RF spectrum paramount for continued LTE expansion across Latin America

LTE has been fast to arrive in Latin America if compared to the time from the first launches of GSM and UMTS worldwide to their landing in the region. While it took 2G and 3G technologies six and five years to arrive, respectively, LTE did it in fewer than 24 months.

Yet, this new technology faced its share of obstacles before it could thrive and expand in the region, the most noteworthy being the availability of radio frequency spectrum allocated for the provision of mobile services. However, the different markets have gradually overcome this hindrance.

In early 2014, the realities of markets such as Argentina, Ecuador, El Salvador, Panama and Paraguay confronted issues in the allocation of this finite resource, either because there was not enough bandwidth to deploy the new technology or because different amounts of spectrum were allocated to the different concessionaires.

Perhaps the most paradigmatic cases at the time were Ecuador and Argentina. In the former, the state-owned company held 62% of a total allocation of 180 megahertz, although it served only 3% of all mobile subscribers in the country. In Argentina, the situation was different: There had simply been no new licenses granted since the late 20th century when the only “data” service available – text messaging – represented a negligible share of mobile operators’ revenue.

When it comes to RF, different aspects should be taken into consideration; ranging from wave propagation, i.e. the maximum distance the signal is capable of reaching, to the type of technology that can be deployed.

Not all RF spectrum concessions are identical, since economies of scale afforded by a specific frequency might not be present in another, regardless of whether the band is higher or lower. For example, there are currently more LTE devices working on the 2.6 GHz or AWS (1.7 GHz/2.1 GHz) band than on the 700 MHz band.

The amount of spectrum allocated is a parameter that helps determine the peak traffic throughput of the technology deployed. While initial releases of HSDPA on a 5-megahertz channel offered peak rates of 14 megabits per second, Release 11 of HSPA+ on 50-megahertz bandwidth would reach 336 Mbps.

In its document ITU-R M.2078, the International Telecommunications Union recommends the allocation of 1,300 megahertz of RF spectrum to ensure the development of mobile broadband technologies. However, as stated earlier, it is not only a matter of allocating spectrum to the market. In addition, it should be done in a seamless, nondiscriminatory fashion.

Although it is utterly important for regulatory entities to allocate RF spectrum for the healthy development of the mobile service sector, many regulators in Latin America are late in terms of the amounts of RF spectrum they have allocated to mobile service providers in their respective markets. While in developed markets the amount of spectrum already awarded is in excess of 600 megahertz and 700 megahertz, in Latin America some markets stand at 400 megahertz, with several others holding less than 200 megahertz of allocated RF spectrum.

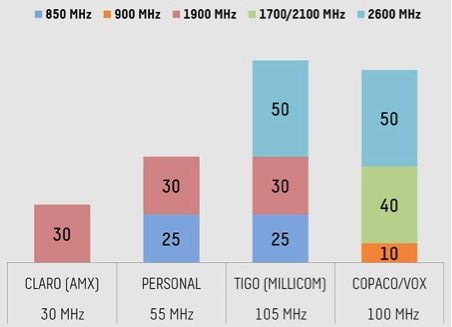

One of the markets showing the largest asymmetry in terms of RF spectrum allocation for the supply of mobile services in bands lower than 3 GHz is Paraguay. There are four mobile operators in this market (considering Vox and Copaco as a single company). According to Signals Telecom Consulting, the total amount of RF spectrum allocated is 290 megahertz, with the operator that uses the least amount for service provision currently standing at 30 megahertz, and the operator who holds the largest number of licenses currently using 105 megahertz.

Source: Signals Telecom Consulting

The importance of mobile connections in the Paraguayan market should not be underestimated given the low penetration rates of the different access technologies available in the country. Data from Pyramid Research shows that in late 2014 Paraguay had less than 6% penetration by fixed telephone lines and only close to 3% of fixed broadband access. In contrast, the consulting firm estimated that mobile services stood at around 107% penetration rates by the same date.

Current adoption levels of telecommunication services by Paraguayan consumers reflect a reality that should not be overlooked: Mobile technology is poised as the main vehicle to boost the adoption of broadband services. However, a public policy is needed to promote the expansion of LTE coverage and establish the necessary conditions so that all mobile operators in the market offer commercial services on this technology.

One of the barriers preventing LTE, which has been present in the market since February 2013, from expanding into rural areas is the large differences among spectrum concession allocations. This disparity in the granting of RF spectrum frequencies results in too little incentive for operators, thus discouraging them from investing in the deployment of new technologies like LTE.

The situation is aggravated from the failure by the Paraguayan regulatory authorities to establish a schedule of new RF spectrum license awards in addition to delays in the digitization of TV broadcast signals. With the analog blackout planned for 2024, the frequency allocation on 700 MHz appears only as a long-term possibility.

In the short-term, the publication of the terms and conditions for the next auction is expected this year, with the process being limited to the award of two 20-megahertz licenses (totaling 40 megahertz) on the AWS band. It is only a small amount of spectrum, although 40 megahertz of additional spectrum could be allocated for mobile broadband services on the 2600 MHz band.

This frequency is currently being used to provide LTE in markets like Brazil, Chile, Colombia, Costa Rica and Peru. Curiously enough, it was precisely on this band that TeliaSonera launched the first commercial LTE network worldwide in 2009. The healthy development of LTE in the region requires that this band add deployments at lower frequencies to accelerate growth.

If the amount of RF spectrum allocated is limited, it is highly likely that operators will use the bandwidth they possess to offer services on different technology platforms. That makes it very difficult for them to introduce a new technology such as LTE, which calls for a network of its own, especially if there are negative expectations regarding a new spectrum allocation process, either because it would happen too late – because the amount of spectrum being auctioned is insufficient – or because the frequencies under consideration are not cleared and it would take years for operators to be able to use them for commercial services, as is the case with the 700 MHz band in Brazil.

The one undeniable fact is that mobile broadband technologies will play a leading role as a tool to increase connectivity in Paraguay.

Government authorities face a serious challenge in the months to come. However, if they manage to allocate the largest amount of RF spectrum, they will be taking a positive step in their efforts to benefit consumers. This would be most welcome by those who live in low-density populations, where current Internet services do not support e-learning or tele-working initiatives.

José F. Otero is Director for Latin America and the Caribbean at 4G Americas.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: / 123RF Stock Photo