LTE has been one of the mobile industry’s most rapidly adopted mobile technologies, with deployments coming particularly quickly in the U.S. Voice over LTE, however, has been a comparatively tough nut to crack and far slower to be launched, much less to gain ubiquity.

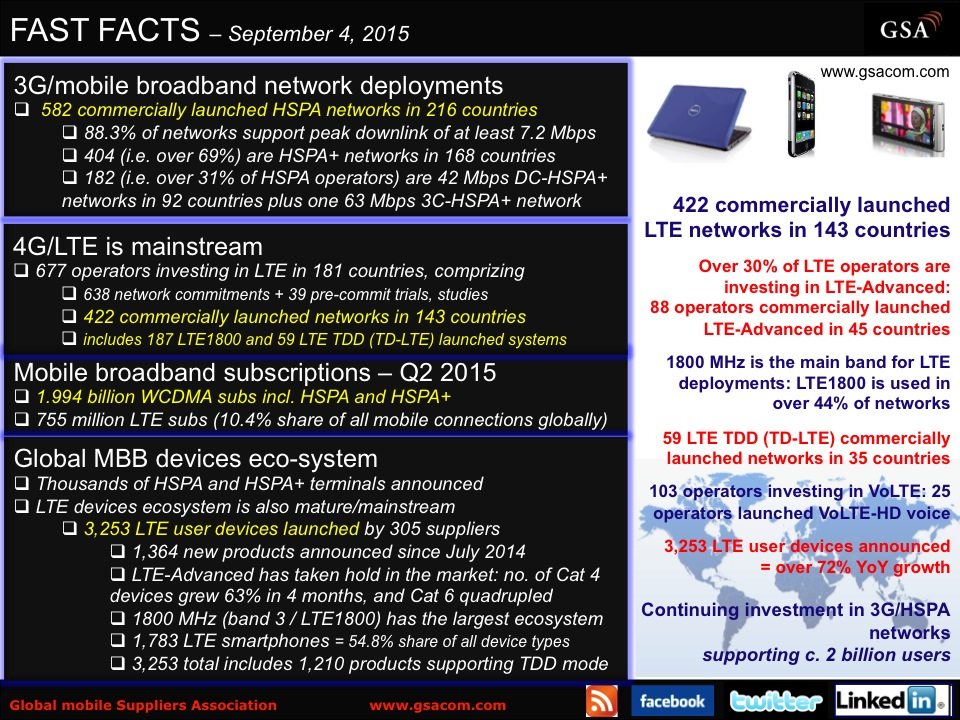

According to the most recent information from the Global Mobile Suppliers Association, there are 422 commercial LTE networks around the world, but only about one-quarter of those operators are investing in VoLTE (103 operators) and just 25 have launched. So what does VoLTE need to move forward?

Addressing technical challenges. Keeping call set-up times short, making sure latency and jitter are in check, and delivering noticeable improvements in voice quality over circuit-switched voice – these are some of the primary challenges to making sure that VoLTE is well-received, and it can be difficult to maintain them consistently, according to John English, a VoLTE expert and product manager with NetScout, which has been working with VoLTE early adopters for several years now. Handling authentication and attachment to the IMS network, the amount of signaling involved and simply the fact of being an IP voice service that takes routed hops around the network can add enough latency to seriously impact VoLTE voice quality. In operator networks that enable circuit-switched fallback, handovers have to be smooth and reliable. A few of the possible issues: there can be mismatches in the amount of resources allocated to a VoLTE call; one-way audio; and voice quality packet impairments that can influence VoLTE’s performance, English said.

Interoperability. In some ways, VoLTE brings the industry back to the days prior to cross-carrier interoperability. While users take for granted the ability to make 2G or 3G calls to any operator, it wasn’t always the case. As Sneha Patni wrote for Spirent’s blog, “the interoperability equation has exploded for VoLTE. … VoLTE’s device to device nature, which means that every endpoint in this ecosystem operates with every other endpoint to carry out the simple function of voice calling. While, this may seem simple to the end user, it is fairly complex with endpoints negotiating with each other, with every endpoint interoperating with every other model from every other manufacturer, regardless of version, and across every carrier’s network. The individual and proprietary nature of each provider’s IMS core adds to this existing complexity.”

