Verizon and AT&T tackle video for value creation

When I was a manager in the engineering and operations workforce in Sprint’s local division (later to become Embarq, and then CenturyLink), I remember a discussion with the VP on a process improvement project. “Jim, everything we do in E&O is about the 22%. That’s the portion of our customer base that generates 88% of our profits.”

This was 1994-1995. The entire customer lifetime value process had not been introduced at Sprint, and Pareto Analysis was a new chapter in Sprint quality procedures. But even then, everyone knew that a few customers drove most of the value. It was a different kind of numbers game, and it was all about the 22%.

This is the same type of thinking Verizon Communications employs today when it discusses wireless net additions. There is a subset of customers – corporations that will deploy many connected devices to dramatically improve productivity; households that will quickly adopt mobile over-the-top video along with FiOS where it is available – who will drive Verizon’s value equation. There are other subsets that add lesser value, but will get some investment attention. After that, Verizon’s investment interest wanes considerably.

Verizon has many high-value-adding customers in the postpaid market – 35.6 million accounts with 2.87 connections per account. Postpaid accounts grew 1.5%, while revenue per account only grew 1%. However, connections per account (led by data-hungry tablets) grew by 4%. Verizon is banking on a repeat 4% performance in 2015 – enough to “price up” a significant portion of accounts into the next tier instead of absorbing the bandwidth in the current tier.

Verizon has been mum on its video plans ahead of its summer launch. However, with Marni Walden in place since late February 2014, there has been leadership over the EdgeCast – content delivery network – and OnCue – the OTT “operating system.” Before leaving Verizon in September, Erik Huggers granted an interview to The Next Web in which he stated: “We built a complete, modern, end-to-end IP-delivered, over-the-top delivered, live, linear, catch-up TV platform.”

Verizon’s actions point to one objective: to become the world’s largest broadcaster. Not the largest wireless distributor of content (it likely can already claim that title for North America, and EdgeCast has been busy over the past 15 months taking on more of Verizon Wireless’ CDN), nor the largest set of available “eyeballs” to view content, which Verizon can also lay claim to for North America. This goes beyond network: It’s an end-to-end content ingestion through device consumption model.

The business model needs to progress even further for this to change. As we have studied through the Dish/Sling TV rollout, many of today’s popular channels still come as a bundle, and, while consumers say they are willing to purchase items on an a la carte basis, there is always a reason for families to avoid cord cutting.

But what about content “snacking” through expansion of something Verizon is already known for thanks to its NFL sponsorship – live sports? Could Verizon be contemplating something as personal as every (pick your team – Ohio State, Ole Miss, Oregon, Alabama, Tennessee, South Carolina) pre- and in-season football game on a per-hour basis, which could include free playback on your FiOS or Wi-Fi enabled device? Could their new product be a mashup of the Longhorn Network meets Verizon Wireless, even if a small portion (22%) of their customer base actually uses the product? The OnCue and EdgeCast networks could enable all of this. All that’s needed is a really good bridge between live content producers and Verizon.

That’s where the announcement earlier this month from Imagine Communications and Verizon Digital Media comes in. Imagine connects the increasingly cloud-based distributed content, per its announcement with Disney/ABC to Verizon’s network in a ready-to-consume format. The missing puzzle piece was found and it’s a perfect fit.

While syndicated shows could certainly benefit from this platform, live high school and collegiate sports would thrive from increased coverage. Verizon would not only make money from smarter ad insertion (also with help from Imagine Communications, whose platforms already enable alternative ads to be inserted on playback), but it would become the broadcast outlet for the 97% of high school and collegiate sports that cannot find a home on linear TV. “Watch more and make more” will be the pitch to colleges and universities.

Bottom line: Verizon has no real “plan B” here – it has to execute this model to resume a mid- to high-single-digit growth rate. It’s going to be a rocky road, but Verizon might end up being the broadcast alternative for the very long tail of live sports. Look for the company to provide more details when it announces earnings on Tuesday and likely look for offerings starting in early summer. It does not take a lot of customers to make this model pay off, but 22 million monthly users would be nice.

