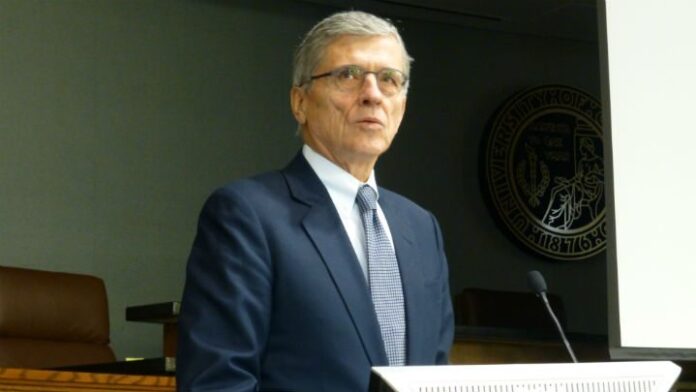

Many of you have called/written me about the general chatter regarding regulatory changes proposed by Federal Communications Commission Chairman Tom Wheeler. The telecom industry needs to take Aaron Rodgers’ advice and “r-e-l-a-x.” While it is strangely undemocratic that the FCC chairman would be very collaborative in the process to date, yet embargo the release of the proposed Report & Order to the public, the report will be released in a matter of days and, as AT&T CEO Randall Stephenson said in his CNBC interview on Friday, the industry will ask for a stay of the order pending the completion of court action.

Chairman Wheeler made some statements recently at a Silicon Flatirons event that describe the three elements of a regulatory framework: Establish a higher “bar” for Internet speed to reflect the changing consumption patterns of Americans; provide the regulatory cover to enable public sector (in this case, municipal taxpayer) monies to be used to compete against incumbent networks; and establish rules that prevent incumbents from using their monopolistic or duopolistic structures to further thwart the advancement of a faster and fairer Internet.

Rather than pick apart the chairman’s speech (see article here that provides a lot more detail on why NABU failed – it had less to do with the cable industry in the 1980s and more to do with a business model that predated e-mail, the browser and Wi-Fi enabled devices), let’s focus on four questions that this Report & Order should address:

1. Does the strategy encourage Google to quickly deploy a third – fiber or otherwise – broadband alternative?

Google is the only one of the larger Internet players that have taken steps to do so. We know that when they announce they are entering a market, the incumbents immediately take steps to make their networks more competitive by providing better service alternatives like StepOne, a startup client, which is being trialed in Round Rock and Austin, Texas, a Google Fiber city. If the strategy does not encourage Google – and others – to do this quickly, then restart the process.

2. Does the strategy lead to two-sided business models that increase the affordability of broadband services?

Interestingly, when Chairman Wheeler outlines his objectives in the Silicon Flatirons’ speech, he cites “fast, fair and open,” but does not tackle the issue of affordability. To get a perspective, take a look at the recent findings of the Corporation for Economic Development: Forty-four percent of Americans are living with savings of less than $5,887 for a family of four. These families’ cares don’t run Ookla speed tests and cannot afford the latest iPhone 6, but some/most of them use an iPhone 4S or a Samsung Galaxy S3 to get their daily information. Raising the bar on home broadband speed means nothing to them if they cannot afford the computing devices that connect to the modem. AOL founder Steve Case won because he understood the value of a two-sided business model – advertising on the AOL home page. Paid prioritization and sponsored data are a couple of examples of two-sided business models that might work. If alternative models can increase affordability, why eliminate the option?

3. Does the strategy leverage existing government investments?

This column has been critical of the National Telecommunications and Information Administration’s Broadband Technology Opportunities Program, which sought to deploy additional resources into underserved markets with limited success (see this excellent article in The New York Times that outlines the failures of the program through February 2013 – there have been several additional failures since this article). The BTOP allocated just over $4 billion in funds – the chairman is proposing more than $12 billion in the next round. What have we learned, and how will this time be different? How do we leverage the existing fledgling/failing investments?

