Verizon spectrum auction results conference call: Densify, baby, densify

Verizon Communications’ Tony Melone, EVP network, and CFO Fran Shammo held a short, but extremely informative, conference call helping the analyst and investor community think about the results of Auction 97 (full information and details here).

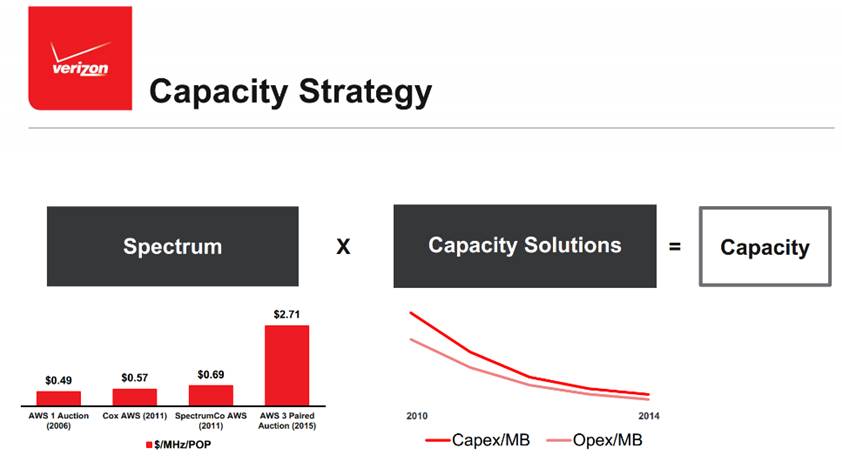

One of the first charts Verizon showed was the price per-megahertz/per-potential customer covered for this auction vs. other auctions:

While the “headline” number of $44.9 billion in total bids is certainly an attention grabber, the relative cost of this spectrum compared to previous auctions is astounding, and, depending on the auction involved, the number and financial capabilities of the bidders were not dramatically different from Auction 97.

Spectrum obtained in this auction cost Verizon nearly four times more than private spectrum purchases (SpectrumCo is the purchase from several cable companies in 2011) and over five times more than the first AWS auction in 2006. As a reminder, Verizon had $75.3 billion in license assets on the books at the end of last year, which is likely more than the total net property, plant and equipment deployed to make the spectrum commercially available. The company’s total wireline + wireless net PP&E is just shy of $90 billion. Things were already getting expensive before Auction 97 – now what?

The answer to that came from Melone on the conference call:

“… certainly at a time where spectrum was at a certain price per-megahertz/POP, that was a very effective solution. As those prices increase, small cell technology, with the improvements there, just the balance of the comparison between the two changed dramatically.”

This is the raw truth – if you have contiguous spectrum (a hallmark of Verizon Wireless’ purchases to date), the ability to add additional capacity through small cells becomes a financially better solution for the shareholder at some point. Said another way, small cell architectures become a more viable alternative if they can be introduced nationally.

Verizon has the capability to do this, and, as discussed on the conference call, already has some metro deployments underway – including a 400-node deployment in Boston. That is good news for small cell and fiber providers that have been working with Verizon for several years.

