During a May 6 conference call discussing TIM Brasil’s latest financial results, the operator’s President Rodrigo Abreu said he’s satisfied with the telecom operator’s performance in the first quarter of 2015. Abreu said he expects that the operator’s future growth will be supported by 4G service expansion and an increase in data consumption. Indeed, TIM’s data services reached 34 million users, an increase of 27% year-over-year, already making up 45% of its total base. This growth is pushed by the rise of smartphone penetration, which reaches 53% of the total base.

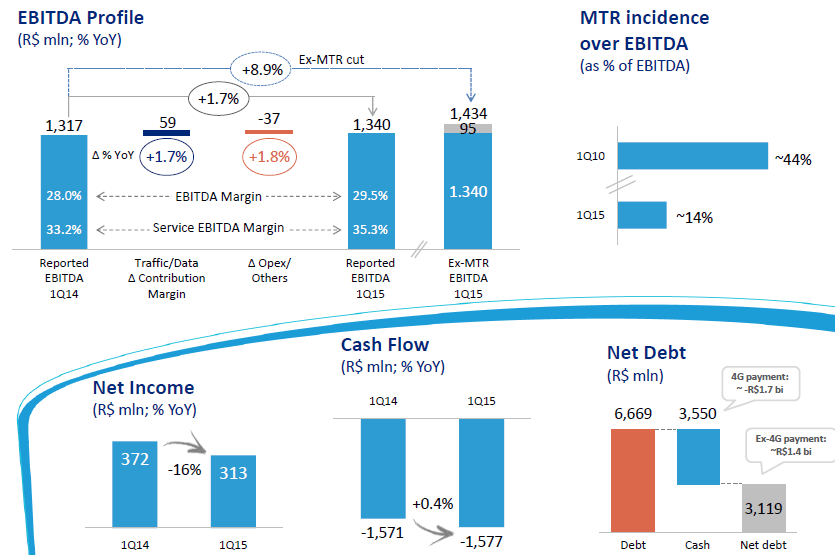

Overall, however, TIM Brasil’s financial results were weak. The operator posted a decrease in revenues (-3.2% year-over-year and -9.9% compared to fourth-quarter 2014) and net income (-16% year-over-year and -32.1% compared to Q4 14). Average revenue per user was also down, 7.2% year-over-year, largely impacted by the cut in mobile termination rates. Without the mobile termination rates impact, APR would have fallen by 3.3% year-over-year, according to TIM.

One of TIM’s major bets is on a strategic alliance signed last year with the world’s largest messaging provider, WhatsApp. The zero-rating offering has contributed to the strong performance in Q1 of its post-paid “Control Plan,” which posted an increase of 23% year-over-year.

While TIM focuses on zero-rating plans, its rival Claro doesn’t believe there’s a huge benefit in partnering with over-the-top players like WhatsApp. Claro had already unveiled zero-rating plans with access to Facebook and Twitter, but they are no longer part of the carrier’s strategy. In a press conference in São Paulo last week, Claro’s president, Carlos Zenteno, said that less than 1% of its customers who took these offers used only Facebook or Twitter. “Customers want to navigate freely on the Internet. That’s why we increased data plans, so they could choose what they want to do on the Internet,” he said.

Fraud management: Revenue analytics leader cVidya has partnered with Huawei to support a leading Venezuelan telecommunications operator to improve fraud management. To better understand the partnership and the case study, RCR Wireless News interviewed Hezi Zelevski, VP of corporate development at cVidya. “Fraud is an issue that has been in telecom for many years, and it will continue. Operators need a solution to stop it,” Zelevski said. Among other things, Zelevski spoke about how the carrier in Venezuela commissioned the upgrade to enable processing of increased network usage data in line with the government’s new security requirements.

More news from the Latin American region:

PERU – In its latest report, the regulatory agency OSIPTEL said there are 1.3 million LTE lines out of a total of 31.8 million mobile lines in the country. Currently, three carriers offer 4G services: Claro, Movistar and Entel.

MEXICO – NII Holdings has completed the previously announced sale of its Mexican operations to AT&T for an aggregate purchase price of $1.875 billion, subject to customary post-closing adjustments. The company said that Nextel’s focus will now be on strengthening its Brazilian operations.

COLOMBIA – MVNO Móvil Éxito launched its 4G services in Colombia.

CHILE – The telecom regulator Subtel plans to invest about $100 million in a fiber optic project that will connect the southern region of the country.

PERU – According to OSIPTEL, in the 10 months that number portability has been available in the country, about 377,000 users have changed their mobile operator without changing their number.

BRAZIL – At the end of March, Brazil had a total of 283.4 million mobile accesses, with Vivo leading the market share.

REGION – Millicom has selected Intraway’s satellite television solution to support the operation of its services in Latin America, which were commercially launched last year.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.