In the middle of rumors that TIM would make an offer to buy Nextel in Brazil, which was denied by both telecom carriers, NII Holdings announced a new CEO for Nextel Brazil. Francisco Valim, former CEO of América Móvil’s NET and former CEO of Oi, agreed to command the Brazilian unit of the U.S.-based company, which recently emerged from its Chapter 11 reorganization proceedings.

Steve Shindler, NII Holdings’ CEO, said Brazil will be the country where NII will concentrate its investments as the company sees a promising long-term growth opportunity. In the process of reorganization, NII Holdings sold its operations in Mexico (to AT&T), Peru (to Entel) and Chile (to international investors).

Nextel has been struggling to succeed. In the second quarter, the company reported a net loss of 64,000 subscribers as iDEN subscriber losses in Brazil and Argentina exceeded 3G net additions in Brazil. Valim’s challenge remains to build Nextel’s 3G subscriber base in Brazil and pursue cost-saving strategies to help improve profitability.

According to Anatel’s latest numbers, Nextel holds the fifth position among the largest telco companies, counting about 2.12 million mobile accesses. But it is very far from the leaders: Vivo, No. 1, counts almost 82.12 million lines, followed by TIM (74,025,144), Claro (71,370,788) and Oi (50,051,487). In July Brazil had 281.45 million lines, of which 74.61% of the total is prepaid.

Valim replaces Gokul Hemmady, who has served as president of Nextel Brazil since 2013.

The importance of 700 MHz

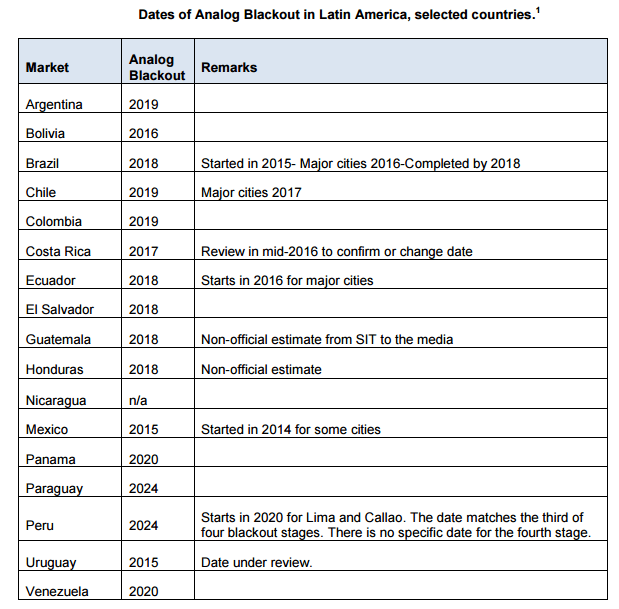

The 4G Americas association posted a report claiming that the 700 MHz frequency band is crucial for the boost of LTE deployment across Latin America. However, the 700 MHz band is in the process of being cleared as a result of the migration from analog to digital television — and in several countries this process will take some time.

The report noted that Latin America has historically lagged behind other world regions when it came to identifying and allocating spectrum for mobile services. It also highlighted that the allocation of sufficient spectrum by governments in Latin America for mobile telecommunication services is key to the industry’s development, the connectivity of inhabitants and the bridging of the digital divide.

More Latin American news:

BRAZIL – Telefónica Vivo confirmed an investment of 25 billion reals ($7 billion) between 2015 and 2017. The carrier responded to RCR Wireless News that it can’t disclose details about in which areas the investment will focus.

PARAGUAY – The government expects to kick off its frequency bands spectrum auction to deploy LTE in December this year, Conatel announced.

MEXICO – Telmex, América Móvil’s fixed-line telecom group, was notified by the Instituto Federal de Telecomunicaciones that the telco watchdog is investigating if Telmex breached the terms of its concession by being involved with a satellite television service. The administrative proceedings initiated by the IFT are related to the commercial agreements with Dish México. Telmex noticed the market that, along with América Móvil, is analyzing the scope and legal grounds of the alleged violations in order to participate in such proceedings and, as the case may be, exercise applicable legal remedies.

MEXICO – AT&T has begun to rebrand its recently acquired Mexican operations Iusacell and Nextel, including the launch of new rate plans under the AT&T brand.

PARAGUAY – Millicom is set to invest about $2.5 billion in the country over the next five years. According to local news citing Tigo’s executive president, Mauricio Ramos, the amount will be used to boost the infrastructure and increase broadband services.

ECUADOR – An underwater cable, the Pacific Caribbean Cable System, connecting Jacksonville, Fla., with Manta, in Ecuador, was launched Aug. 21. It has the transmission capacity of up to 80 Tbps and covers 6,000 km.

Wondering what’s going on in Latin America? Why don’t you follow me on Twitter? Also check out all of RCR Wireless News’ Latin American content.