These next two weeks, we’ll recap the first quarter with a quick spin through the top 10 events that will influence telecom earnings calls throughout the year. Thanks to several of you who sent in your own nominations.

Top 10 events of Q1 (in no particular order)

The first quarter of 2014 saw 20 to 25 events competing for a top spot. While there have been many noteworthy events this quarter, it’s remarkably quieter than last year (we welcome your thoughts on why). Here’s our take on the most impactful events in no particular order:

1. Sling TV announced at CES

Priced at $20 per month for ESPN, CNN, A&E, AMC, HGTV, TNT, TBS, History Channel, Travel Channel, Cartoon Network and more. Low-priced add-ons to customize the TV experience include $5 for SEC Channel, ESPN News, ESPN U, Univision Deportes, BeIN networks, and more. There were over 100,000 signups, according to Re/Code. The product boasts full compatibility with Amazon Fire TV, Roku and Microsoft XBox One platforms with Google Nexus Player coming soon, but no Sony PS3/PS4 platforms due to their competing Playstation Vue product launched on March 18.

Decent reviews (read this one from TechHive) indicate Sling still has a way to go on user interface, but that everyone in the tech media community is rooting for them. A late quarter addition of AMC and A&E may have impacted initial sales. The $20 price point is very attractive as it’s close to the price of leasing an additional set-top box for another room in your house.

Bottom line: Big idea, decent implementation, amazing use of the existing Hopper and Sling infrastructure. Sony and Apple have real competition.

2. (and 3) The FCC AWS-3 Auction 97 ends, and Verizon sells off more of its local properties

Auction 97’s $44.9 billion in gross bids is a lot to pay for spectrum, especially when most pundits were predicting that winning bids would only fetch $20 billion. AT&T bid extremely aggressively, to the tune of $18.2 billion, and Dish Networks, independent of third parties, also was a surprise winner in many metropolitan locations with $10 billion in wins including 15 megahertz of unpaired spectrum, although not without some criticism of their partnering strategy. See more in this The Wall Street Journal article. This prompted aggressive courting from T-Mobile US, with $1.8 billion in wins, which suggested at Deutsche Telekom’s Investor Day the “Dish and we [T-Mobile] makes some sense … from the standpoint of integrating that spectrum and capability and deploying it at our network.”

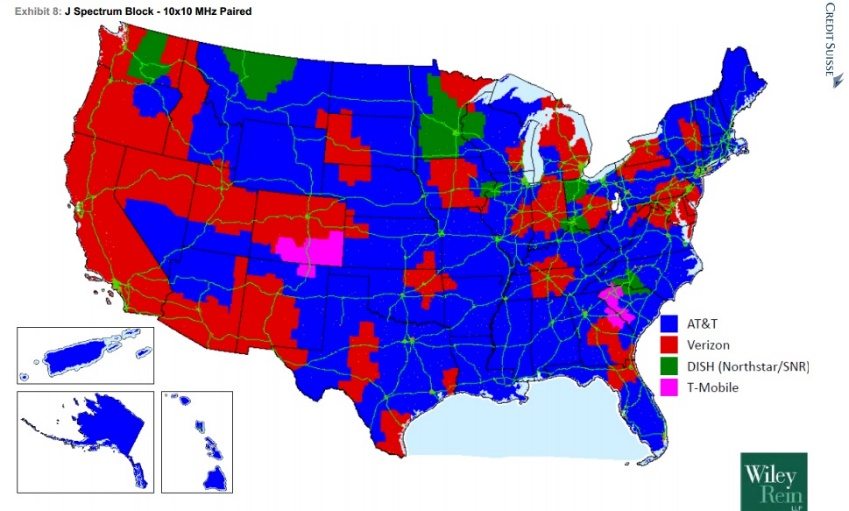

From the attached map (courtesy of Wiley Rain), the most coveted 10-megahertz J-Block of spectrum was divided pretty evenly between AT&T (blue in map) and Verizon Communications (red). However, Dish and T-Mobile US won larger portions of the country in the G-, H- and I-Block bands, and Dish won the A1 and B1 unpaired spectrum blocks across most of the country.

The larger-than-expected price tag led Verizon to more aggressively jettison its local exchange presence in California, Florida and Texas for $10.54 billion (see Frontier’s announcement here). This represents approximately 3.7 times 2014 estimated earnings before interest, taxes, depreciation and amortization and 1.8 times 2014 actual revenues. Most importantly, these markets contain 1.2 million FiOS video subscribers, or about 21% of the total FiOS video franchise; 54% of the assets they acquired were FiOS enabled.

This left many (including me) scratching our heads. How will Verizon increase the profitability of the Verizon video franchise if it continues to descale the business, since programming costs are highly dependent on viewership? Will this have a negative effect on Verizon’s ability to compete in the enterprise space in Tampa, Fla., Dallas/Fort Worth, Texas, and Los Angeles?

4. The Apple Watch launch date and features disclosed

As many of you reminded me last week, the Apple Watch was technically introduced in its Sept. 9 announcement. But few saw a $10,000 watch coming and sharing the stage with a $350 brand. Can Apple quickly gain share in all parts of the “wearables” spectrum? How will wireless carriers (no separate radio means no gross add) and Best Buy distribute this product, which will undoubtedly sit side-by-side with Samsung and other models? How will applications be redefined as a result of Apple’s bold push into tiny screens?

Bottom line: Extremely effective advertising (if you have been watching college basketball, you have seen the ad), and heavy developer support mean that Apple’s launch will be a screaming success, especially at the highest end which will undoubtedly sell out. The Apple Watch’s magnetic charging mechanism is also a lot better than alternatives. The watch needs to have staying power and that only comes with a lower price. It will be very interesting to see how Apple solves that equation.

5. Samsung Galaxy Note 6/6 Edge introduction

It’s amazing what an aluminum alloy body will do for first impressions of a Samsung Galaxy phone. “Samsung, reborn” are the first words from the CNET review. “Welcome back, Samsung” from Mashable as they proclaim the Galaxy S6 the Android “Phone of the Year.” A nonreplaceable battery and no micro-SD card capabilities have many crying foul, until they see the super-fast charging capabilities – 10 minutes of charging time for 2 hours of video playback – and 32 gigabytes baseline capability for the same price as Apple’s iPhone 6. There’s no waterproofing, but then again there’s no annoying charging cover to close as the Galaxy S5 has. Super changes to phone capabilities include improved optical image stabilization and f-stop.

T-Mobile US took its Galaxy S6 promotion to a new level with 12 months of free Netflix for all preorders, and Sprint is discounting the phone charges to free with the purchase of an $80 unlimited plan.

Bottom line: Good reviews influence early adoption, and the wireless carriers appear to be solidly behind promotion. This is going to be a very good selling phone for Samsung (and Google Chromecast). Next up: a better tablet.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: / 123RF Stock Photo