The remaining top Q3 events

Last week, we covered five events/trends that will impact third-quarter, total year and 2016 results (these are in no particular order):

1. The announcement and launch of the Apple iPhone 6s and iPhone 6s Plus, which included significant network radio improvements for T-Mobile US (700 MHz band 12) and Sprint (specifically carrier aggregation). Apple announced sales surpassed 13 million units at launch, and a big reason for this (besides including China as an initial launch country) was the increased phone upgrade activity at T-Mobile US and Sprint. Update: With the exception of T-Mobile US (now with iPhone 6s delivery dates as long as eight weeks), wait times for new iPhone 6s Plus devices have stabilized.

2. Federal Communications Commission approval of Frontier’s acquisition of Verizon Communications’ California, Texas and Florida properties.

3. FCC starts shot clock on the Charter/Time Warner Cable/Bright House Networks merger.

4. Altice announces its intention to acquire Cablevision for $17.7 billion including debt. Update: Despite the volatile market, Altice was able to quickly raise funds to finance the Cablevision acquisition.

5. Samsung announces the Gear VR (virtual reality) for $99 starting in November.

5 additional industry-shaping events

1. The end of subsidized wireless phone pricing (for all devices – sort of)

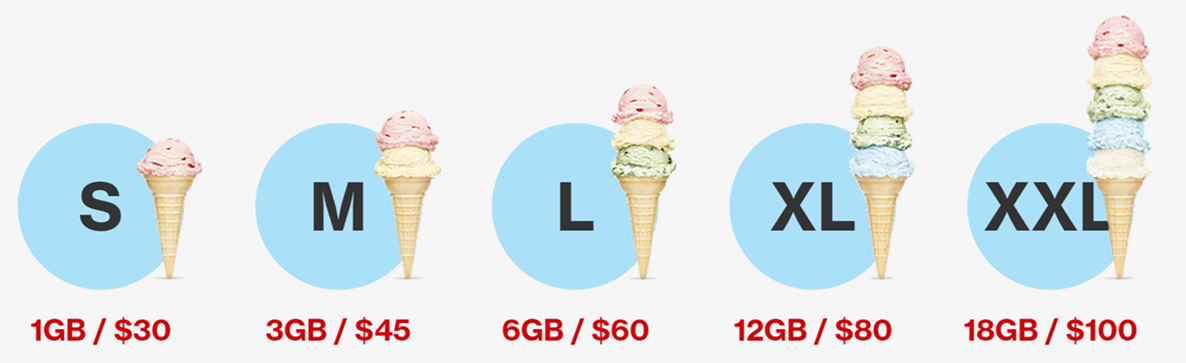

In mid-August, Verizon Wireless announced it was scrapping its current pricing plans for newer, simpler ones (total plans were reduced from 22 to five – see picture below for current device plans). In the process, it also ended two-year contracts and subsidized phone plans. Verizon Wireless’ emphasis on keeping its pricing process consistent across distribution channels seemed like a tip of the hat to T-Mobile US and a dig at AT&T Mobility, the last of the “big four” wireless providers to actively offer device subsidies.

For those of you who have been regular readers, the end of handset subsidies is not a surprise. Market trends were already pointing toward a nonsubsidy world:

• Higher-end smartphones were becoming more expensive than a $199/$99/$1 structure would allow. The iPhone 6 Plus, introduced last year, seemed to test a price point that was a bit more than the mass market could pay, especially for a family of four or more devices. A better alternative seemed to be $25 to $30 per month per device, and an additional $3.34 per month for 30 months is a lot easier sell than $100 upfront for the 16 gigabyte to 64 GB to 128 GB upgrade.

