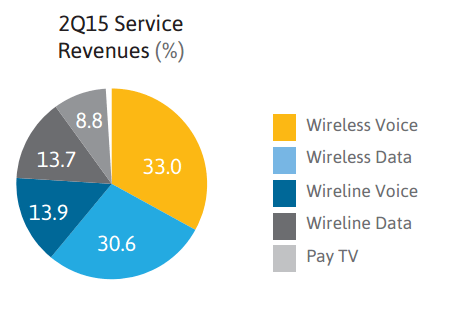

América Móvil posted 219.999 billion pesos ($13.7 billion) in second quarter revenue, almost flat (-0.1%) compared to the same quarter in 2014. However, the company’s earnings before interest, taxes, depreciation and amortization decreased 5% year-over-year and net income dropped 16% year-over-year. Looking at the first half of the year, total revenue grew 1.5%, EBITDA was down 4.1% and net income dropped 28%.

“The expected EBITDA diversification efforts into Brazil and Europe have not materialized as quickly as we would have hoped, for a variety of reasons. Nevertheless, we expect Mexico and Brazil [year-over-year comparables] to begin to ease in 2016 and see good value in [América Móvil] shares for the patient value investor,” noted Kevin Smithen and Will Clayton, analysts at Macquarie Capital.

América Móvil announced plans to invest $6 billion over the next three years to improve and upgrade its mobile network in Mexico. The release came after an AT&T announcement of a $3 billion investment plan in Mexico.

América Móvil also named former NET Servicos President Jose Felix president of its Brazilian operations. The Mexican telecom group’s Brazilian operations include cable and pay-TV provider NET Serviços, mobile phone company Claro and fixed telephony and broadband Internet firm Embratel.

There will still be three leaders heading business units in the country. The residential business unit (NET Serviços) will be headed by Daniel Barros, while the personal market (Claro) will remain with Carlos Zenteno as executive president. Jose Formoso continues to lead Embratel, the corporate unit.

Mexican Internet increase

Due to growing investments in 3G and “4G” in Mexico, industry trade group GSMA expects the country will reach 100 million broadband connections by 2020. In the first quarter of 2015, there were a reported 50 million connections in the country, with growing mobile broadband adoption seen as driving future growth. The GSMA predicts LTE services will cover 85% of the country’s population within five years, an increase from 30% today. The increase is expected to support growing smartphone penetration, surging from 30% today to more than 60% by the end of 2020.

Peru telecom

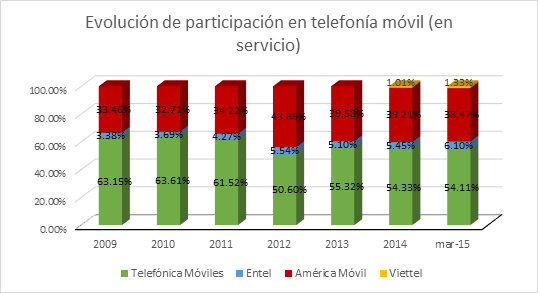

Smaller telecom operators are gaining market share at the expense of larger rivals. Peru counted 32.2 million mobile lines the end of March, an increase of more than 332,000 since the end of last year. Of the new lines, small carriers accounted for 7.43% of the increase. Entel Peru counted 6.1% of the total, while Viettel picked up 1.33%. Market share for larger operators dipped slightly from 93.54% at the end of 2014 to 92.58% in Q1 2015. Telefónica still dominates the market with 54.11% market share, followed by América Móvil with 38.47%.

More Latin American news:

Brazil – Embratel, owned by América Móvil, launched a new satellite, the Star One C4. The satellite uses the Ku band and is expected to allow for the expansion of DTH services in Brazil and Central America.

Argentina – Telefónica is set to invest about $930 million to expand its networks for both fixed and mobile services in the country.

Brazil – The country ended June with 282.45 million mobile connections, a penetration rate of 138.2%. Prepaid lines continue to dominate, accounting for 74.85% of the total.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.