GfK recently conducted an online study of 5,800 participants in Brazil, China, Germany, Russia, the United Kingdom and the United States on the topic of connected cars. I recently had an opportunity to talk with them about some of the key findings of the report.

The participants included drivers of premium and standard car makes and models along with a mix of new and used automobile owners. In all cases, the majority of participants were vehicle owners as opposed to those who leased or took part in car sharing options. Of the total participant population, 44% commuted daily by car while 26% took a bus and 21% were able to walk to work. They were also asked how driving made them feel – important later when we look at the connected car results. Today the top feelings associated with the driving experience are happy, relaxed, peaceful and free. The heaviest drivers were in China and Russia with more than seven hours per week logged behind the wheel.

So what about the connected car? For this section of the research, leading-edge consumers were identified to highlight and compare their responses to the general consumers in the study. This group represented about 20% of the overall sample and were categorized in the following way:

- Passionate about driving.

- Owning a new car.

- Talking about cars regularly.

- Influential in their social circles about cars.

- Likely early adopters.

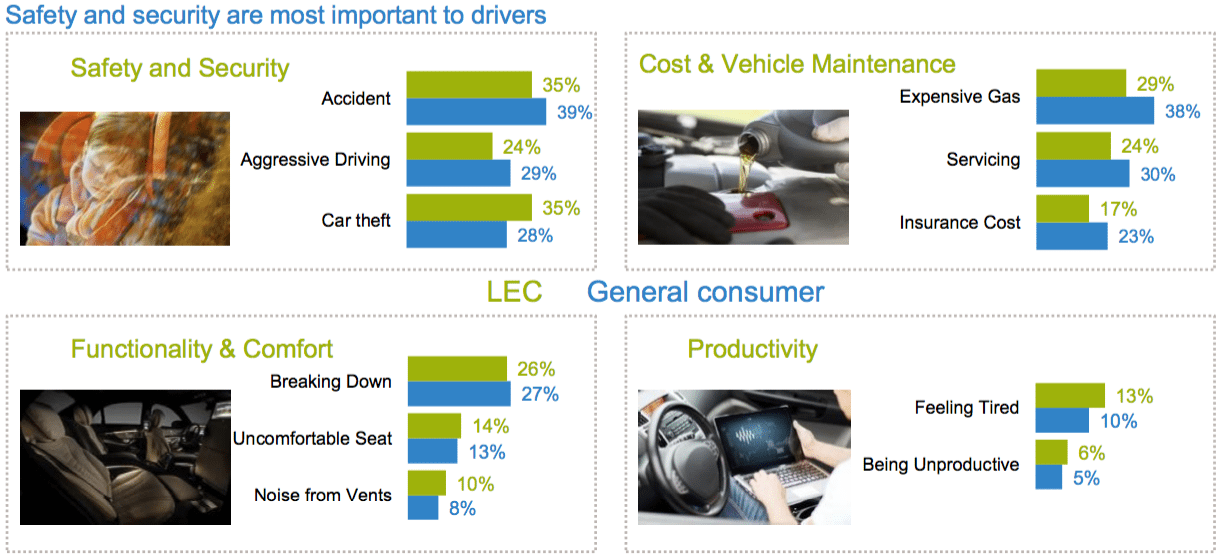

The top four concerns to these drivers were focused in the categories of safety/security, cost/vehicle maintenance and functionality/comfort. Somewhat surprising was that productivity enhancements ranked very low on the priority list. With all of the talk about autonomous driving enabling you to do other things while underway in your car, it doesn’t seem at this point that that topic is piquing the interest of these consumers. It could be lack of awareness or it could be actual lack of interest, but it’s interesting to find this difference as autonomous driving is a major discussion point for the OEMs that are touting this functionality in the future.