• The cost to produce lower-end smartphones – as well as the availability of reconditioned mid-range smartphones – began to reduce the value of a free phone when paired with certain wireless plan types. For example, the HTC Desire 626 is an LTE-capable device with an eight-megapixel camera, 2,000 mAh battery and up to 1.5 GB of RAM – a good phone for browsing and low data-intensive tasks like e-mail, Angry Birds and Pandora. Its current list price at AT&T is $185 – two years ago that price would have been $329 or higher. As the costs among the highest-end phones began to rise ($700 to $900) and the lowest-end phones began to fall (from $300 to $350 to below $200) one plan could not fit both types of subsidies. It made perfect sense for the industry to detach the device from service payments.

• It didn’t hurt that the wireless carrier with the most success in 2014 and through the first two quarters of 2015 had been solely promoting subsidy-free plans. Verizon Wireless was not pioneering, but merely following T-Mobile US’ freshly plowed ground.

Subsidies have died and it’s going to hurt Best Buy and others that depended on them to drive sales. Couple this with the continued rollout of Amazon.com’s Prime free same-day delivery and Sprint’s Direct 2 U plans and the real losers from this change are wireless retail distributors.

2. Increased marketing and differentiation of borderless plans

In mid-August, AT&T Mobility revamped its Mobile Share Value plans and began to include unlimited talk and text to Canada and Mexico in its $100 (15 GB) and up plan types. This came on the heels of T-Mobile US’ July 9 announcement of its “Mobile Without Borders” plan that includes free calling, texting and 2G data to Mexico and Canada for all Simple Choice customers.

If you are not a frequent cross-border traveler, these changes are not going to change your decision to use one carrier over another. For the 30 million U.S. wireless customers who routinely use their device in a country different from the United States, the changes initiated by T-Mobile US (global reductions in roaming voice rates and inclusion of free messaging) and accelerated by AT&T Mobility (unlimited borderless calling to Canada and Mexico for $100 and up data buckets) could not come at a better time. Perhaps the airport SIM card dispensers will go the way of airport payphones.

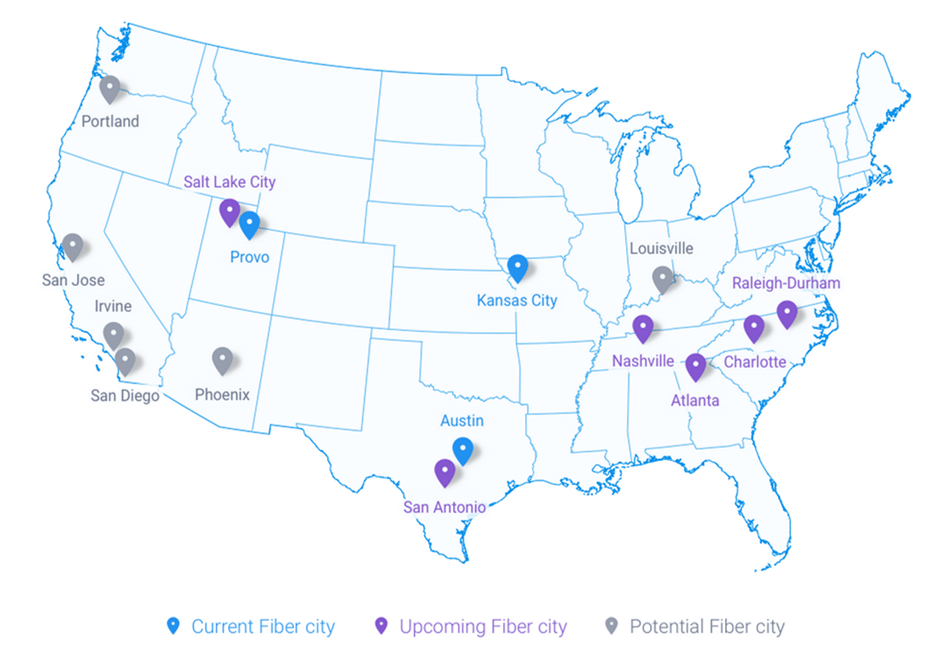

3. The slow but steady expansion of Google Fiber

In August, Google announced that San Antonio, Texas, will join the ranks of Google Fiber cities starting in 2016. In September, Google announced three additional cities – Irvine and San Diego, Calif.; and Louisville, Ky., will join the ranks of potential markets for Google Fiber. Below is a full map of all of the markets Google has either deployed, is in the process of deploying or has entered into active discussions. Interestingly, none of Google’s announced areas overlap with the post Frontier-sale Verizon FiOS footprint.

