The Brazilian telco market had total revenue of $77.24 billion in 2014, an equivalent of 4.2% of the country’s GDP.

All together, telco operators invested $9.57 billion last year; if the acquisition of spectrum licenses is concluded, the total rises to $11.42 billion.

The country ended 2014 with 372 million accesses, of which 45 million were landlines, 280.7 mobile lines, 24 million Internet broadband accesses and 19.6 million were pay-TV subscribers.

Brazil is the No. 4 cellphone market in the world – China is No. 1, followed by the United States and India.

Last year, smartphones sales were up 55% compared to 2013, totaling 54.5 million units, according to a survey conducted by IDC. When adding feature phones to the count, 70.3 million cellphones were sold in 2014.

The survey also showed that 15% of all smartphones sold in Brazil last year were LTE enabled, however that number is expected to reach between 30-35% next year. As for the expected number of devices, IDC predicts an increase of 16% in the smartphone market for 2015, totaling 63.3 million commercial units.

Currently, the average smartphone penetration rate across Latin America sits at 31%. On the other side, as the adoption of smartphones increases, carriers are growing more concerned about how to monetize their network investments. Telecom industry trade association GSMA recently said it expects data traffic across Latin America to hit 15.9 exabytes in 2018.

Chile’s Internet growth: According to numbers released by the Chilean telecom regulator Subtel, Internet accesses grew from a penetration rate of 49.1 per 100 inhabitants in 2013 to 64.1 in 2014, reaching a total of 11.5 million accesses last year. Part of the increase is a result of 3G and 4G deployments. Of the total accesses, 78.2% were made via smartphone.

By December, Chile counted 132.2 mobile lines per 100 inhabitants, reaching a total of 23.7 million lines. Postpaid lines reached 31.1%. Movistar, owned by Spanish group Telefónica, leads the mobile market with 38.3% of market share, followed by Entel (35.6%), America Movil’s Claro (22.7%), Nextel (1.4%), the MVNO Virgin (1%) and VTR (.4%).

More news from the Latin American region:

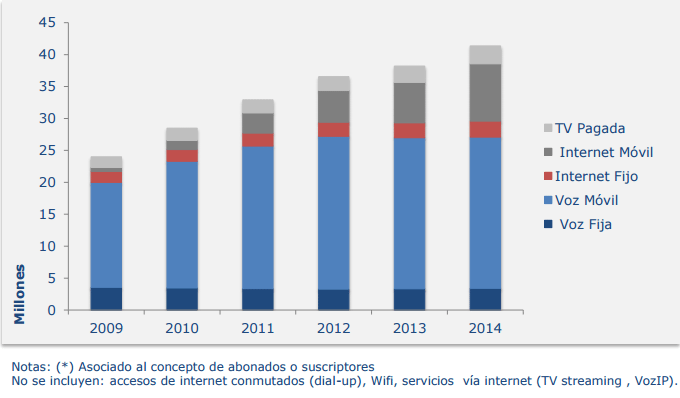

COLOMBIA – The country’s ICT ministry announced that the use of information technology and communications services has grown 44% since 2009.

CHILE – A new mobile virtual network operator has launched services in Chile. The MVNO, called “Simple,” is owned by former directors of Telefónica, which operates as Movistar in Chile. Simple will use Movistar’s network to reach all areas of the country.

PANAMA – Facebook has selected Digicel to launch its nonprofit, Internet.org, in Panama. The announcement was made during the Summit of the Americas.

COLOMBIA – El Pais reported that Emcali expects to secure a telecom strategic partner by June. Emcali hopes to find an investor to help the company provide fixed telephony, Internet broadband and pay-TV services.

CHILE – Nextel is ready to deploy LTE services using AWS spectrum. The goal is to obtain some spectrum in the 700 MHz band that telecom regulator Subtel still holds.

MEXICO, COLOMBIA – With headquarters in Florida, VoixStar Telecom announced it will begin operations this summer in Mexico and Colombia. The offer includes full mobile service with VoIP services, no PIN prepaid long distance and reloads or top-ups for any mobile company in the world.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.