For both the LECs and general consumers, safety and security was key. The topics of most interest were emergency braking, emergency calling functionality, self-parking and pre-incident preparation by tightening the seatbelts. Another surprise came in the infotainment category, which is often heralded by both the automotive and telecom industries as a key revenue driver for the connected car. At this point, GfK found that is really only true in the LEC category and not as much with the general consumers. I’m not overly surprised by this finding as I think for the general population we are still looking for that “killer app” that will motivate the general population to spend money on the connected car. Although more than 80% of the LECs were interested in topics such as augmented reality windshield displays, in-car voice recognition functionality, in-car Wi-Fi and in-car video and event recorders; these features were of interest to only about 50% to 60% of general consumers.

The connected car specific concepts GfK put forth to the group of survey participants were categorized as follows:

- Entertainment

- Autonomous driving

- Vehicle data tracking

- Safety

- Life organizer

- Electric car

- End-to-end mobility

Although the percentage of individuals interested in these concepts varied between LECs and general consumers, the categories of highest interest did not. It was really around safety and vehicle data tracking.

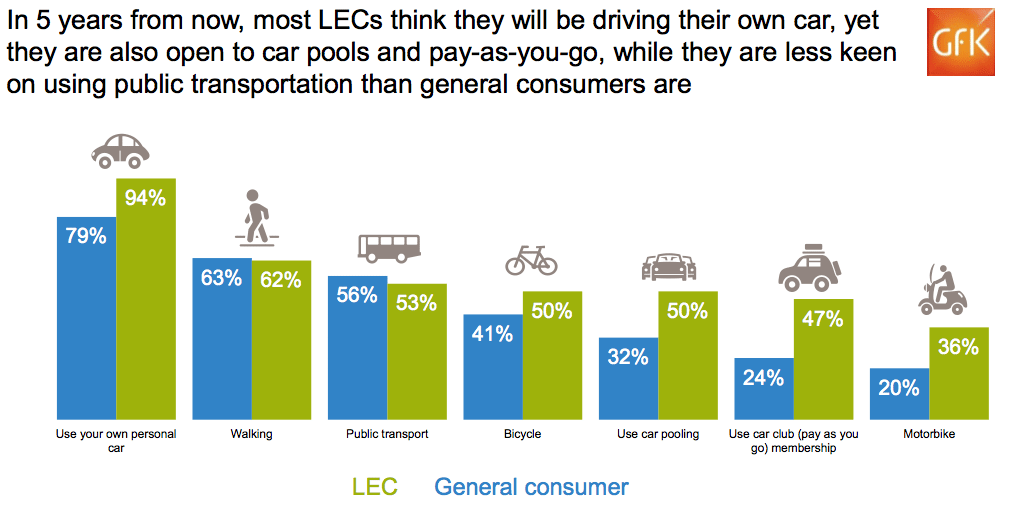

There were two aspects of the survey that truly surprised me. I mentioned earlier how driving made the survey respondents feel, well, there is a second set of parameters around how the connected car made people feel. What really surprised me were the autonomous driving results. With all of the industry hype, the results were polarizing. Although there were interested respondents, there were also many who said that autonomous driving would make them feel anxious and powerless. The other surprising result was what transport will hold in 5 years time. With all of the discussion of car sharing taking over car ownership in the near future, the study did not see this in the general consumer category. There was a view to support this in the LECs though.

What this research shows is that we still have a great deal of work to do as an industry in educating the general public on the connected car topic, and as a result, services to this audience may shift the monetization of the connected car further into the future then desired by the industry itself.

More details about the survey can be found at GfK’s website.

GfK will also join RCR Wireless News as a speaker on the upcoming connected car webinar.

Like what you read? Follow me on twitter!

Claudia Bacco, Managing Director – EMEA for RCR Wireless News, has spent her entire career in telecom, IT and security. Having experience as an operator, software and hardware vendor and as a well-known industry analyst, she has many opinions on the market. She’ll be sharing those opinions along with ongoing trend analysis for RCR Wireless News.