Last August, Sprint was in turmoil. The T-Mobile US merger continued to elicit a “no means no” response by the Federal Communications Commission. “Framily” results, while initially strong, were being impacted by a resurgent T-Mobile US.

Something had to change, and on Aug. 6, Dan Hesse stepped down as Sprint’s CEO and Marcelo Claure, a board member, took over. A billionaire telecom executive with a passion for soccer and a love of celebrity was moving to Kansas City (and forcing his entire executive team to do the same)!

Could this be the desired turnaround? Could Claure restore the luster last seen when Candice Bergen was the “dime lady” and free Fridays were the rage for business customers? There was hope for a stronger Sprint.

In that light, we penned one of the most-read articles called “Dear Marcelo” in which we offered some unsolicited advice:

1. Wireless success is highly dependent on wireline success (and specifically 2.5 GHz deployment success is highly dependent on an in-building strategy).

2. Make peace with cable (before T-Mobile US does).

3. Measure your team through the customer experience, not an arbitrary budget metric.

4. Build a culture of innovation that goes beyond the limits of current mega-suppliers.

Overall, Sprint has done an excellent job in reducing subscriber loss and reducing churn, thanks to an eye-popping 20-gigabyte family plan that depended on high breakage (average data usage with industry growth rates) to be profitable. It also has leveraged Brightstar and other Softbank relationships to improve its overall costs. The 800 MHz and 2.5 GHz network upgrades have helped out a lot in major cities and overall LTE coverage is broader than many expected.

Sprint also gets the innovation and leadership award for its “All-In” phone leasing plans, although adjusted earnings before interest, taxes, depreciation and amortization now has to be readjusted if one is performing competitive comparisons. The carrier has made it easy for prime credit customers to get a new Apple iPhone 6/6 Plus or the new Samsung Galaxy Note 5 for an attractive monthly payment. While the “Cut Your Bill in Half,” “Direct 2 You” and RadioShack store expansions are still unfolding – RadioShack being a real head scratcher – the core family and All-In offers continue to resonate a year later. That’s the sign of a powerful first 90 days as CEO.

The reality: Sprint cannot define victory

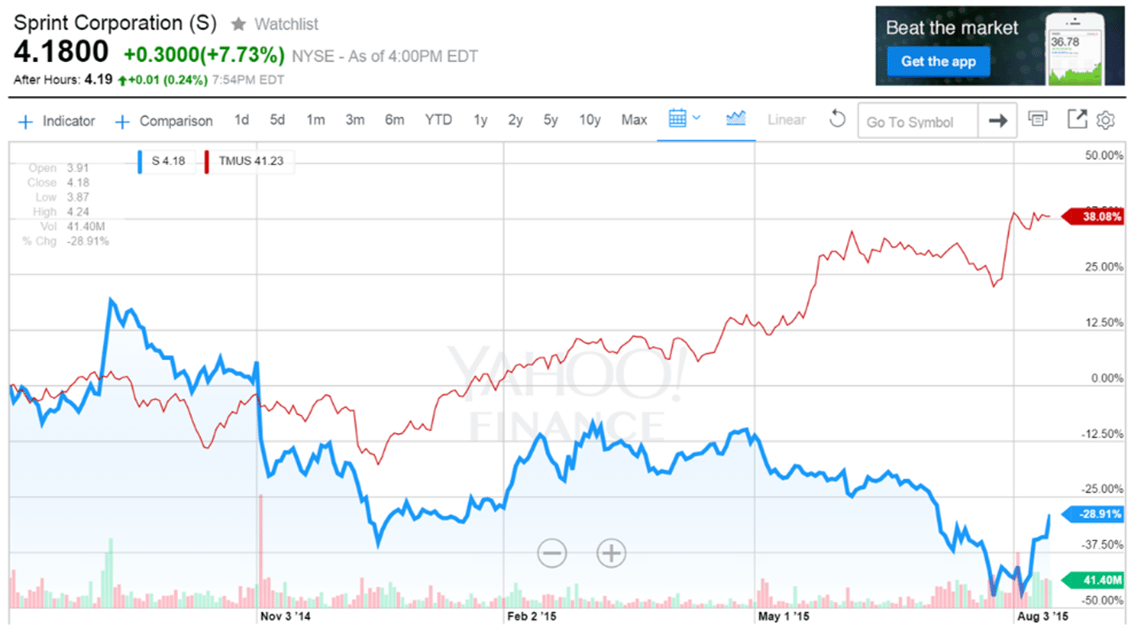

Given all of these changes, Sprint’s stock should be soaring, as most stocks do when analysts realize that the worst financial results are in the past and earnings growth is just around the corner. Why then, has the stock price fallen 29% (and as much as 47%) since last August? Why has T-Mobile US’ stock risen by 38% since the day Claure took over as CEO while Sprint has fallen 29%? Why is T-Mobile US’ equity value now twice that of Sprint?

