Verizon: On Edge

Verizon led off the earnings parade last week, and the headline was their anticipated growth rate (3%) compared to their previously stated growth rate (4%). The primary reason cited by Fran Shammo, Verizon’s CFO, was the Edge take rate:

“Some of the other changes in the assumption fact is the take rate of Edge. I would tell you we never anticipated that Edge would accelerate as much as it has, and looking forward into 3Q being at 60%, that’s much higher than we had anticipated. But the market has moved us there. … Coming into this year we knew that service revenue would dilute. We are seeing more dilution than we anticipated because more customers are selecting that Edge plan.”

Moving customers from subsidized to equipment installment plans isn’t easy, and a higher percentage of customers moved to EIP-based plans than anticipated (49% in the second quarter, up from 38% in the first quarter, and more than double the 18% reported in Q2 2014). With each EIP line conversion, $15 to $25 moves from service to equipment revenue. Worst of all, this transition is just beginning for Verizon, with 16% of the retail postpaid base converting.

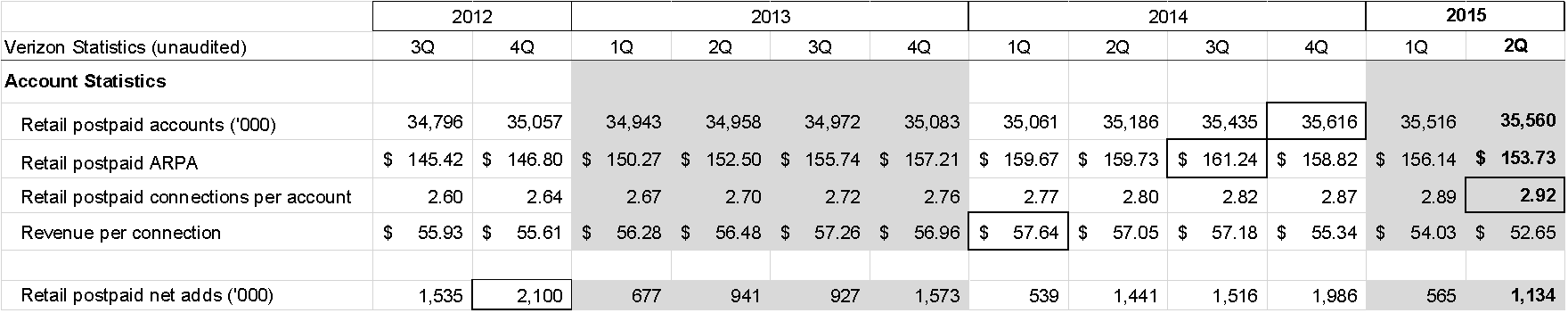

Verizon’s 10-quarter ARPA/ARPC trends are as follows:

· Total number of accounts grew slightly (0.1%). In Q2 2014, total accounts grew by 0.4%. Had Verizon grown at Q2 2014’s sequential growth rate, accounts would have risen by an additional 82,600 (or about 241,000 connections using 2.92 connections per account).

· Average revenue per account fell $2.41 in Q2, slightly better than the $2.68 decline in Q1. Without the sequential growth in connections per account (from 2.88 to 2.92), the quarterly decline would have been close to $4. Verizon peaked on ARPA in the third quarter of 2014 and will likely experience a $10 annual drop (or more) in 2015.

· Verizon did not talk about customers “pricing up” into higher buckets in Q2. This could be because many are just getting used to their current plans, and that customers can adjust their usage habits fairly quickly (e.g., watch more video over Wi-Fi).

Even with all of these changes, Verizon still managed to grow its segment, service and overall operating margins. Those trends are likely to benefit from increased EIP conversions in the short term (less subsidy costs taken into the “cost of equipment” line item).

Edge/EIP is a transitional event. It is not a statement of Verizon’s cost competitiveness. In fact, with more dark fiber leases going into the ground and 700 MHz purchased at what looks like a fairly attractive price, one could argue that for the next several years Verizon could grow its margins considerably. What will trigger this growth? Video, whether it comes from the carrier’s summer launch or from continued “price ups” in the traditional buckets.

What should put the telecom community on edge (pun intended) is Verizon’s deteriorating wireline performance. Yes, it is selling three island properties, which may have taken some wind out of the marketing sales for Tampa; Irving, Texas; and California; and yes, Time Warner Cable came back roaring with aggressive New York City/New Jersey promotions after its Comcast merger was scuttled, but the wireline business is sick, and price/promotion in the Northeast seems to be Verizon’s only way out. Technology/speed is not resonating with potential cable (or DSL) converters, and this should be very troubling.

Bottom line: Verizon will grow its way out of the EIP transition. How soon depends on data growth. The real worries should be the ability to execute a new line of business launch (not done since FiOS and that was a new network, not a content broadcast business) and the ability to manage the DSL and TDM (circuit-switched voice to packet voice) transitions in its wireline business.

AT&T: Through the knothole?

