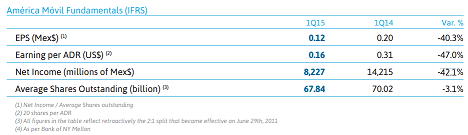

Latin America’s largest telecom group América Móvil ended the first quarter with revenue up 3.1% over the year before in Mexican peso terms, while operating profits declined 6.6% and net profit fell 42.1%.

In a statement, América Móvil explained that depreciation and amortization charges rose 1.6%, and its financing costs reflected foreign exchange losses, mostly because of the sharp depreciation of the Brazilian real against the U.S. dollar in the quarter.

América Móvil noted that Brazil was its largest and fastest-growing region. According to the telco, mobile data revenue continued to be the biggest driver of growth, followed by pay-TV, rising 12.0%, and 9.9%, respectively.

América Móvil counted 368 million access lines in Q1, of which 289.6 million were from wireless subscribers, 34.5 million were landlines, 22.3 million were broadband accesses and 21.6 million were pay-TV units.

Auction: Colombia is getting ready to auction big frequency bands in the 700 MHz spectrum. The National Spectrum Agency plans to start the auction process by August, making 90 megahertz in the 700 MHz available for telecom operators to deploy LTE. In June 2013, Colombia bid bands in the 2.6 GHz, granting licenses to Claro, Movistar, Une/Tigo, DirecTV and Avantel to launch commercial services using 4G mobile technology. Some LTE test deployments in the 700 MHz were made in 2012 in a collaborative effort by Huawei, ZTE and Ericsson.

M-commerce: The growth of Latin America’s mobile market is one of the main reasons for mobile merchants’ strong interest in the region, said Pyramid Research, claiming that mobile network operators in the region should explore m-commerce beyond m-payments. In a video interview with RCR Wireless News, Marcelo Kawanami, senior analyst at Pyramid Research, explained why Latin America is an attractive region for m-commerce and commented about recent initiatives.

More news from the Latin American region:

BRAZIL – According to telecom regulator Anatel, there were a total of 282.56 million mobile lines in Brazil in February, which represents a penetration rate of 138.66%

REGION – Huawei is gaining space in Latin America.

BRAZIL – TIM announced it has closed the sale of 4,176 telecommunication towers to American Tower do Brasil. In November, both companies agreed to the sale of up to 6,481 towers for approximately $1 billion. They expect the remaining 2,305 towers to be sold in the coming months.

CHILE and PERU – Entel will invest $2.1 billion in Chilean and Peruvian operations by the end of 2017. The amount will be used to deploy LTE, increase quality of service and expand mobile coverage.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.