The simple answer can be summarized in one word: horizon. Not Verizon, although T-Mobile US’ “#neversettle” campaign was directly aimed at their larger counterpart, but horizon.

Sprint is doing a lot of things – cutting costs, deploying networks, improving the customer experience – but to what end? Is merely a positive postpaid phone net additions number an acceptable “finish line” when T-Mobile US has just posted 1 million branded postpaid retail net additions for the fourth consecutive quarter (driven by a 1.3% monthly churn rate)? To Sprint’s credit, getting to positive is an achievement, but T-Mobile US is getting stronger – a lot stronger. And Verizon Communications and AT&T are beginning to use their size and industry clout to create meaningful differentiation in content delivery.

Sprint’s current horizon is “above water.” No doubt there is a 300-year plan tucked away in a secure safe in Japan, and there are myriads of three-year plans being modified to reflect $15 billion in spending on mini-macro architectures with large employee reductions, but there is no rank and file elevator pitch for how Sprint will lead the wireless industry. Here’s the best elevator pitch we have heard from a Sprint employee/officer recently:

1. Sprint’s upcoming network changes will attract disproportionately new customers. Sprint will win with speed across most metro areas.

2. Sprint’s existing All-In and 20 GB family plans will maintain and improve their relative attractiveness.

3. Sprint will leverage the global reach and scale of Softbank to maintain a free-cash-flow-generating cost structure that will more than pay for network growth.

Some of you are probably reading this thinking that most employees could not begin to communicate this with as much clarity as is outlined above. To Claure’s credit, however, I have heard renditions of this pitch from several current employees over the past three months. To many of them, it’s Network Vision (Sprint’s LTE deployment and 3G upgrade) done right plus a couple of sizable layoffs (cue the nervous laughter) and a side shot of empowerment. The current employee base is skeptical yet believes – not blind to “I’ve got a secret” promises over the past 15 years (Sprint ION being the costliest technology promise of the past two decades), but willing to take the next step.

The harsh reality is that the rank and file Sprint employee does not understand the concept of victory. This is not achieving a budget goal or being retail postpaid phone net add positive or receiving a RootMetrics award, but an acknowledged defeat of the incumbents. Without a doubt, few if any of the legacy Sprint employees have ever existed in an environment where victory was defined. The concept of beating an opponent is completely foreign and not “Sprint nice.”

To be victorious, someone needs to surrender. Who is going to surrender tens of millions of customers to Sprint? In fact, what should the victory horizon look like? Here are some thoughts:

1. Sprint’s victory horizon needs to be one that is relevant and achievable. On June 30 Sprint had 45.4 million combined postpaid and prepaid customers. Growing that number to 68 million by the end of 2019 (22 million to 23 million connections in four years) with an average service revenue per user of $45 is not a pipe dream. And adding $1 billion in monthly revenue by the end of 2019 is audacious, but achievable with the right network architecture. Someone will definitely feel the impact of Sprint’s victory.

2. A “big hairy audacious goal” like the one described above resets the assumption about how the network is designed and how the (local wireless) network is architected. The same network engineers who forecasted five-year growth of a few T-1s at an average cell site in 2009, and who missed the symmetrical nature of wireless growth thanks to picture uploads in 2011, need not apply for these positions. Twenty million net new connections implies data growth of two to four times per year for four years. Transitional goals like “FCF positive” and “net port positive” are nice to mention, but designing a network that works better yet is 10 to 20 times larger within the depreciable life of the network asset is going to require a new breed of thinking.

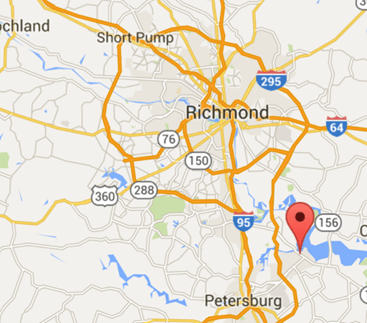

3. Growth may not be directly connected to a handset – it might be connected directly to a router (or an antenna that is connected to a router). Below is a map of Hopewell, Va., a small but quickly growing suburb of Richmond and Petersburg (for those of you not familiar with the area, it’s shorter from Richmond to Hopewell than it is from Arrowhead Stadium to the Kansas City airport).

