4G device market more than doubles

A report by GfK found a mass transition to “4G” devices is upon us. Led by China, the wireless technology more than doubled its unit share over last year.

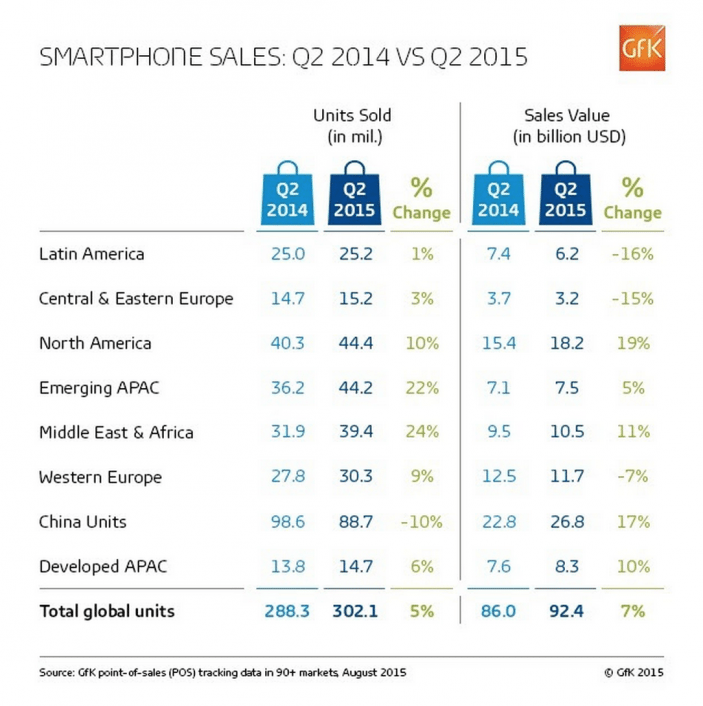

Overall, the report found that in the second quarter of 2015, smartphone sales value grew 8% over last year while unit sales grew by 6%. The 4G-enabled unit share grew from 26% in 2014 to 58% in 2015.

The report forecasts that this trend will continue as India begins its transition from 3G to 4G.

“India is expected to be the largest contributor of absolute smartphone unit growth globally this year,” Kevin Walsh, director of trends and forecasting at GfK said. “The main reason behind this is the currently low smartphone penetration in the market together with a significant intensification of the competition amongst the smartphone vendors, which will drive ASP erosion allowing more affordable devices in the market.”

When breaking down the growth, we see regional trends developing. North America grew by 10% over last year, but is currently seeing a trend of price polarization, meaning that high-end devices (more than $500) and low-end devices (up to $250) are growing much faster than midrange priced devices ($250-$500) as the market approaches a saturation point.

Western Europe is also beginning to see market saturation. The market grew 9% over last year, but saw the average sales price drop.

China led the way in high-end smartphone sales, which led to a 17% growth in market value over last year. But while the world’s largest market saw a growth in overall value, it also saw a 10% decrease in unit sales in the second quarter of 2015.

Central and Eastern Europe saw its demand grow by 3% while Russia’s year-on-year unit sales decreased by 11%. Latin America also saw growth slow on the back of an economic slowdown in Brazil. Overall, the region only grew 1%, a significant drop from the 28% increase the region saw in the first quarter of 2015.

As stated earlier, India will play a significant role in the future growth of 4G as competition heats up between local device makers and those from China and other markets around the world. India saw an overall increase of 40% in 4G-enabled devices. Price wars between local vendors and aggressive Chinese companies has pushed the average sales price of the phones down by 12% from last year. Low-end devices make up 80% of overall sales in India.

Below is a rundown of device sales and value.

“Weak macroeconomic trends will continue across a number of major countries such as Brazil, Russia and China, but recoveries when they come are often faster than expected especially for tech sectors,” Walsh concluded. “In addition, we are still a long way from saturation in emerging markets while adjacent industries to the smartphone fuel the next round of growth generally complementing, and in some cases cannibalizing, smartphone growth.”

GfK uses proprietary market modeling and consumer research to produce its market forecasts. Value is based on unsubsidized retail pricing, according to the research firm.