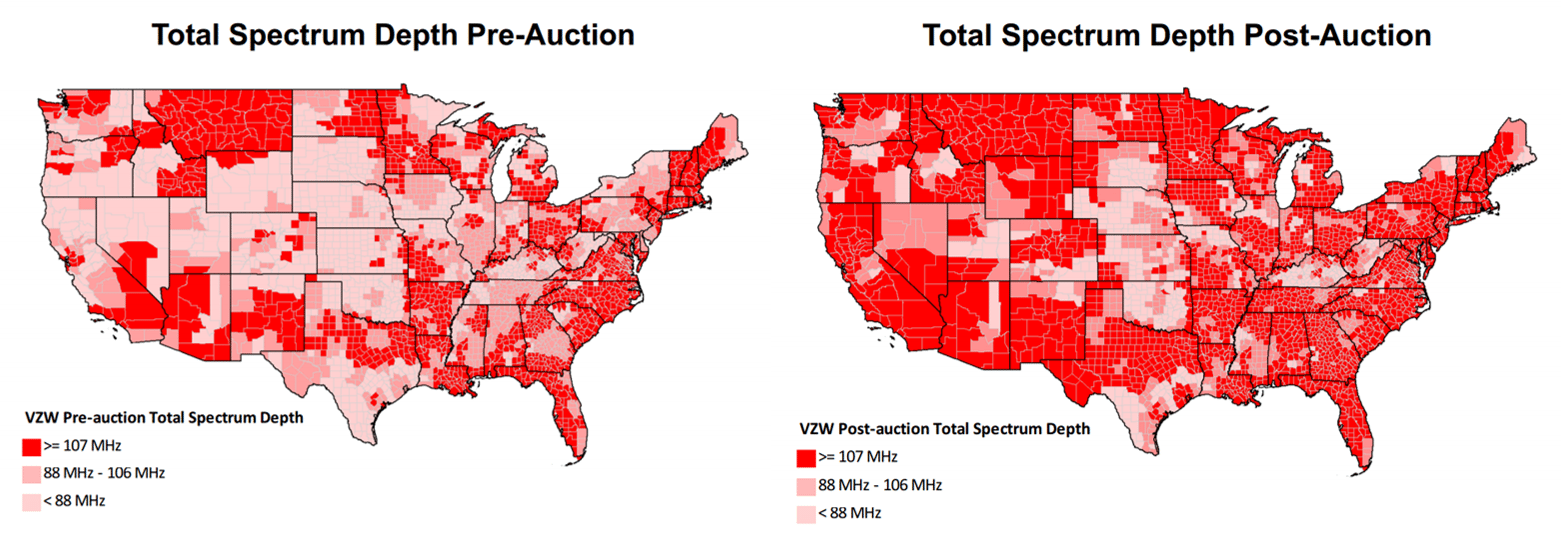

Verizon also showed its new map of spectrum holdings before and after the auction:

It’s very clear that Verizon’s strategy was to nationalize its total holdings. Generally, the company achieved it with 46 of the top 50 markets with more than 40 megahertz of 1.7/2.1 GHz spectrum, but there are going to be areas where midband (1900 MHz) is going to need to be repurposed soon or densification needs to happen quickly: Chicago; south Florida; Oklahoma; Kentucky; West Virginia; and south Texas did not improve holdings significantly. Fortunately, there are good fiber partners in most of these locations.

In more rural markets, there are U.S. Cellular (Kansas, Iowa, Oklahoma, Nebraska, West Virginia, Maine); C Spire (Mississippi, south and western Tennessee); and other alternatives. With a friendlier Federal Communications Commission, they could even be more than friends.

Bottom line: Verizon will be accelerating its small cell deployment efforts with more than $500 million in incremental spending each year for the next three years. This is good news for the industry, and potentially worrisome news for those expecting another record-breaking FCC auction in 2016.

T-Mobile US’ Math

On Feb. 19, T-Mobile US released earnings and hosted an informative and entertaining 90-minute quarterly earnings call. While we have covered a lot of T-Mobile US’ accomplishments in recent columns, it’s worth noting just how far T-Mobile US has come in the past year. In 2014, they achieved the following:

• 4 million phone net additions

• 4.9 million total postpaid net additions

• 8.3 million total net additions

• 9% service revenue growth

• 13.1% total revenue growth

• 6% adjusted earnings before interest, taxes, depreciation and amortization growth.

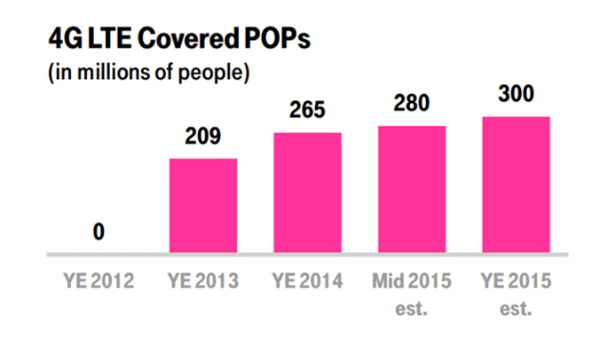

• 56 million more POPs covered with LTE (209 million to 265 million)

After such stellar results, the company’s meager estimates of 2.2 million to 3.2 million postpaid net customer additions has a lot of people scratching their heads (including yours truly). True, this lower postpaid net customer addition estimate is paired with an $800 million to $1.2 billion increase in adjusted EBITDA and only a slight increase in capital spending, but 2.2 million? Really?

Let’s start with some basic math. T-Mobile US ended 2014 with 27.185 million branded prepaid customers. For the sake of round numbers, let’s assume 450,000 customers churn each month (1.66%), leaving T-Mobile US with 5.4 million churned customers and a requirement of 7.6 million gross additions required to hit the low end of guidance (27.185 million – 5.4 million churning + 7.6 million gross additions = 29.385 million projected year-end 2015 customers).

While 7.6 million customers may seem like a steep number, let’s consider the tailwinds T-Mobile US has at their disposal. First, as the chart from their earnings presentation shows, they entered 2015 with a larger LTE footprint that’s going to continue to get larger throughout the year.

