Telefónica’s 2014 full-year and fourth-quarter net income slumped 34.7% and 89.5%, respectively, in a year-over-year comparison. Total revenue decreased 11.7% for the full year and 14.1% in Q4 2014.

In a statement, Telefónica’s executive chairman César Alierta said that the Q4 results represent the culmination of a period of intense transformation that has strengthened the company, its growth potential and financial position in just over two years.

The results were affected by the adoption of the exchange rate set at SICAD II in Venezuela and a provision for restructuring costs. However, the telecom company gave an upbeat forecast for sales growth, saying it expects sales to increase 7% this year and more than 5% in 2016.

TIM investment: TIM Brasil, which is owned by Telecom Italia, released its three-year strategic plan for 2015-2017, including a total investment of more than $4.54 billion. The main goal is to extend 4G coverage to more than 15,000 sites – currently 3,700 antennas – and 3G coverage to over 14,000 sites by 2017. TIM expects the data traffic to keep growing and plans to expand LTE to cover 79% of the urban population. The carrier expects earnings before interest, taxes, depreciation and amortization to grow continuously throughout the plan.

Peru’s 700 MHz auction: Peru is set to hold an auction for the provision of broadband mobile services with LTE technologies. The government plans to offer up three blocks of 15×15 megahertz of spectrum each in the 698-806 MHz (700 MHz) band. Other bands have been previously tendered for LTE.

“The 700 MHz auction is part of a national plan to boost the development and use of broadband in the country, through the deployment of infrastructure, devices, content, applications, skills and digital services, for the economic and social development of the country,” said Maravedis analyst Adlane Fellah. In 2014, the telecommunications sector in Peru generated $5.8 billion in revenue, 70% of which came from mobile telephony.

More news from the Latin American region:

Argentina – Optimum Capital and Kingsley Capital are buying Nextel Argentina for an undisclosed amount. According to local news reports, the sale is expected to close in March.

Claro is expected to launch LTE services in June, becoming the third carrier to offer 4G services in Argentina.

Venezuela – Telefónica’s Movistar announced the launch of LTE services in Venezuela. Movistar was awarded spectrum in the 1700-2170 MHz (10×10 megahertz) and 2600 MHz (20×20 megahertz) bands. Caracas and Puerto La Cruz will be the first cities covered by Movistar’s LTE services.

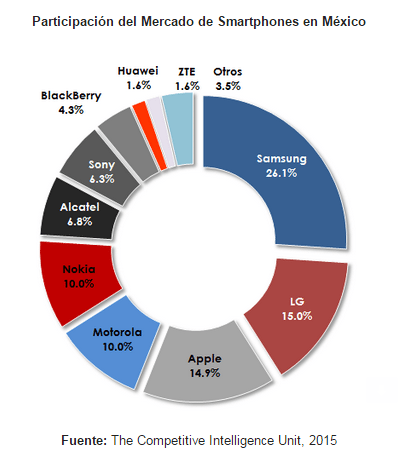

Mexico – With nearly 104 million mobile lines, the Mexican market for smartphones is growing. By the end of 2014, smartphones totaled 52.6 million units (50.6% of the total) and for the first time surpassed feature phones. Samsung leads with a 26.1% market share.

Antel Communications entered the Mexican wireless market through a partnership with Telefónica’s Movistar, the country’s No. 2 carrier. The first shipment of Antel’s Olé branded 3G smartphones entered the country in November and are being sold to Movistar customers.

Colombia – Mobile virtual network operator Virgin Mobile said it has reached 2 million subscribers in Colombia. The MVNO market in Colombia has flourished, ending 2014 with 2.8 million customers, significantly more than the 807,000 in December 2013. Still, MVNOs represent only 5% of total active mobile lines.

Jamaica – Brian Butler was named the new CEO of Digicel Jamaica. According to the company, he will transition into the role in the coming weeks.

Brazil – The number of broadband connections increased 44% year-over-year. Brazil ended December with 192 million accesses. Mobile lines, both 3G and LTE, led the broadband expansion.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.