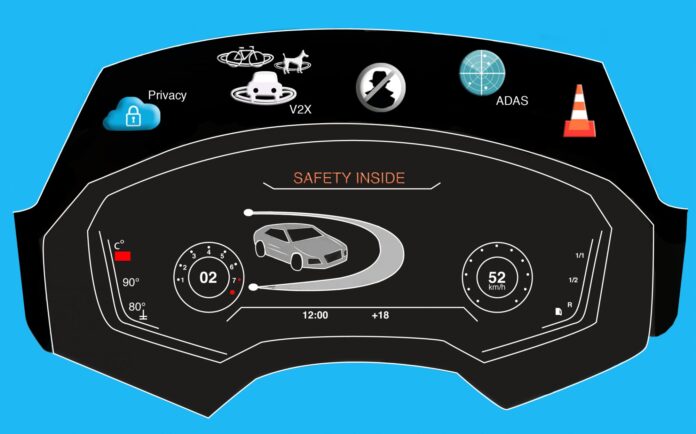

Cyber security and data privacy

How do we ensure the connected car is safe from cyber attacks and who is responsible? Additionally, how does customer data stay private in this world? Read more in RCR’s recent coverage of this topic.

OEM readiness

The automotive industry has historically been a very closed industry in which the different players did not collaborate, but focused on competing. For the connected car model to work there needs to be an open business model. The speed to market is much slower in the automotive world, so can it keep up with the expectations of consumers for connected car functionality and technology? The concept of having an ongoing relationship with the driver and delivering services is new to many of these organizations. How will the global reach of the connected car be addressed in organizations with historically centralized decision-making? Regional regulations and telecom infrastructure could prove challenging in this scenario.

Lastly is the changing model of automobile ownership. Today’s young drivers are more interested in car sharing than car purchasing. The OEMs feel up to this challenge and realize that these topics are important, but the question is how quickly can they adapt?

Government and regulatory requirements related to V2I

According to Rohde & Schwarz, for this technology to work 50% of the cars on the road need to be equipped with this functionality. But not only the cars need to addressed. On the other side of the equation is equipping the infrastructure. Who pays for it? Many industry viewpoints are that these upgrades will only happen because regulation will force them to. But given the state of the roadways in many countries, it makes you wonder if the funding will actually become available. Additionally, there is still a lack of standards as to how cars should communicate with each other.

Where’s the killer app?

Although everyone is very excited about the concept of the connected car, the business model for the consumer still seems elusive. There doesn’t seem to be any “killer app,” for lack of a better term, that will make the consumer spend money on the connected car. Telefónica surveyed consumers in Western Europe and found that they don’t understand what the connected car is. When diagnostics was discussed, it didn’t resonate with them personally in Germany, Brazil or Spain. Specifically in Germany, female respondents were interested in the connected car helping them appear more knowledgeable about their cars when going to the repair shop, for example.

Most importantly: Who pays to make all of this technology work? It’s great to talk about the additional safety provided by the connected car, but consumers aren’t used to the concept of paying more for safety, generally something expected from their cars.

Data management

The amount of data collected from cars continues to increase as the number of sensors in them increases. Do OEMs have the ability to store, analyze and react to this data? Vodafone shared some figures provided by BMW and Audi on this topic. In 2014, BMW said that the average car with 65 ECUs has 15 gigabytes of data onboard resulting in about 60,000 diagnostic sessions per day worldwide. Audi reported that from 2011 to 2014, its connected cars have generated more than 75 terabytes of data – some staggering figures. In addition, there are many cars with 100 million lines of code that are beginning to generate recalls due to software bugs, thus showcasing the importance of over-the-air updates.

Cars speaking different languages

More general industry concerns are related to the scenario of a mix of “smart” and “dumb” cars on the roadways and the implications to ADAS and autonomous driving timelines: The automotive life cycle vs. the telecom life cycle and how the two can co-exist. Along the same topic is when the industry will cover the tethered smartphone vs. embedded solution for infotainment in the vehicle.

The question was also raised as to when there will actually be a connected car industry vs. separate automotive and telecom industries trying to work together. At last year’s Telematics Munich conference there was a great deal of discussion on the topic and whether or not the automotive OEMs become the mobile virtual network operators of the future instead of working with the MNOs as they do today. I’m not sure buying mobile phone service from BMW is the way forward, but more surprising things have happened.

So where do we go from here? These topics alone could make anyone run for cover, but doesn’t that occur in any new market? The convergence of two large industries – telecom and automotive – is not going to be undertaken lightly and is going to generate a lot of growing pains. That said, there’s too much opportunity for everyone involved to not be excited about what’s to come with connected cars. Although the list of concerns is great, the alignment as to what the concerns are across the industry should provide hope that they will come together to resolve them.

Want to learn more about these topics? Join RCR’s connected car industry landscape webinar on Jan. 28 to hear from industry experts. The link to register is here. Also, on that day, a new feature report on the topic will be available for download at no charge.

Like what you read? Follow me on twitter!

Claudia Bacco, Managing Director – EMEA for RCR Wireless News, has spent her entire career in telecom, IT and security. Having experience as an operator, software and hardware vendor and as a well-known industry analyst, she has many opinions on the market. She’ll be sharing those opinions along with ongoing trend analysis for RCR Wireless News.