This week, we’ll touch on the Federal Communications Commission’s special access investigation announcement; comment on AT&T’s public relations blunder with a quadruple-play customer (and equally embarrassing confession to the Los Angeles Times); and look at the beginning of the 600 MHz auction activities.

The FCC investigates large volume/term discounting practices with potential competitors

Last Friday, the FCC opened up an investigation into the tariffing processes of AT&T, Verizon Communications, CenturyLink and Frontier (full FCC order here). These tariffs are between the incumbent telecommunications providers and competitive local exchange carriers, which include XO, Birch, TW Telecom, Level 3 and even out-of-territory divisions of the incumbents themselves. Here’s a brief summary of the allegations (from the FCC document):

“Competitive LECs assert that, in order to compete for customers with any demand for relatively low bandwidth services beyond large downtown areas, they must purchase as wholesale inputs significant amounts of business data services from the local incumbent LEC. They assert further that in practice their only option in making such purchases is to be entangled in a web of terms and conditions that limit significantly their ability to respond to marketplace opportunities to deploy their own infrastructure, which would introduce additional choices for customers. If true, the consequences could well be that, despite competitive entry for a segment of the demand for business data services, incumbent LEC dominance over facility-based provision of such services is preserved in many areas and costs for entry or expansion for competitive LECs is increased with the direct result of that dominance being that end-users are deprived of the benefits of both competition and innovation.”

What this paragraph states is that in order for competitive LECs to have a chance, they need to sign up for large-volume discounts, which commit them to purchase nearly all last-mile connections from the incumbent. This commitment prevents them from purchasing more from cable (most cable companies have wholesale divisions) or from building into multitenant facilities for their customers.

To put this into context from an incumbent perspective, total transport revenue for AT&T – both wholesale and retail – were $6.8 billion for the trailing four quarters ending June 30 (total wireline revenue was $57.5 billion). However, as this column has noted several times, transport revenue generates a lot of earnings before interest, taxes, depreciation and amortization (cash flow) because the build process is very capital-intensive, and maintenance costs have risen on a per-circuit basis as the incumbents lose market share to cable providers.

It will be very interesting to see where this investigation leads. While there is nothing inherently wrong with having a large-volume commitment, which could translate into a large percentage of circuits ordered – depending on the competitive LEC’s product offerings, pricing strategy, etc. If there are no intermediate volume purchasing tiers (e.g., order this package or revert to much higher rates) the FCC might find a way to play a role. Applying one or two volume discount “rungs” on a revised laddered schedule is a more balanced way to address this issue than shortening terms or modifying/eliminating termination liabilities for violating agreements.

Regardless, the wholesale arms of the cable commercial services units are the big winners here. With relations between the competitive LEC community and their incumbent peers at an all-time low, cable could gain meaningful scale to justify additional line extensions at a time when residential services growth (and corresponding capital requirements) are beginning to slow. This would put a serious dent in the profitability outlook for each of the incumbents.

More to come on this topic and kudos to CompTel for leading the charge.

AT&T’s monumental misfire (and quick confession)

In September, an AT&T quadruple-play customer from El Sereno, Calif., emailed CEO Randall Stephenson with a few suggestions on how it could improve its service. First, where AT&T only had DSL services (no U-verse speeds), Alfred Valrie wrote the following, according to the Los Angeles Times:

“Hi. I have two suggestions. Please do not contact me in regards to these. These are suggestions. Allow unlimited data for DSL customers, particularly those in neighborhoods not serviced by U-verse. Bring back text messaging plans like 1,000 messages for $10 or create a new plan like 500 messages for $7.

Your lifelong customer, Alfred Valrie.”

Clearly, Valrie has established that these are suggestions only, and that he’s not looking to be contacted. He calls himself a lifelong customer. Asking for improved volumes to compensate for relatively slower DSL services is not a hair-brained idea. And, since Valrie is likely spending $200 or more for quadruple-play services, trimming voice/data by a few dollars per month is not a big stretch for AT&T.

Rather than send a quick: “Thanks for your suggestion. We’ll look into it” note and popping it into a virtual file never to be read again (I’ll admit to having done that a few times while I was at Sprint), they sent the Valkyries (a.k.a., the intellectual property division of AT&T’s legal department, led by Thomas Restaino) after him. According to the Los Angles Times (see hyperlink above), the response to Valrie read in part:

“AT&T has a policy of not entertaining unsolicited offers to adopt, analyze, develop, license or purchase third-party intellectual property … from members of the general public,” Restaino wrote. “Therefore, we respectfully decline to consider your suggestion.”