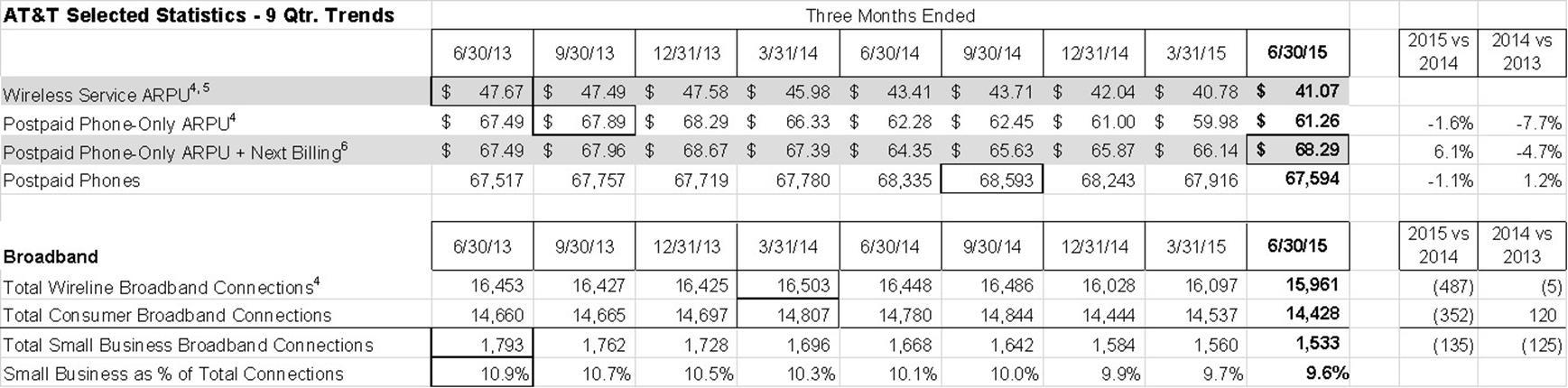

AT&T announced earnings last Thursday after the markets closed (but before the Federal Communications Commission officially approved its acquisition of DirecTV). There were many things to be encouraged about with AT&T’s current state, but the most important development was that it appeared to have hit the important subsidy-based to equipment installment plan conversion milestone. This drove phone-only ARPUs sequentially higher (see below) and phone-only + Next billings to historical highs:

Driving the phone-only ARPU is the fact that AT&T Mobility is beginning to see upgrades from the $100 for 10 gigabyte data plans to the $130 for 15 GB and $150 for 20 GB levels. Even with the addition of a one-month Rollover buffer (a smaller knothole added in response to T-Mobile US’ Data Stash plans), ARPUs grew.

What allowed AT&T Mobility to pull through this plan-change knothole so quickly? As the chart above shows, the massive ARPU decline resulted from its decision to allow existing customers (smartphone customers prior to Feb. 2, 2014) to switch to the Mobile Share Value plans (including the $15 per month unlimited talk and text plan) with no termination penalties. With 77% of smartphones already on MVP, and 37% of the base already on Next (see nearby picture), AT&T Mobility now has to manage the impact of additional Next conversions (especially during the next iPhone cycle).

AT&T Mobility is now through the worst of it. Even with Rollover, vacation schedules will drive phone-only ARPU higher (see 2013 and 2014 Q2 to Q3 changes), and the Q4 iPhone cycle will continue the trend. While postpaid phones continue their slow decline as customers leave for other carriers (likely Verizon Wireless and T-Mobile US), the value from the existing base continues to grow.

Also worth noting in comparison to Verizon is AT&T Mobility’s improvement in prepaid metrics (Verizon Wireless’ prepaid and wholesale businesses get minimal focus compared to postpaid retail). Rather than decommission Cricket, AT&T Mobility revived the brand and the prepaid subscriber base is now larger (both growing faster and churning less) than when AT&T Mobility combined Aio Wireless and Cricket a little over a year ago. AT&T’s CFO John Stephens seemed very comfortable with the tradeoff between Cricket and AT&T brands:

“On the prepaid side, with both our Cricket and GoPhone brands, we added some premium customers. I think I mentioned that two-thirds of our Cricket customers are buying out of the higher plans. Those are $50, $60 a month plans. … And those ARPUs are higher than the feature phone ARPUs we are losing and, quite frankly, higher than a lot of some people in the market’s postpaid ARPU. So we are getting great tradeoff … there is very low acquisition subsidy costs with regard to those customers. We did sell over 7 million smartphones … in the quarter. A lot of those were in our prepaid space. … Beauty of it is that the customers are satisfying the financial requirements of those phones such that it’s allowing us to keep our margins up.”

From these and other recent comments, AT&T Mobility does not appear to be punting on Cricket any time soon.

While AT&T Mobility seems to have pulled through one knothole, the transformation of AT&T as a result of the DirecTV deal represents a “make or break” event. As the metrics above show, AT&T’s wireline broadband metrics were weak, and transitioning video customers from U-verse to satellite is not as easy as it appears (vs. Sling and other emerging over-the-top alternatives). And, while AT&T was quick to take credit for reaching 900,000 small and medium business locations with fiber, it’s not clear from the Q2 broadband figures that it actually helped stem the exodus to commercial cable offerings (Comcast had over 20% or $200 million annual growth in Q2, yet only has 25% penetration in small, and less than 10% in medium/regional businesses).

Bottom line: While one knothole has been cleared in postpaid wireless and AT&T has successfully integrated Cricket into the larger wireless portfolio, broadband continues to be weak. AT&T faces a substantial challenge with new in-region satellite products, continued bandwidth disadvantages compared to cable in residential broadband (cable will likely account for a more than 100% share of decisions relative to their telco brethren), and small business will become a highly competitive battlefield for the next several years.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: julydfg / 123RF Stock Photo