As promised, this week we draw some conclusions from the results of our mobile first poll, which resulted in three ways to be an innovative leader as your company is planning for 2016 and beyond. Often, strategic planning sessions can be pretty dry and boring events – at least until someone asks “the question.”

We look at three questions that are begging to be asked at each of your companies, and our hope is that these questions will stimulate others. They are:

1. How does your company look on a five-inch screen?

2. How can an asset-turn focus change how your company conducts business?

3. If big data is “hot stuff,” then why can’t it answer your customers’ questions before they ask them?

Embrace mobile first

First, let’s look at the five-inch screen question. Said another way, if desktop and laptop screens suddenly disappeared tomorrow, would your customer experience be any different than it is today?

And if mobile is so important, why do most telecom companies treat it like a second-class citizen? As Ben Evans of Adreessen Horowitz stated in a recent blog post, “It’s the smartphone that has full functionality – a camera, location, social integration and so on. The PC and the laptop do not.”

If the traditional Web format were to disappear tomorrow, and all that was left was a mobile version of your company, would you be ready?

Let’s spend a bit more time with this question. What does a strategy of “embrace mobile first” mean and why is it important?

First of all, this strategy forces simplicity. Think about when your favorite website came out with its first mobile version. It was too busy. Why? The mobile version was designed to be a replica of the web version – everything that was good for the 11-inch screen was good for the four-inch screen. Thankfully, content was curated and in future versions only the most important information was retained. Go to the American Airlines website and their newly designed Android or Apple app and you will see what I mean.

Second, embracing the mobile first approach demands efficiency. What if music-streaming services decided to provide the same throughput over smartphones that they do to devices connected through an Ethernet connection? We’ve all experienced the effects of inefficient apps – frequent crashes, endless spinning wheels, frozen smartphone browsers. Those who depend on their smartphones are a very unforgiving bunch. Efficiency is the standard, and highly efficient apps are rewarded.

Third, if the app is good, we’re a very loyal bunch. Take Google Maps, with over 1 billion installs, the app has over 4 million ratings of 4 or 5 stars. What’s the probability that a satisfied Google Maps user is going to switch to MapQuest or Verizon Navigator or, if on an iPhone, Apple Maps? It’s an unlikely switch so long as the app is good and that good stays fresh. We are creatures of habit and do not like change just for the sake of change (moving from an Apple to an Android device is an entirely different matter), but we expect apps to get better. “Good and always getting better” needs to be the drumbeat.

Fourth, we’re a feedback-rich bunch. Just read the reviews on Google Play or iTunes. Yes, if your app sucks you’d better get ready for some feedback. And it’s going to be a lot more direct than what you received when you hyperlinked “feedback” at the bottom of your website.

The result of these four factors is brand change. Your brand can be more impactful even when the screen size has shrunk – just ask The Weather Channel. It takes a lot of work to make your company look good on a smartphone. Don’t underestimate the effort.

The secret to success in the telecommunications industry: an asset turn focus

The second question that will get a conversation started is: “How are we turning our assets?” This question lets you in on the decomposition of a formula that is little known outside of the finance department. Most of us know the terms return on invested capital or return on net assets. But I put up the decomposition of the formula for you that the finance group uses. It’s profit margin (with or without taxes removed – take your pick) times something called asset turns or net revenue divided by net assets.

When was the last time your company set a budget target around profit margins? Everyone watches earnings before interest, taxes, depreciation and amortization or operating margin like a hawk.

But when was the last time your company set a budget target around asset turns? Aligning sales compensation to less-asset-intensive businesses? Rewarding those who “gave back” or postponed some investments so others could be made in new innovations (commonly called the investment dividend)? These instances are rare.

Companies that lead have a plan about both sides of the equation: Margins still matter and scale still matters, but in asset-intensive industries like telecom, asset utilization and asset intensity matter even more.

Companies that place a focus on assets tend to show greater operational command, they understand why things like network functions virtualization and software-defined networking are critical and they use their understanding to drive market share gains. Said another way, if you understand where the asset-intensity puck is headed, you will win. If you don’t, someone else will win. Few companies have emerged as leaders without a keen understanding and command of their assets.

Throw your CFO for a loop by tossing out the question: “How could we drive higher asset turns?” Bet you get a smile.

Big data, meet self-service

Lastly, ask the question: “If big data is such hot stuff, why can’t it answer customer questions before they ask them?”

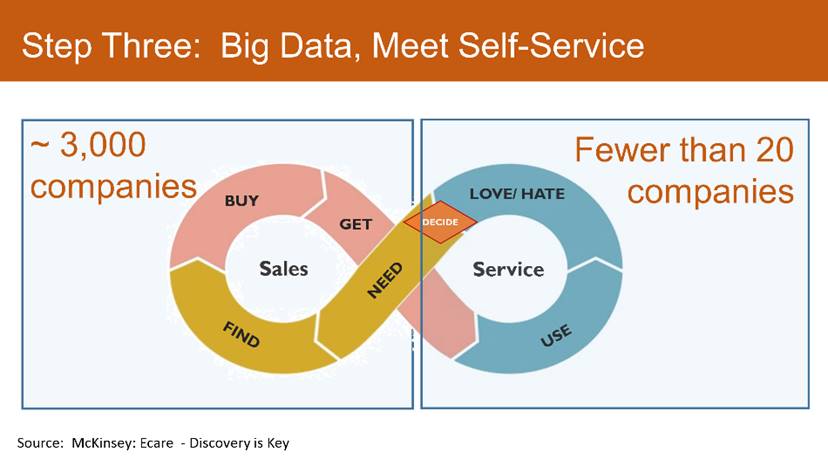

The chart shown is a well-known representation of the customer life cycle developed by McKinsey. Buy, get, use, love/hate, decide, need and find. Many of us can recite this or a similar chart from memory.

Here are the facts: Assuming the trend holds in 2015, there will be just under 3,000 big data firms attacking the marketing equation. According to the Chief Martec folks, and they are the ones who keep the numbers, the number of companies focused on building the right profile and placing the right ad so customers “buy, buy, buy” grew from 947 at the beginning of 2014 to 1,876 at the beginning of 2015. We’re on our way to 2,700 companies this year, thanks to venture capital and low barriers to entry. All to drive the left-hand side of this chart.

How many are on the right-hand side? Those that want to drive better use and tip the scale from hate to love? Sad to say, but the number is fewer than 20. There are approximately 150 companies driving customers through the doors for every company shepherding them through the use and loyalty within the product. That’s crazy.

The main reason for that is that the shepherding process is hard. Tech ops touches the customer on a service call and they use one vocabulary to update the customer record. Then customer service touches the same record with a hard to understand “reason code” for every call. Then the customer goes to a service center to get a totally different experience, or, if lucky, can go on-line and seek assistance through self-help videos. No wonder the customer is confused. How do we create sense out of all of this?

One of the startups I have been working with over the past couple of years is really making headway. It is comprised of a bunch of workflow software engineers turned mobile/big data specialists based in Austin, Texas, called StepOne.

I love the sentence Troy uses: “If we don’t get it right the first time, the system will learn.” Too many times, companies try to answer today’s top 10 questions as opposed to building a learning system that provides the answer to today’s and tomorrow’s needs. There are a few brave souls like StepOne trying to solve the right side of the customer experience, and that’s where the questions get harder to solve yet yield clearly identifiable results.

Summing it up

Three simple questions:

1. How does our company look on a five-inch screen?

2. How are we turning our assets?

3. If big data is “hot stuff,” why can’t it answer customer questions before they ask them?

These are three excellent conversation starters as you plan for 2016. Thanks again for your time, and happy planning.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.