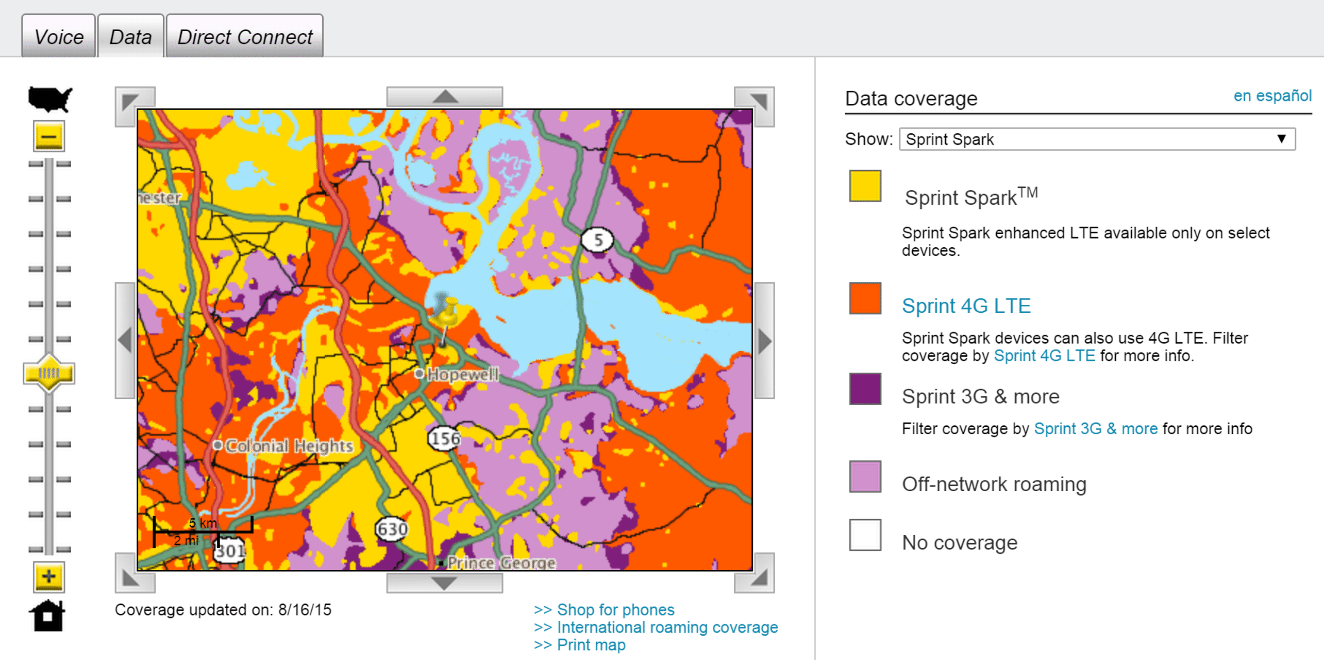

Residential broadband customers have two choices according to www.broadbandnow.com: Verizon DSL (no FiOS) at three megabits per second for $30 per month (regular rate is $35) and Comcast with 25 Mbps for $40 per month (regular rate is $67). The same monthly circuit cost for a small business customer is $48 to $53 (VZ) and $100 (Comcast). Guess who is winning? To make matters worse, see below for Sprint’s wireless coverage in Hopewell as of Aug. 16 – a bad mosaic for sure (and to think of the data experience cliff that customers go through moving from Spark yellow to Verizon Wireless 1xRTT purple roaming speeds – the net promoter score in Hopewell must be outrageously negative).

With the new BHAG described earlier, Sprint needs to stop thinking solely about handsets and start thinking about connections, and these need not be wholesale connections exclusively. Turn the map above solid yellow and offer small business customers a $70 per month “fast as possible” circuit with a minimum of 10 Mbps and a 35 GB cap. Or, better yet, pull a Google Fi on data access and charge a one-time fee of $500 to connect and an annual fee of $500, and have business customers pay only for the data they use.

As you can see, there are plenty of opportunities to add connections. Handsets are going to continue to be important, but enterprise branch connectivity can move the needle without breaking the bank. Many of the former Clearwire employees realize this and have specifications already written for a premiere business data backup product.

4. Create local operational partnerships that deliver as much value as the financing partnerships being established for handset leasing. Turning any geographic area solid yellow is going to take a lot of work and require a lot of money. Growing 20 million to 25 million net new customers over the next four years is also going to cost a lot of money – more than $15 billion.

For the largest metropolitan areas, Sprint needs to control and manage its metamorphosis. For the suburbs and the byways, that’s a different story. Why not bring the Alamosa, US Unwired, Ubiquitel, IPCS and other affiliate bands back together to lend a hand? This is more than network management – give them the rights to “fight local” against Verizon Wireless and AT&T Mobility. Protect the entity from any parent bankruptcies– as has been done with the “Special Purpose Entities” described in your most recent 10-Q filing – and reunion is possible.

This “re-affiliation” accomplishes two important objectives: It spreads the financial and deployment risk of the new mini-macro architecture beyond Sprint, and it allows historically weaker market-share areas to regrow without the fetters of Sprint’s dwindling advertising budgets.

Transformational change is hard. Creating competitive advantage against AT&T Mobility and Verizon Wireless is even harder. Sprint needs to define a victory horizon and engage external parties to help secure success. Time is running out.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.