Charter targets Bright House in deal to combine No. 4 and No. 6 cable providers

Cable industry consolidation looks set to continue as Charter Communications announced plans to acquire Bright House Networks for $10.4 billion. The move, if approved by regulators, would combine the country’s No. 4 and No. 6 cable operators.

Once completed, the combined entities are set to operate through a partnership that will see Charter own 73.7% of the business, with Bright House parent company Advance/Newhouse controlling the remaining 26.3%. For its troubles, Advance/Newhouse will receive $2 billion in cash, with the rest of the proceeds coming from common and convertible preferred units in the joint operation.

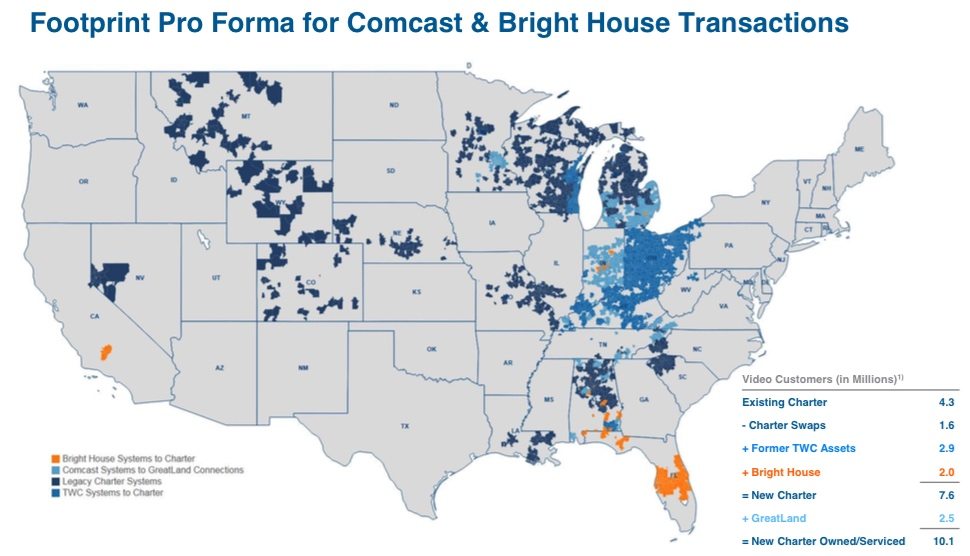

The deal would add approximately 2 million video customers to Charter’s holdings, with Bright House’s footprint focused mainly in central Florida and some outlying systems in parts of Alabama, Indiana, Michigan and California.

Cable companies have become increasingly important to the wireless telecom space as their extensive fiber footprint has become a source of high-speed backhaul capabilities for cell sites. Cable providers are also taking advantage of that footprint by rolling out Wi-Fi services that offer voice and data connections targeting their embedded cable customer bases. In announcing the latest deal, Charter claimed Bright House had some 45,000 Wi-Fi access points.

Charter’s proposed deal comes as federal regulators continue sifting through Comcast’s $45 billion bid for Time Warner Cable, in a move that would combine the nation’s No. 1 and No. 2 cable providers. That deal was announced more than a year ago and has seen a number of stoppages related to content-related confidentiality agreements. Charter had originally been a bidder for TWC, and had recently stated it would again go after TWC should the Comcast proposal fall apart.

Charter is also in the process of acquiring a 33% stake in Midwest Cable, which Comcast is spinning off as part of its TWC deal.

Analysts appeared positive on the Charter-Bright House deal, noting that it would help bolster Charter’s operations in the face of over-the-top competition from content providers like Netflix and HBO, while at the same time signaling confidence from Charter that the pending Comcast-Time Warner Cable deal is likely to be approved.

Bored? Why not follow me on Twitter