South Korea’s three major mobile operators were the first to market with interoperable VoLTE services, announced in July (and enabled in part by Syniverse). The work was the culmination of three years of cooperation; the Korean government formed the VoLTE Inter-working Technology Consultation Group in 2012 to establish standards and specifications for VoLTE interoperability, with SK Telecom, KT and LG Uplus participating as well as several research institutes. According to the GSMA, the three operators planned to start with making interoperable VoLTE available on five devices and migrate all customers to the technology by this November.

Meanwhile in the U.S., AT&T Mobility and Verizon Wirelessannounced last year they would work toward interoperability that they hoped to achieve this year. Some U.S. operators – notably Verizon Wireless – have also opted not to implement 2G/3G fallback for VoLTE and are instead offering the service essentially “as-is”, warning users who opt into the carrier’s Advanced Calling 1.0 that if they leave LTE coverage their calls will drop and that they may want to consider turning the feature off if they’re in an area with spotty coverage.

More device penetration. The number of VoLTE-enabled devices at carriers are significantly increasing – mostly due to the latest iterations of flagship devices from Apple and Samsung. Both Verizon Wireless and AT&T Mobility, for example, have more than two dozen phone models that support VoLTE. Newfield Wireless found a substantial bump in VoLTE usage and corresponding drop in legacy calling spurred by the most recent releases of new iPhones that are VoLTE-capable. But VoLTE capabilities are still relatively new in the device world, and generally limited to recently released high-end devices – most customers probably haven’t upgraded their phones in the time span in which VoLTE devices have been readily available, and mid-range price options are primarily in the form of slightly older iPhone or Galaxy S models. (And even among phones which support voice over LTE, fewer support video over LTE.)

“We’re still in the first wave of investments for sure,” said English. “There are a lot of dependencies here. Aside from the LTE coverage, you’ve got to have devices to support it.”

VoLTE as a default and/or a plan option. Currently, high-definition voice is still an opt-in feature; and so far, not one for which operators are charging extra, as they continue to work out the bugs in call set-up times, voice quality and other quirks that have so far kept VoLTE largely in beta-mode. Until VoLTE – and the rich communications suite that can accompany it – can be monetized successfully by operators either in terms of efficiency or new revenues, the service is destined to remain on the fringe.

“With the improved coverage and penetration of LTE as well as the massive adoption of smartphones, VoLTE has become a priority throughout the world for operators that wish to bring HD voice service to their LTE customers,” said Paul Budde of BuddeCom, as part of a report on VoLTE. “Nevertheless, while VoLTE services certainly offer opportunities, over-the-top mobile VoIP services will attract the largest revenue market shares, at least in the short and medium term.”

More coverage. There are still large sections of the country where HD voice coverage is either unavailable or spotty. AT&T Mobility’s HD voice coverage, for example, is concentrated in urban corridors on the east and west coast and a huge swath of the southeast.

English said that many carriers have ongoing VoLTE projects currently, and are focused on getting the basic service up and running, go through “friendly” user trials and then start their roll-outs. He noted that, unlike other services that carriers may take a market-by-market approach to deploy so that a new service is tightly controlled, it is difficult to take that same approach with VoLTE – so operators are faced with trying to roll out a new, highly sensitive service on a national basis.

English also noted that operators’ VoLTE rollouts will be limited by the extent to which they have or haven’t invested in IMS within their networks – and that the parallel development of voice over Wi-Fi may end up being to VoLTE what Wi-Fi has been for the cellular data network. Cisco has also predicted that VoWi-Fi will have a significant impact on the network, with VoWi-Fi minutes expected to exceed VoLTE minutes by 2018 and carry 53% of mobile IP voice by 2019.