This week, we will examine five of the top 10 developments for the third quarter and determine their short- and long-term effects on the telecommunications industry. These events are in no particular order and several of them have been suggested by readers.

Apple launch: Quién es más macho?

Almost a month before the iPhone 6s announcement, Sprint launched its “iPhone For Life” promotion. In this program, new and eligible Sprint customers traded in their phones in August and Sprint provided them with a $15 per month iPhone 6 or 6 Plus lease. The customer could then upgrade their iPhone 6 (Plus) to the iPhone 6s (Plus) by the end of the year and keep the $15 per month rate – as we discussed two weeks ago, Sprint gets carrier aggregation in the iPhone 6s model. At the next upgrade (after Dec. 31), the lease price will revert to $22 with an eligible trade-in.

While the iPhone for Life title was catchy, the program was harder to sell in the stores than expected and, as many of you asked in follow-up comments: Why would Sprint want to encourage upgrades during the holiday season? This question is still unanswered. Sprint responded with an aggressive plan on Sept. 11, which allows iPhone 6s customers to lease a new device for $15 per month with a smartphone trade-in (iPhone 6s Plus is $19). This plan includes one eligible upgrade per year at the new upgrade price.

T-Mobile US responded with an aggressive promotion on Sept. 22: If the customer turns in an iPhone 6 (or most Samsung Galaxy S6 models), they will get a new iPhone 6s for $5 per month (for an iPhone 5S, the new monthly payment would be $10 per month). This was met with an enthusiastic response – not only would existing customers get a discount on their equipment payments (up to $22 per month), they would get a 700 MHz Band 12 capable phone (the iPhone 6s is the first device with this band included).

Sprint on Sept. 24 responded with a headline that read “Not so Fast, T-Mobile!” It dropped its lease rate on an iPhone 6s with an iPhone 6 trade-in to $1 per month ($5 per month for the iPhone 6s). No other rate discounts were offered on other devices, but the iPhone Forever rate of $15 holds through the end of 2015.

While these rates pair well with the general Apple hysteria that accompanies a launch, there is a more fundamental point here: Without a device that is capable of accessing faster network technologies, customers will not enjoy their benefits. Without these benefits, there are few reasons to move from AT&T Mobility and Verizon Wireless to Sprint or T-Mobile US. This phenomenon has existed ever since the first network upgrades (3G and then LTE-capable smartphones), but the ramifications are much greater today. Sprint’s speed claims ring hollow (pun intended) unless you have a Samsung Galaxy 6 (Plus, Edge, Edge+) or Note 5; LG G4 or G Flex 2; HTC One M9; and now the iPhone 6s. And, with Sprint having this faster network deployed in 41 markets, there’s a good shot that many customers will see a dramatically different experience.

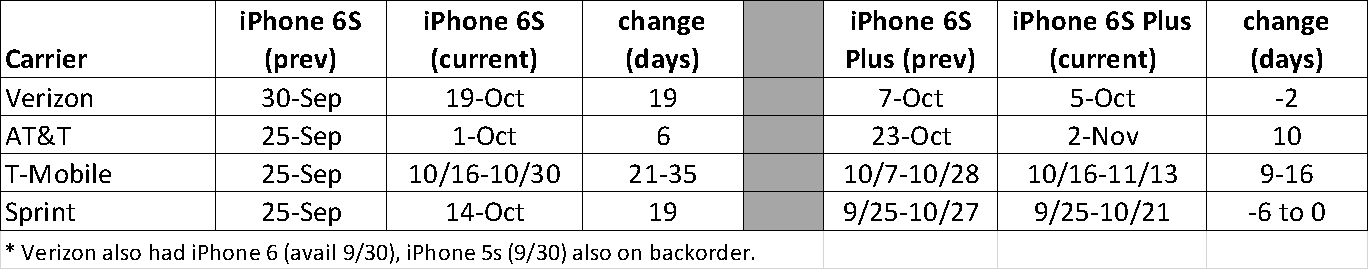

The result is a marked increase in many waiting times for all iPhone devices vs. those reported in last week’s column (times as of 5 p.m. EST Sept. 26):

T-Mobile US has experienced the largest changes – which is not a surprise given its “10 GB for All” promotion in addition to both the attractive phone rate described earlier and the fact that Apple Music playing does not count toward data levels. AT&T Mobility’s increase in availability also is not much of a surprise given its large iPhone base. The immediate availability of some Sprint iPhone 6s Plus devices is a bit of a surprise, but could be a reflection of supply chain improvements due to its relationship with Brightstar.

