T-Mobile US’ ‘to-do’ list

Last week, the new No. 3 carrier, T-Mobile US, held its quarterly earnings session – it’s hard to classify it as an earnings call since there are as many “tweets” and e-mail questions from avid followers as there are Wall Street analysts in attendance. Unlike the Verizon Communications and AT&T calls, most of the questions are not fielded by the CFO (Braxton Carter, second from right in picture), but by their chief network officer (Neville Ray, far right in picture) and relatively new COO (Mike Sievert, far left). The call sounded more like a public operations review and less like an investor relations-led quarterly earnings conference call. The full packet of quarterly earnings information can be accessed here.

Importantly, there were no negative surprises in this quarter (machine-to-machine flatness was the closest thing, but T-Mobile US explained it perfectly on the call). In some instances revenue growth in one area masks defects in others, but that did not seem to be the case with T-Mobile US this quarter.

Last week, we talked about AT&T and Verizon’s progress through the “subsidy to equipment installment plan” knothole. T-Mobile US is now 93% through that transformation – a remarkable statistic, which turns the focus to service average revenue per user, which was up 1% when adjusted for Data Stash accounting accruals.

Many of you have asked: “How can T-Mobile do [the latest ‘Un-carrier’ initiative]?” This question was loudest when Music Freedom was announced a little over a year ago. I think one of the reasons is because T-Mobile US does not look at Un-carrier initiatives as departmental objectives – will this reduce calls to care? or, will this reduce churn? – but rather as subscriber benefits that support a data-first strategy that improves the comparative attractiveness of T-Mobile US. If you have worked for a large wireless carrier, you will understand the magnitude of the last statement. If not, e-mail me and I’ll explain in greater detail.

Has T-Mobile US gone crazy and created “social freedom” with unlimited/uncounted Facebook access? No. Has T-Mobile US changed course and offered buckets of free LTE data to customers who travel to Europe? No, free data is available at a lower speed, but for higher bands, there is a weekly charge. Has T-Mobile US changed its focus to tablets? No, because it has a new iPhone coming out (presumably with Band 12 included) and has the lowest base penetration of the “big four.” As shown by its sequential flatness in cost of services and a $325 million sequential increase in revenue, it is exercising financial discipline – but it’s a result of an acquisition-led strategy that is logical for a challenger.

Going forward, T-Mobile US has a “to-do” list that extends far beyond strategic partnership discussions. Here are a few ideas that we think should be included:

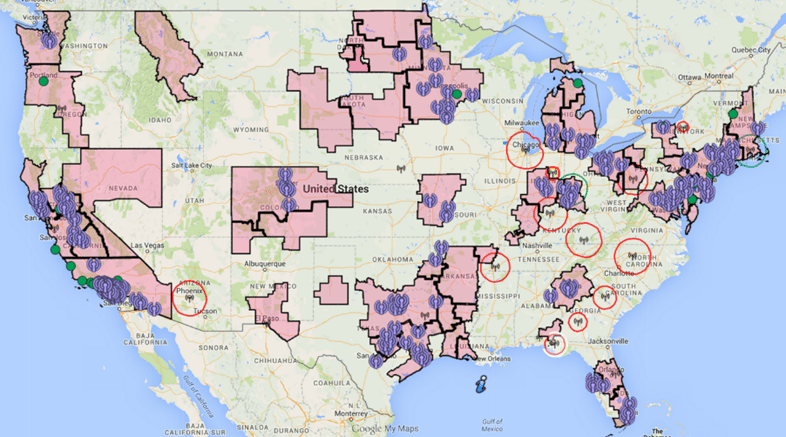

1. Complete the 700 MHz network build as soon as possible. Ray stated on the call that T-Mobile US would like to have a Band 12 device in 50% of the base by the end of 2015. That’s a very ambitious goal considering that no previous iPhone model has Band 12 included. More Band 12 devices drive more data usage, which drives up ARPU. Below is the T-Mobile US 700 MHz spectrum map, including where it faces issues related to channel (51) interference. More details at the Spectrum Gateway site can be found here.

2. Manage the transition from today’s “four for $100” plan to tomorrow’s “four for $120” plan. One of the large acquisition engines from 2014 was the “four for $100,” which allowed each member of the family the opportunity to enjoy 2.5 gigabytes of data before being slowed down to much lower speeds (Band 12 deployment exacerbates this speed cliff). While T-Mobile US has not disclosed the exact figure, let’s assume that there were 1.5 million families on this plan with an average of 3.25 lines per plan (4.9 million lines in total) prior to the introduction of their new “four for $120” plan. All of these customers need to be transitioned in the next five months because on Jan. 1 the 2.5 GB allocation drops by 60% to 1 GB before the data cliff kicks in. The new plan is very attractive, but it needs to be repurposed for retention. And, at $120 per month it helps out ARPU (four-times the data for 20% more). If T-Mobile US does not manage this transition, Q1 and Q2 2016 churn will spike as more customers trip the 1 GB threshold.