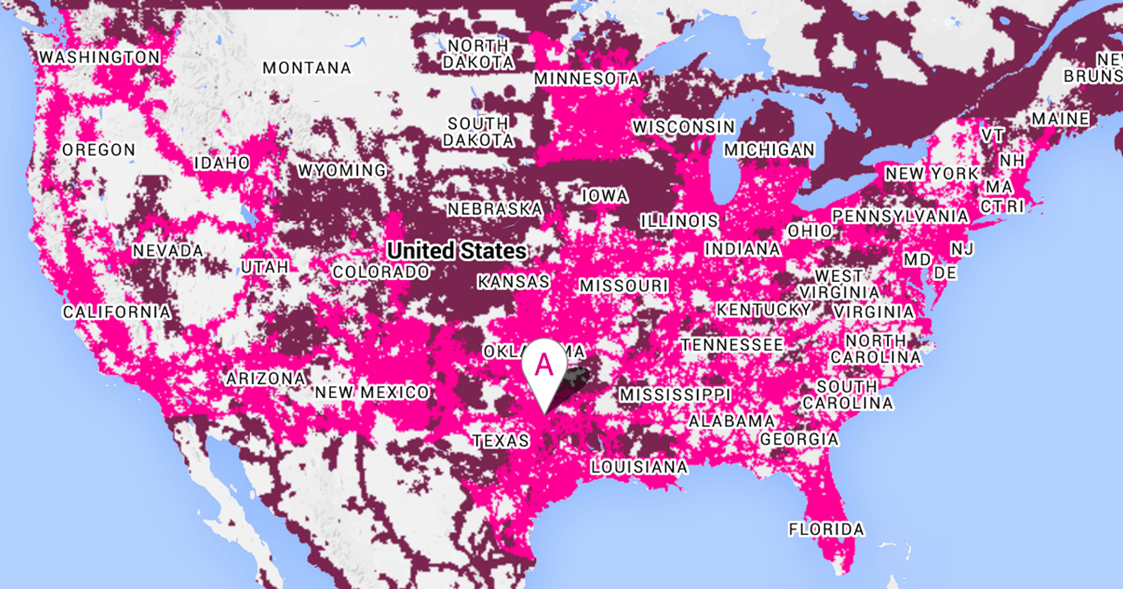

At the end of 2013, T-Mobile US covered 209 million POPs with LTE. That number grew to 233 million by the second quarter of 2014, 250 million in the third quarter and 265 million in the fourth quarter. Prior to that, if customers had any coverage, it was at a 2G (kilobits per second as opposed to megabits per second) speed. Any LTE expansion should therefore be viewed in the same light as a market relaunch. Because these are not new market launches, adoption rates for the new network occur at a slower rate – the brand, as well as the investigative tendencies of a skeptical population, need time to catch up with network speeds. T-Mobile US’ current LTE and 2G network coverage is shown in the map below:

T-Mobile US currently has approximately 12% of the “big 4” branded postpaid market, with Sprint at around 30 million; T-Mobile US at 27 million, AT&T Mobility at 76 million and Verizon Wireless at 102 million. Let’s assume that its market share in the 2G-only markets is 3-4% and that once the market relaunches, share grows by 2% in the first month and 1% per month thereafter until the 12% threshold is reached (again, these are placeholders only). If these estimates are close to reality, then T-Mobile US should grow 1% each month for at least 3 months for the 32 million POPs that it grew from Q2 to Q4 2014 – from 233 million to 265 million. That is their first 1 million gross additions, and close to that for net additions.

Add to that the projected growth of 35 million LTE POPs in 2015. Assuming that it grows these markets by 6% throughout 2015, that’s another 2.1 million gross additions, and, again, close to that for net additions.

Bottom line: LTE expansion in 2G markets alone gets T-Mobile US at least 3 million of its 7 million to 9 million gross additions required to hit its 2015 guidance. (Note: LTE expansion also helps T-Mobile US’ retail prepaid expansion as well.)

That leaves about 4 million to 6 million additional postpaid gross adds. One of the “un-carrier” moves has been to extend equipment installment payment credit status to T-Mobile US prepaid customers who have paid 12 consecutive bills. CEO John Legere and CMO Mike Sievert indicated on the call that this is likely a much better indicator than anything coming from a credit agency – see more here. T-Mobile US currently has 16.3 million branded prepaid customers, so let’s assume 36% of them meet the criteria outlined above and that one-third of these opt into EIP status. That represents an additional 2 million retail postpaid “gross adds,” as well as increased prepaid churn. More details on why 36% and the one-third rate make sense are available from the carrier upon request.

That brings us to 5 million gross adds: 3 million from LTE expansion, plus 2 million from the “smartphone equality” initiative. We have yet to look at external customers coming in from Verizon Wireless, AT&T Mobility and Sprint for the remaining base. If we assume that the rest of the base does not gain any market share whatsoever, T-Mobile US will add 5.4 million gross additions to cover their churned base.

Bottom line: With moderate to conservative assumptions, it’s likely that T-Mobile US will generate 10 million to 11 million gross additions in 2015, not the 8 million to 9 million implied in their guidance. They will get this from the following:

• “New market lift” for the second half of 2014 LTE markets launched of 1 million gross additions.

• “New market lift” for full-year 2015 LTE markets launched of 2 million gross additions.

• Smartphone equality postpaid gross additions of 2 million, with a similar amount of branded prepaid churn.

• Existing – end of 2014 – market gross additions from Sprint, AT&T Mobility and Verizon Wireless of 5 million to 6 million, which allows the existing markets to stay even on a market share basis with 2014 levels.

We have not even touched on increased gain from family plan initiatives hinted to on the earnings call, which would boost the 5 million to 6 million figure, and any increase in tablet gross additions from a new iPad launch. Either T-Mobile US’ math is light, the smartphone equality initiative is a PR play and will not be seriously marketed to the base, or there is an unmanageable churn surprise just around the corner. I’m going with the math sandbag and hope that Verizon Wireless and AT&T Mobility are paying close attention to their market shares in the Midwest and South.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.