The implications of device turn-ins are not well known at this time. However, refurbishment supplies are going to go up in the fourth quarter and, to a (much) larger extent, in 2016. Compressed cycles mean big opportunities for newer companies that specialize in retailing devices, such as Glyde and Gazelle. This also puts pressure on device manufacturers to continue innovation and development.

Bottom line: The iPhone 6s launch is helping everyone (including third parties like Best Buy), but T-Mobile US appears to be experiencing longer waits for both models. It’s definitely a “top 10” event.

Can starting a 180-day shot clock qualify as a top 10 event?

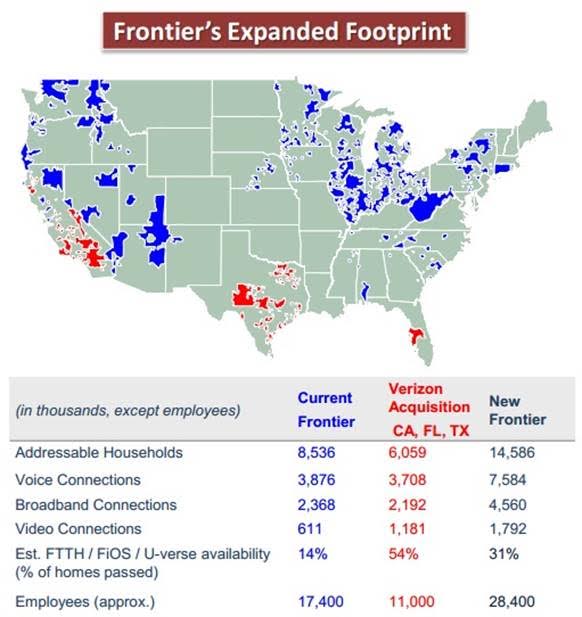

Yes, and Federal Communications Commission actions qualify for two of the top 10 events in the quarter. First, on Sept. 2, the FCC approved Frontier Communications’ purchase of Verizon Communications’ California, Texas and Florida properties (Frontier announced this acquisition on Feb. 5). This is a very quick turnaround for a transaction of this size, and to many was an indication that the FCC would likely move on other mergers as well.

Second, on Sept. 11, the FCC started the informal 180-day shot clock on the Time Warner Cable/Bright House Networks/Charter Communications three-way merger. There continues to be wrangling over the FCC’s ability and willingness to keep content deals out of the public eye (the FCC should honor the protective order if they ask the cable providers for confidential and proprietary information), and the FCC has asked for information about the quality/throughput/treatment of online streaming providers such as Netflix and Hulu (see Bloomberg article here). The three merging parties appear to be ready for the questions, however, and few see the prolonged approval process that plagued the TWC/Comcast proposed merger.