AT&T is also transforming, but in a different way

AT&T is going through a very different transformation. Unlike Verizon, AT&T spent big at the auction – $18 billion, or $8 billion more than Verizon. The company did this despite having a much larger local exchange footprint, especially when Verizon’s sale of Tampa, Fla., Dallas, Texas, and California properties is completed. It would be interesting to compare Verizon’s and AT&T’s economic tradeoff equations between purchasing additional spectrum and densification of existing spectrum holdings.

AT&T’s method to scale in video is not to become the largest broadcaster, but rather to become the largest purchaser of content through its DirecTV acquisition. At the Morgan Stanley conference in March, AT&T’s EVP of home solutions, Lori Lee, stated: “Our video product today is not profitable but we are in it because we know customers love to bundle video and TV.” She further states that “60 cents of every dollar we earn in revenue … goes straight to the content guys, and when you think about DirecTV… they pay 20% less than we do in U-verse.”

Rather than transform the broadcasting equation, AT&T has chosen to adopt the current linear broadcasting model and use its newfound scale to drive increased profitability. This is a model based on service integration – broadband, satellite, U-verse, mobile and voice – as opposed to product innovation. AT&T has had a lot of success with bundles, and has consistently favored a “total franchise” over a “wireless franchise” model.

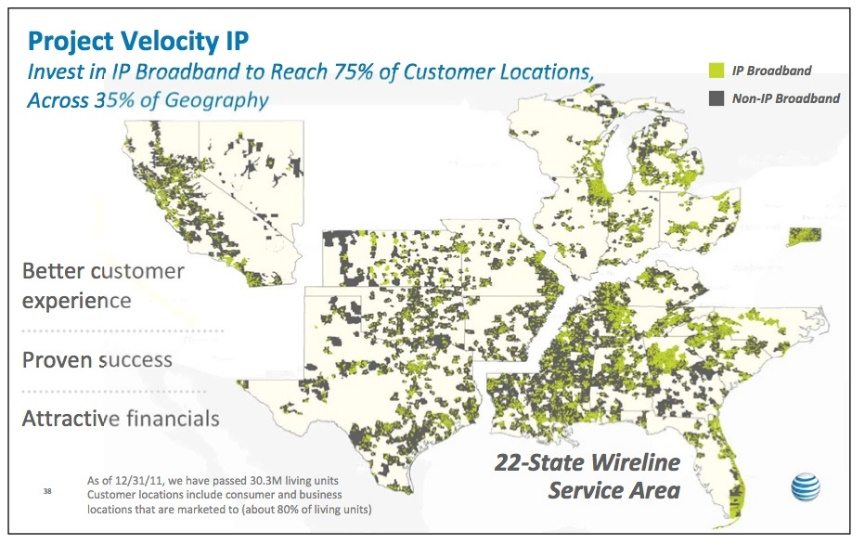

There are pros and cons to both approaches. AT&T has largely implemented Project VIP, which lays a very broad 75-megabit per second DSL foundation to compete with cable, and, as Google is learning, this infrastructure can be tactically upgraded to 1 gigabit per second in certain markets when conditions warrant.

The company also had healthy spectrum holdings before its recent Auction 97 (AWS-3 spectrum) wins. While its 700 MHz, 800 MHz and 1.7/2.1 GHz spectrum band holdings are well known, AT&T now owns a considerable amount of the WCS (2.3 GHz) band thanks to its purchase of NextWave, Sprint, Horizon Wi-Com, Comcast and San Diego Gas & Electric holdings. This band could be used in a variety of ways, including broadcast video, perhaps integrated into other connected car needs.

DirecTV will change AT&T’s consumer division DNA to be less about Internet connectivity – notifications, speed – and more about content delivery, such as caching, streaming, proximity and optimized performance. In turn, AT&T’s network organization, complete with $60 billion in VIP investments, will significantly improve the delivery of content for DirecTV (less satellite, more fiber delivery when possible – bundled video and data becomes a combined company necessity to achieve certain cost reductions rather than a bundled product offering).

Bottom line: Both Verizon and AT&T will report earnings this week. To some extent, they will be “more of the same” with no or negative phone net additions offset by growth in tablets and other connected devices. AT&T will cement its dominance in connected car, and both carriers will attribute better than expected performance in business to increased sales in enterprise security offerings. The real headlines will be made, however, with their diverging video approaches. Verizon’s will be based on broadcast delivery through wireless means, while AT&T’s will be a broader “all of the above” approach.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.