4. Does the strategy drive more fiber investment?

This is the most critical question. Market forces have driven the deployment of fiber to tens of thousands of cell sites and tens of millions of homes. Existing digital subscriber line technologies will drive 75 megabit per second speeds, and new technologies leveraging the G.fast standard will drive more than 1 gigabit per second to homes starting this year (see Ars Technica article here). Both of these require deeper fiber deployments, if not to the home, to the nearest aggregation point (e.g., the node). While the chairman declares the goal of “economic return as an incentive for an investment in broadband infrastructure” to be legitimate, no details have been provided to show how government policy will accelerate fiber deployments. If the policy does not accelerate fiber deployments, then restart the process.

(Note: relatively speaking, the applications using the broadband infrastructure have created hundreds of billions of dollars more shareholder wealth than the wireless and wireline networks they transit. See more here).

There’s a lot the government can do to improve broadband availability and affordability. Competition is the catalyst for success. If the FCC cannot promote capitalistic solutions to solve these problems, the issue will be left up to either judges or Congress and the president. More to come after the details are released.

CenturyLink’s earnings: caught in the middle

CenturyLink provided a quarterly and full-year earnings report last Wednesday. As we have stated in several previous columns, they provide a fairly good proxy for the state of the incumbent local exchange provider section of the telecom ecosystem. Like its peers, CenturyLink is in the midst of a transition, although it appears that the worst declines are behind them.

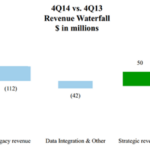

Their fourth-quarter waterfall chart provides a good visual of the transitions affecting the company. Legacy revenue, consisting mainly of voice and low-speed access services continue to be under pressure, although it appears that the largest declines are behind the company. Data integration revenues – customer equipment and special construction revenues – were also down in Q4 2014. In total, these revenues represent just over 3% of the beginning revenue balance; revenue losses from local lines net of strategic revenues have been as high as 6% in recent years.

Of greater concern is the inability to grow new revenues. CenturyLink spent $160 million on AppFog and Tier 3 in the last half of 2014 (net of cash on hand), and these acquisitions should have started to show meaningful revenue gains. Revenue growth of $50 million – with no material sequential revenue growth due to collocation revenue pressures – is very slow, especially on a quarterly revenue base of over $2.3 billion. (Note: even a “normalized” figure shows a strategic services growth rate of 3.5%.)

To increase the sales opportunity base (and to get the right salespeople in place to sell cloud and security services), CenturyLink reorganized. While the full extent of this reorganization is not yet known, management tempered first-half 2015 expectations to reflect the transition time needed to sell and provision cloud services. Two CenturyLink veterans, Karen Puckett and Maxine Moreau, now run the company – this number had been as high as five in recent years. Provided that the bureaucracy of a large corporation can be minimized (meaning decisions can be made more quickly and that market performance can be localized), this is a recipe for success. There are many who doubt that this can translate into the growth expectations established by the company, but any growth above 3% will be viewed as a positive sign.

Bottom line: CenturyLink needs a win before the Comcast/Time Warner Cable merger is completed. The Data Gardens and Cognilytics acquisitions are good starts, but there must be a sales force to create a compelling value proposition to customers. This starts with end-to-end service performance and pricing that reflects marketplace realities.

Six undeniable trends shaping 2015

While there are a lot of events swirling throughout the telecom ecosystem, here’s some undeniable trends based on recent news:

1. The U.S. economy is going to grow faster in 2015 than 2014. This growth will be disproportionately in the South and West, with Texas leading the way. No other region of the world – except China – matches the 2015 growth prospects in the United States.

2. Price competition is going to be more prevalent in the wireless consumer marketplace. This will help T-Mobile US and Sprint, and hurt Verizon Communications and AT&T. The extent of the impact will be driven by the success of Verizon Wireless’ churn-reduction efforts.

3. Legacy (T-1, DS3, OC3, OC12) circuits are going to be quickly replaced by fiber-based (Ethernet) initiatives. This change is not confined to carriers alone – there are many small businesses eagerly awaiting the availability of fiber-based providers (see point 5 below).

4. Absent the resumption of radical regulatory policy, fiber deployments for core network needs – small cells, fiber-to-the-tower, in-building fiber – will continue to grow.

5. Cable commercial services will be the fastest-growing sector in telecom; $1.1 billion or 20 to 22% growth on a combined basis for the combined Comcast/Time Warner Cable in 2015.

6. Apple+Google+Facebook+Microsoft+Amazon.com will generate $2 to $3 in equity market value for every $1 created by the entire telecommunications industry.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.