The Colombian agencies for spectrum and communications regulation, the ANE and CRC, have posted a draft to auction spectrum in the 900 MHz, 1.9 GHz, 2.5 GHz and 700 MHz bands. The agencies will accept comments on the draft until June 12. The document can be found here.

Small cells in Brazil: TIM Brasil has partnered with the state power company Copel for a small cell project. The telecom operator will install 3G and 4G small cells on Copel’s lamp posts across Curitiba, the capital of the state of Paraná in southern Brazil. TIM said the goal is to use the nearly 3 million Copel posts in Paraná to reinforce coverage and improve data traffic.

TIM and Copel have negotiated for almost a year to close this deal. Copel will be responsible for the attachment, data transmission and power supply of the cells. Huawei was chosen as the small cell provider. In Paraná, TIM has 8.5 million customers and a 55.8% market share.

Connected car tech in LatAm: Latin American transit users will soon see some use cases of connected car technology with the goal of improving urban transportation systems and enhancing mobility. Volvo Bus Latin America and Ericsson have signed an agreement for localization and customization of Volvo’s ITS4Mobility intelligent transport system, which will be offered commercially by both companies in Latin America. As part of the project, bus operators will be able to track their fleet in real time, and passengers will have access to real-time information about bus arrival times.

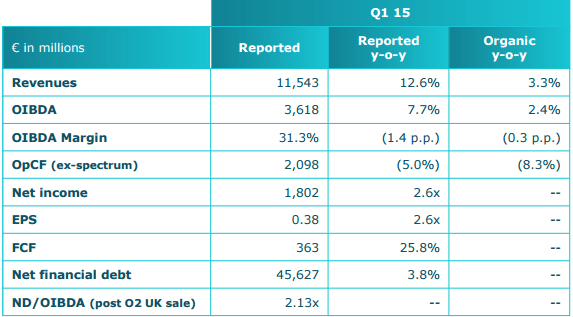

LatAM plays big role in Telefónica’s first quarter: Brazil and Telefónica Hispanoamerica generated 56% of Telefónica’s total revenue of $12.86 million in Q1 2015. The company’s total revenue was 12.6% higher than the same period last year. At the end of March, Brazil alone accounted for 24% of total revenue, while Spain represented 25% and Germany, 16%. Telefónica ended Q1 with 40% of the revenue from mobile services consisting of mobile data revenue, which increased by 30.9% year-over-year.

In Brazil, mobile data acceleration led to year-over-year growth in average revenue per user. Data traffic was booming (+50% year-over-year), driven by higher LTE usage. As for Telefónica Hispanoamerica, smartphone accesses increased, with a net addition of 3.1 million smartphones, even though there is still limited smartphone penetration – 29% total with 21% prepay.

More news from the Latin American region:

BRAZIL – Telecom regulator Anatel will make leftover spectrum in the 2.5 GHz and 1.8 GHz bands available for auction. The spectrum auction draft is expected in October.

LATAM – According to the GSMA, there were 39 operators with live LTE networks in Latin America in March, covering 15 of the 22 countries in the region. However, 4G only accounted for 2.4% of the total 683 million mobile connections in Latin America in the first quarter of 2015, below the 8.4% global average.

BRAZIL – Huawei has implemented 70,000 telecom sites in Brazil in partnership with local carriers.

PERU – Anite has been selected to provide 12 Nemo Invex benchmarking platforms for OSIPTEL. The Peruvian government will use the equipment to verify the performance of cellular operators’ services throughout the country.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.