The European Commission recently announced that roaming charges and poor mobile Internet connections for European Union customers are set to become a thing of the past.

Beginning in 2017, consumers will be able to travel within the EU and pay the same price they get at home for voice, texts and data. That means no more nasty shocks when the phone bill comes in after traveling abroad.

While the change is great news for consumers, it does pose a number of challenges for network providers.

Can a uniform law be effective in such a varied marketplace?

The EU may be a common marketplace for goods and services, but we know from our modeling work at Real Wireless that the cost for providing network services in different EU countries varies greatly from one country to the next.

Indeed, the cost varies even within countries themselves because of differences in population density, availability of real estate for base stations, availability of backhaul services and many other factors.

One measure value that a regulator may ascribe to a quantity of spectrum is calculated by comparing the value of this section of spectrum against the costs incurred by rolling out the additional infrastructure required to support the services that use the spectrum.

Operators will either pay spectrum fees set by regulators or bid for spectrum, but in either case they would not rationally pay more for spectrum than the value of the potential profitability of the business the spectrum would support.

Typically it costs a lot more to support services in less populous areas. For example, rural areas often cost more than cities. In cities, the infrastructure typically enjoys much higher levels of utilization, which brings in more income from users. Conversely, some rural areas face high fixed costs to roll out infrastructure, but then see much lower levels of utilization as a result of the lower subscriber density in the area.

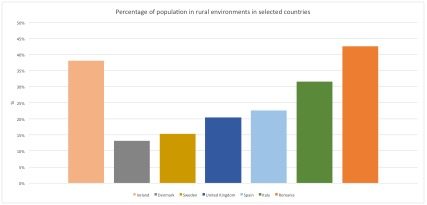

The figure below demonstrates just how variable population distributions are within some major European countries.

Percentage of population in rural environments in selected countries (data from Geohive).

Most governments find it desirable that a large percentage of their population can access mobile communications services – and they often provide economic benefits to encourage rollout to the more remote, “last to be served” population areas. Government regulators also will typically stipulate conditions for rollout, encouraging more people to be served. Both the fees and rollout conditions are set on a national basis, which has an impact on the cost of providing the minimum infrastructure required.

This new EU legislation will seek to establish a common price to be paid for service irrespective of where that service is being consumed. We therefore have the potential for highly asymmetric costs and services that could cause market distortion.

After all, there’s nothing to prevent users taking SIM cards from a country where services can be provided at a low cost and using them in a country with a high rollout cost – whether the result of topography, nationally imposed rollout conditions or low population density. Excess demand for these SIM cards would tend to push costs higher than otherwise expected.

The issues this new legislation presents are not only compounded by the asymmetrical nature of spectrum – particularly in terms of supply, availability and regulation – but also by the inability of network operators to differentiate their pricing while roaming, despite the reality being that each will still face different costs for terminating calls. The market will ultimately end up distorted as a result of separating the cost of goods from the cost of provision.

Who is going to take responsibility for service quality?

Cost aside, the question remains of who is going to be responsible for ensuring that quality of service remains consistently high across the entire continent. Unless the EU makes responsibility clear through law, Europe is faced with a messy blurring of responsibilities between the EU and its nation states.

The next two years before the changes become reality will prove to be vital in terms of planning and clarifying how the new market will work. Mobile operators will need to approach the European Commission directly to ensure the law provides clarity on these issues, in order to ensure that they are in a position to manage the responsibilities they will face come 2017.

Charles Chambers has expertise in applying systems engineering skills for communication system design and deployment, product development and regulatory issues. He enjoys identifying practical solutions to solve complex problems based on existing and foreseeable technical, market and regulatory environments. Working for operators, regulators and equipment suppliers, Chambers has worked on system definition of satellite mobile systems, mobile network planning, regulatory policy for spectrum management and market analysis. His work has spanned a broad range of wireless technologies including mobile, broadcast, fixed wireless and personal area networks. He has authored nine patents. Chambers gained his PhD in Digital Signal Processing at the University of Strathclyde.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.