3. Build retail presence in a disciplined manner. Sievert did not release any actual store information on the call, but it’s pretty clear that T-Mobile US’ retail presence is lagging their LTE expansion. Some of this effect is buffeted by a solid online experience, but there’s value to retail expansion. One surprise would be to see an announcement between T-Mobile US and Amazon.com to leverage the retail giant’s “Same-Day Delivery” capabilities. A well-executed “home team partnership” strategy would make Sprint’s “Direct 2 U” and RadioShack efforts look outdated and expensive.

4. Develop cable partnerships. Begin with the question: “When AT&T and DirecTV offer four-line wireless family plans, 45 (75?) megabit per second high-speed Internet and premium TV for $199 …” and work your way back. AT&T has been setting the table for this moment and needed DirecTV to do it. Folks in Dallas are downright giddy, and they should be because they pulled off the regulatory approvals that Comcast and Time Warner Cable could not. Now the fun begins.

With more bandwidth freed up for faster data speeds (see Bob Bickerstaff’s June blog post here), Dallas can offer a new kind of triple play with owners’ economics. They can stuff the DirecTV offering with channels that appeal to certain demographics (e.g., Kansas City Royals fans who want MLB Extra Innings for the rest of the season), and they have a seamless Wi-Fi offload solution. Best of all, they can make money at a $199 monthly price point without sacrificing stand-alone pricing (which is “free?” 45 Mbps high-speed Internet or premium DirecTV video?).

T-Mobile US may well end up responding to AT&T’s triple-play move. Or it could talk to its friends in the cable industry (in the midst of the Charter/TWC/Bright House Networks merger) and make something happen quickly. With the cable industry’s affinity to Wi-Fi technologies, T-Mobile US could have a better in-home voice solution than any other carrier as well as a ready-built offload strategy. And, as we will discuss next week in our cable roundup issue, home voice connections will shrink more slowly than many people expect.

T-Mobile US’ bandwidth upgrade offering could be as simple as “switch to T-Mobile US’ family plan. If you are an existing cable high-speed Internet subscriber, we’ll pay for your speed upgrade for the rest of the year in the form of a gift card/credit. If you are new to cable, we’ll double the benefit.” Keep it simple, focus on bandwidth (which aligns everyone’s strategies), and get a T-Mobile US Personal Cell Spot in every home that lacks adequate coverage.

5. Develop small business partnerships. I look forward to the next T-Mobile US call in which Sievert refers to deal close as opposed to deal flow ratios (and 200,000 net additions from their small business initiatives). Like the previous paragraph, which described the framework for a home-based cable partnership, T-Mobile US should actively explore a small business selling network, which combines its wireless offerings with cable and/or DSL providers. Cable should be the natural partner, but business DSL providers (CenturyLink, Frontier and Windstream being large regional players, and Birch, Earthlink, Granite, XO and others on the national level) also need a strategic solution to grow revenue and retain customers.

OnStar: We are not immune

In response to the Fiat/Chrysler hacking fiasco (and their relationship to Sprint), many of you sent me articles indicating that OnStar (AT&T) could suffer a different security breach. At the DefCon convention this week, Samy Kamkar is scheduled to show how a small $100 device comprised of a Raspberry Pi computer and three radios could be used to intercept the car owners’ credentials. Kamkar said in this Wired article:

“If I can intercept that communication, I can take full control and behave as the user indefinitely. From then on I can geolocate your car, go up to it and unlock it, and use all the functionalities that the RemoteLink software offers.”

The issue with OnStar is different from the one Chrysler faced. In Chrysler’s case, the car could be controlled while in motion (read about Andy Greenburg’s harrowing experience here). The Chrysler zero-day exploit directly allowed the hacker to control all aspects of the car and did not involve placing a supplemental device near the car’s console. The GM man-in-the-middle vulnerability, while serious, allowed the car to self-start and self-unlock, but not drive away (car keys are still required for this function). In both cases, the auto companies (in Chrysler’s case, with Sprint’s help) were able to quickly fix the issue, but it highlights how hundreds of millions of dollars of industry investment to turn cars into smartphones means little if Cadillacs, Camaros and Cherokees are vulnerable.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: kchung / 123RF Stock Photo