Google learned a lot from its first deployment in Kansas City, Kan. As this Fast Company article points out, having fast Internet speeds is not as important to many low-income neighborhoods as it is in wealthier locales. Google’s 75% penetration in higher-end “fiberhoods” is great, but 30% in poorer sections of the Kansas City metro represents a real challenge.

There, cable and telco competitors are catching up. Comcast is already offering 2-gigabit-per-second speeds (symmetrical) in a few neighborhoods in Atlanta (and growing), and Time Warner Cable is ramping up its Maxx efforts in Charlotte and Raleigh-Durham, N.C. AT&T is now obligated, thanks to the FCC’s “concession” extracted during the DirecTV merger discussions, to offer AT&T GigaPower services to 12.5 million locations. It will be interesting to see the reaction to these offers when these cities are actually deployed.

4. Comcast goes national

One of the least widely reported stories of the quarter was Comcast’s announcement of the creation of a national services division to serve the needs of Fortune 1000 enterprises. While cable companies have had commercial services divisions (and have had networking interfaces to serve regional needs), the creation of a nationwide organization with the focus of managing in and out-of-territory needs is new and groundbreaking.

Couple this with Comcast’s acquisition of Contingent Network Services – a very reputable managed services provider based out of Cincinnati (a Time Warner Cable territory) – and everything is shaping up for a fiber-based competitor to AT&T and Verizon for domestic opportunities if their smaller cable colleagues (including Charter + TWC + Bright House) agree to provide connectivity at competitive rates. It also will be very interesting to see how Comcast will tackle international connectivity.

5. Sprint’s announcement that it will sit out the 600 MHz auction and cut $2 billion to $2.5 billion in expenses

After last week’s column went to press, a report emerged in The Wall Street Journal online that Sprint would be sitting out the 600 MHz auction. This has obvious implications to the reserve spectrum bidding dynamics (re: reserve spectrum was set aside for smaller carriers). Removing Sprint might also impact the level of interest from broadcasters that equate fewer bidders to lower auction yields. This is more a story about Sprint’s steadfast belief that deploying its current spectrum is a better option for shareholders than buying new, but the effects of Sprint’s decision to bypass the auction have not yet been felt.

On top of this, Sprint announced plans to cut up to $2.5 billion in additional costs. This comes on the heels of an 11% workforce reduction in the first year of Marcelo Claure’s tenure and complicates the “improve network to No. 1 or No. 2” goal (and, from the most recent RootMetrics results in Harrisburg and Scranton, Pa., as well as Baton Rouge and New Orleans, La., Sprint’s speeds are not keeping up with competitors (see more here). The $2.5 billion figure also does not include any positive effects Sprint will receive from increased leasing (fewer subsidies, less equipment installment plan long-term accounting effects).

If the reductions are headcount-focused, the majority will likely come from one of three sources: Front line employees working in retail stores (a tough decision); network (a really tough decision); and customer service (which has already seen several reductions thanks to simplified pricing plans put in place by Dan Hesse). Sprint’s details concerning how it will reduce costs will likely impact its ability to refinance $2 billion of debt, which is due in 2016. Details will likely come throughout the rest of this year, but the CFO’s note has certainly raised anxiety levels across the company.

This certainly provides plenty of content for Q3 earnings reports.

A special tribute

We lost a wireless industry titan in September. Roger Linquist, founder of MetroPCS and a friend to many Dallas entrepreneurs, passed away midmonth at the age of 77. His obituary says it all – odds beater, hard worker, risk taker, pioneer, family man.

Nearly all of the former MetroPCS employees I talked to over the past two weeks loved working with Roger and everyone had a story to tell. He will be missed in the Dallas business community and throughout the wireless industry.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.