Airbiquity recently held a webinar to discuss findings from a Nielsen and SBD study that looked at the implications of infotainment solutions to auto buyers. In other words: Does infotainment actually drive customer loyalty?

Automotive OEMs are working to pack more and more infotainment features into vehicles to differentiate themselves from their competitors. The question is whether or not consumers are noticing and if it actually translates to loyalty. The survey, conducted during the first half of 2015, focused on the United States and included 14,000 recent car buyers who answered 100 questions covering 70 different technologies.

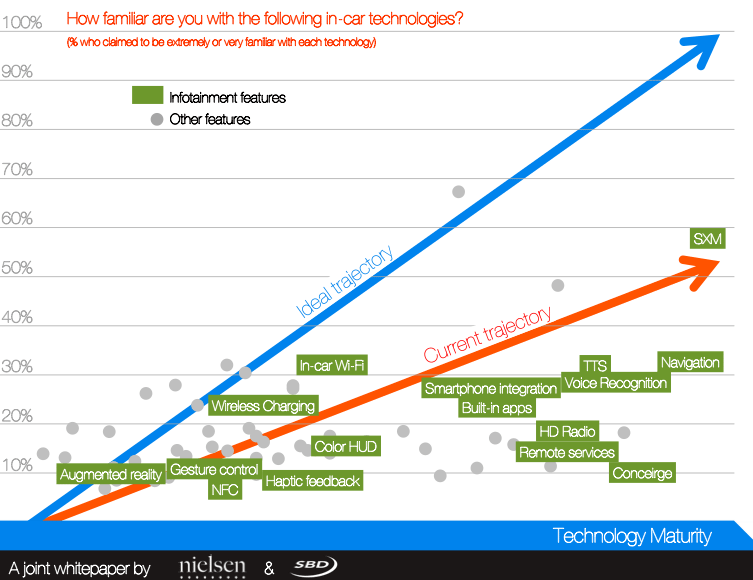

Some of the key findings of the research were actually not that surprising to me. Although there is a great deal of industry discussion on the topic of the connected car and infotainment; I have stated on a regular basis that there is still a great deal of market education that still needs to take place and consistency of the terminology around these topics is needed throughout the industry.

Highlights of the research included the following:

- Less than 40% of respondents claimed to be familiar with these features;

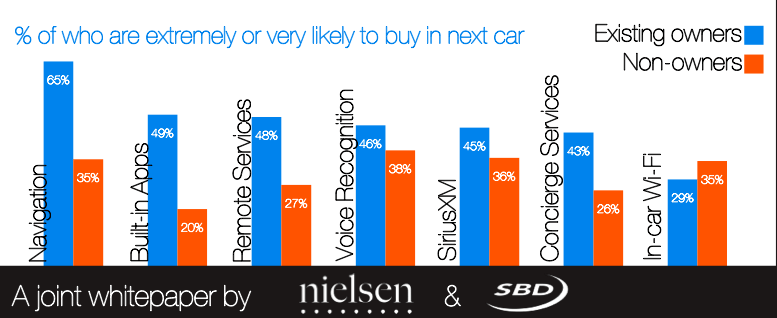

- Those familiar with the features were only slightly more interested in purchasing them than those that were not, although 29% were interested in a repeat purchase;

- Satisfaction of infotainment functionalities were lower than most in-vehicle functions; and

- 44% of respondents claimed to have never used the infotainment features available in their vehicles.

There’s still a long way to go it seems.

The growth in awareness is happening, though. In a 2014 survey, only 15% of respondents were aware of connected car technologies of this type. In this year’s survey the figure increased to 29%, and those who had not heard of these technologies decreased by 13%, another sign that awareness is increasing. But the amount of respondents who had heard of these features but didn’t know what it meant to them to have them has been relatively consistent year to year.

Terminology is another challenge, even for those whose vehicles have these features. Drivers with services such as OnStar and Sync identified them as connected car or infotainment functions. Yet BMW drivers didn’t seem to identify ConnectedDrive as either a connected car or infotainment service. That is surprising as BMW is widely regarded as one of the market leaders in this space. Another surprising finding of the survey was that 43% of respondents felt OEMs are putting too much technology in the vehicles. This will likely lead to challenges with the monetization of these functions.

As OEMs look to provide more and more features for drivers, this could make the business case for doing so quite challenging. To further complicate the business case, the study found that only 14% of interview participants considered these features in the top three considerations for their car-buying criteria. And that 14% mainly consisted of drivers under 30 – the age group also likely prime candidates for car sharing and other smart mobility solutions. In theory this could reduce this figure even further when taking those options into consideration. What does this actually mean for OEMs? It could be that these features should presently be considered as a vehicle differentiator vs. an upsell or monetization opportunity.

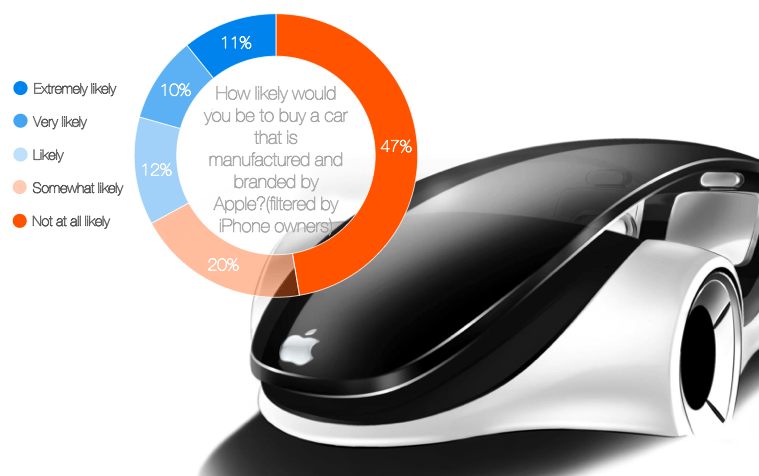

I won’t go into more statistical detail; you can find out more by watching the webinar mentioned above. I will just end with a visual based on the vision for an Apple car that asked iPhone users if they might actually purchase such a vehicle. This says something about loyalty. Or not.

Like what you read? Follow me on twitter!

Claudia Bacco, Managing Director – EMEA for RCR Wireless News, has spent her entire career in telecom, IT and security. Having experience as an operator, software and hardware vendor and as a well-known industry analyst, she has many opinions on the market. She’ll be sharing those opinions along with ongoing trend analysis for RCR Wireless News.