Gulp. What’s most amazing about this communication is that at least three people at AT&T probably approved the response, and it appears that none of them actually read Valrie’s note, which clearly contains nothing innovative or groundbreaking, but strongly hints at the frustration that there are data speed inequities occurring in AT&T’s network in Southern California, and that customers who balance wireless and wireline services might deserve more of a discount than wireless-only customers.

Before Stephenson delivered the mea culpa of the week to the Los Angeles Times, however, an AT&T spokeswoman, Georgia Taylor, actually explained to the reporter that AT&T’s action was deliberate:

“In the past, we’ve had customers send us unsolicited ideas and then later threaten to take legal action, claiming we stole their ideas,” she explained. “That’s why our responses have been a bit formal and legalistic. It’s so we can protect ourselves.”

Again, Stephenson has apologized for AT&T’s response and indicated that the company has taken appropriate measures to prevent this from happening again, but it makes me wonder how many other customers received a bullying note from AT&T in 2015? I received one in the summer of 2010 for using the words “Rethink Possible” in a column (we modified it slightly), but that letter was not threatening by any means and I had an excellent dialogue with the external counsel who was probably paid by the hour to read my column.

In all seriousness, executives need to read these notes as fellow customers and apply rational thinking and appropriate action. Listen less to the legal department and more to quadruple-play customers.

The 600 MHz auction preparty begins – who cares?

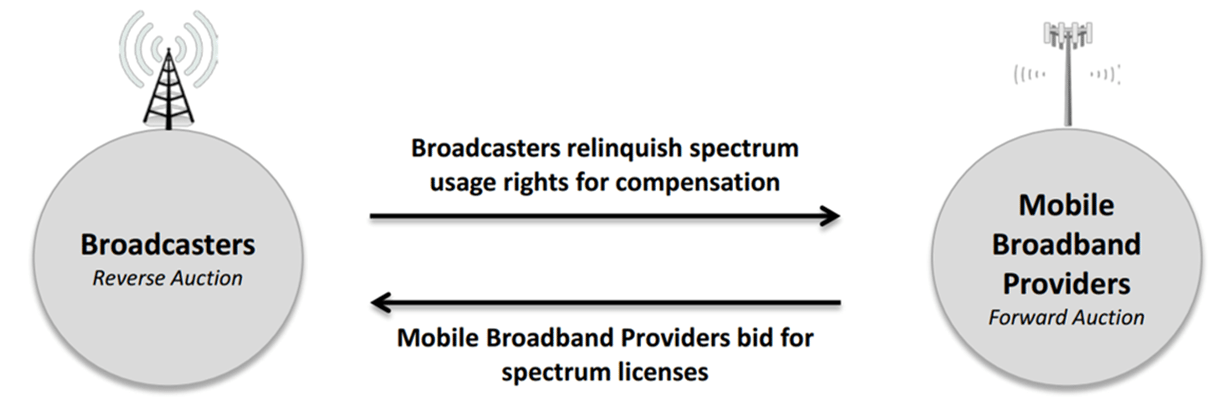

The FCC was also busy this week releasing the initial market pricing for the 600 MHz incentive auction. There are two parts to the bidding process, as outlined in the above diagram provided in a recent FCC/Greenhill presentation:

1. Maximum “ask” pricing for each broadcaster in each market. As in any forward (or reverse) auction, an initial asking price has to be established. In the case of the 600 MHz auction, the FCC established three prices: one whereby the broadcaster receives funds and shuts down; one in which the broadcaster receives lesser funds, but agrees to share a new channel with another broadcaster; and one where the broadcaster receives an even lesser amount, but has more flexibility to locate its new broadcast channel. In nearly all publicly available information, it’s most likely that the second and third options will be the most common choices for broadcasters.

This is a reverse auction, which means pricing will not go up. The FCC has a spectrum “supply” that it is looking to fill in each market, and their intent is to fill the spectrum at a rate that yields the highest possible take for the U.S. government (and taxpayers).

2. Minimum “bid” pricing from would-be bidders (most likely current wireless carriers, with the exception of Sprint). The FCC table is here. Of particular note are the FCC’s new 415 partial economic areas, which is appropriate given their smallish nature. For example, in addition to Missouri’s Kansas City, St. Louis and Springfield, the towns of Cape Girardeau, West Plains, Moberly, Farmington, Kirksville, Rolla, Hannibal, Maryville, Macon, Columbia and St. Joseph, all have their own PEAs. This structure should enable competitive bidding from rural wireless providers in markets where prices may have previously been prohibitively high.

The broadcasters will look at the first schedule and notify the FCC of their intention to participate in the reverse auction by mid-December. Based on the pricing already established, it’s likely that many, if not most, will choose to play and remain in operation. Look for more on this topic over the next six months.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.