Cablevision’s French savior

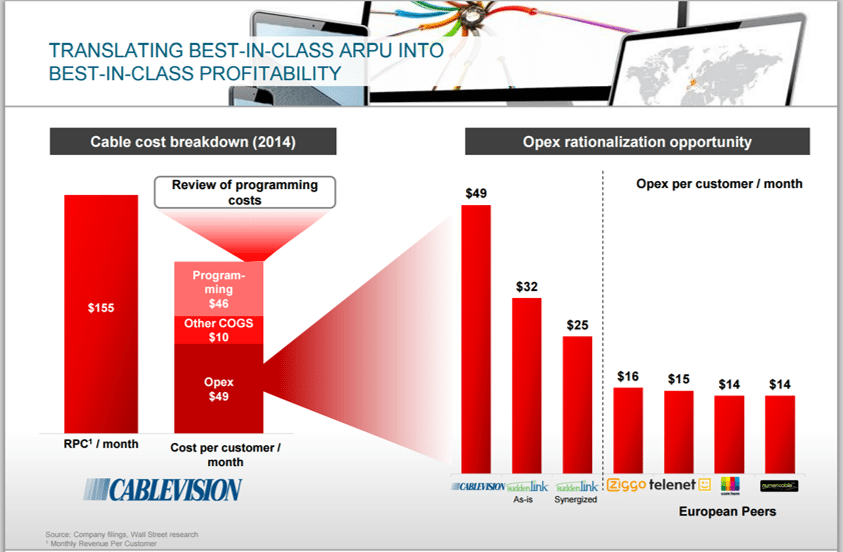

The news that Cablevision was acquired by Altice did not surprise most – it was the perception that they paid a hefty premium for the pioneering. but geographically constrained, property. Bloomberg Intelligence pegged the $17.7 billion offer (includes debt) at an earnings before interest, taxes, depreciation and amortization multiple of 9.64 and at $6,712 per video customer (a snapshot figure only, as video value would not be a reason for acquiring any cable company). These figures compare to a peer group EBITDA multiple of 9.35 and per video values of $7,138 to $8,040.

On the face of it, Altice paid a competitive multiple. But, what about Cablevision’s long-term growth prospects (as merger-and-acquisition B-school classes teach – the “value of g”)? If Q2 earnings are any indication, Cablevision is in a dogfight for subscribers with Verizon FiOS, and Verizon’s management team is redirecting its focus to more competitive local Northeast operations. Over the very short term, there may be additional subscribers who switch due to the changeover from AT&T to Frontier, but those issues are largely considered to be behind them.

Where does that leave Altice? Anticipating this question on a conference call, Altice President Patrick Drahi showed the chart above to explain the cost savings synergy strategy (the full investor presentation from Altice investor relations is available here). Some implementation details came at an investor conference where Altice’s CEO Dexter Goei revealed that 300 employees at Cablevision make more than $300,000 annually.

“There’s a new sheriff in town. … We will probably run things a bit differently,” said Drahi. “My model is to bring U.S. [average revenue per user] to Europe and European expense to the U.S.”

Without a doubt, Long Island is one of the more expensive places to live in the United States. And 300 employees represents about 2.2% of the total employee base. But cutting 50% of the 300 employees would only represent a $45 million to $60 million annual reduction (again, this excludes senior executive pay which will undoubtedly be less than the $40 million-plus paid out to Jimmy and Chuck Dolan earlier this year). These changes alone would meet the majority of the G&A target laid out in its investor presentation. Is Altice’s strategy to attract talent in less-expensive Suddenlink strongholds of St. Louis and Dallas/Tyler, Texas? Or is this the typical elimination of overlapping positions?

The answer to these questions (as well as Altice’s ability to wring out $300 million in annual network operating savings) determines the premiums paid if and as Altice rolls up the rest of the industry. Definitely a trend to watch for the rest of 2015 and 2016.

Samsung gears up for VR

Amid all of the iPhone hype, Samsung announced a $99 version of its Gear VR available for the holiday season. Full details on the Oculus-powered device are here. One of the most important features is that it is 22% lighter than the previous version. As Gizmag states in its hands-on review, “It’s not that we ever thought the previous model felt heavy, but the new Gear VR does get you closer to completely forgetting that you have a mask strapped to your face.”

This feeling just became a lot more important as the Oculus store just landed Netflix, Fox and Hulu (coming soon) for streaming video. There’s a terrific blog on Netflix describing how VR will impact movie-viewing experiences. Since it would take another column to summarize the article, I’ll just include the link here. Bottom line: $99 price point will lead to increased adoption and additional content. Oculus store titles will get more play on Facebook (I have already seen sponsored ads on my news feed within a day of searching). An Oculus/Steam relationship could be around the corner. And it’s more portable, albeit less powerful, than the Rift. Best of all (to Samsung), Apple does not have it – yet.

Next week, we cover the second half of the top events that are shaping Q3 results.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: gyddik / 123RF Stock Photo