Latest semiconductor merger follows Avago buy of Broadcom, NXP purchase of Freescale

Chip-making giant Intel plans to purchase smaller competitor Altera for $16.7 billion – that’s $54 per share – in an all-cash deal, according to a June 1 announcement from the Santa Clara, Calif.-based powerhouse.

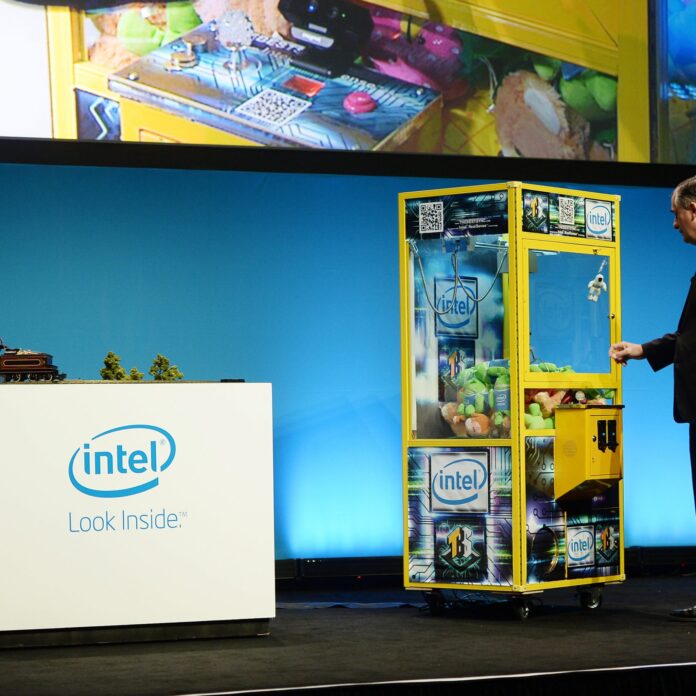

Intel CEO Brian Krzanich said the acquisition, which has been approved by the boards of both companies, will position Intel to be an industry leader in the data center and “Internet of Things” segments.

“Intel’s growth strategy is to expand our core assets into profitable, complementary market segments,” Krzanich said. “With this acquisition, we will harness the power of Moore’s Law to make the next generation of solutions not just better, but able to do more. Whether to enable new growth in the network, large cloud data centers or IoT segments, our customers expect better performance at lower costs. … This is the promise of Moore’s Law and it’s the innovation enabled by Intel and Altera joining forces. We look forward to working with the talented team at Altera to deliver this value to our customers and stockholders.”

According to Intel reps, the pending acquisition will integrate Altera’s FPGA portfolio with Intel’s Xeon processors. The deal is expected to close within in a six- to nine-month time period.

Consolidation in the semiconductor industry is a trend of late. Just last week Avago Technologies announced a $37 billion deal to acquire Broadcom. In March Freescale agreed to an acquisition by NXP Semiconductor for more than $16 billion.

“Given our close partnership, we’ve seen firsthand the many benefits of our relationship with Intel – the world’s largest semiconductor company and a proven technology leader – and look forward to the many opportunities we will have together,” said John Daane, president, CEO and chairman of Altera. “We believe that as part of Intel we will be able to develop innovative FPGAs and system-on-a-chips for our customers in all market segments. Together, we expect to drive meaningful value for our customers, partners and employees around the world. This is an exciting transaction that provides immediate and significant value to our stockholders. We look forward to working closely with the Intel team to ensure a smooth transition and complete the transaction as quickly as possible.”