This week, we’ll explore Verizon Communications’ announcement that it might shed $10 billion worth of assets to further focus on wireless and media, and take a look at Sprint’s mixed earnings release.

Verizon: no backbone?

On Friday afternoon, Reuters reported that Verizon is considering the sale of up to $10 billion in wireline assets that include its MCI enterprise division (domestic and global) as well as its Terremark data centers (including the flagship NAP of the Americas). This comes on the heels of CenturyLink’s disclosure earlier in the week that it will likely sell off most of the Savvis data center assets and Windstream’s sale of its data center assets to St. Louis-based TierPoint.

How could something that was so valuable and strategic in 2011 turn into an albatross four years later? Was the “everything-as-a-service” strategy that promised secure yet speedy connections a failure? What are the implications of this to FiOS (residential and business fiber services in the Northeast) and to their main wireless competitor, AT&T?

The answers to these questions are found with a basic examination of the enterprise market.

1. Voice, the primary source of enterprise revenue a decade ago, has moved from being circuit- to packet-based. New architecture costs are fundamentally cheaper, and business opportunities have changed from being end-to-end service providers (retail) to being experts in circuit-to-packet translations (wholesale). This is the primary component of the “secular changes” frequently cited by Verizon Communications’ management in quarterly earnings calls and presentations.

2. Cable is providing increasing competition to AT&T and Verizon Communications digital subscriber line connection alternatives. In the very small (fewer than 50 employees) and small business segments (50 to 500 employees), DSL and SONET-based connectivity was the standard. Now it’s split between DOCSIS, which is capable of delivering at least 50 megabit-per-second circuits to most locations for $70 to $90 per month, and DSL in which service availability varies; costs vary; highly priced voice circuits might be required. Verizon made several comments over the past decade that they struggled with figuring out the small business segment. Comcast, Cablevision, Cox, BrightHouse and Time Warner Cable solved that equation.

3. Most of the major cloud competitors (IBM/Softlayer, Amazon.com, Microsoft Azure, Google) do not sell or market end-to-end backbone connectivity to enterprise customers. Their focus is on delivering highly reliable, scalable and affordable computing services. Below is Gartner’s “Magic Quadrant for Cloud Infrastructure-as-a-Service.” Verizon slipped in May to the “niche player” category (it had previously been consistently viewed as one of the “visionaries”) joining the ranks of NTT, CSC, Virtustream, Rackspace and others. Interestingly, Verizon Communications has been consistently slipping over the years in its “ability to execute” rating. This perception does not bode well for the potential buyer unless it is a current visionary or leader.

4. Lastly, the number of corporate-liable wireless devices is shrinking as a percentage of total enterprise connections. Given this “bring-your-own-device” trend, the age-old argument that wireless services are “pulled through” because of a robust wireline product portfolio is becoming less meaningful. Also, Verizon Communications and AT&T continue to dominate what remaining corporate wireless spending remains due to Sprint’s increased focus on retail (consumer) footprint expansion and T-Mobile US’ limited success above the 500-employee level.

With these and other factors as a backdrop, the question becomes: “Who buys what assets?” Is it a foreign carrier wishing to establish an enterprise foothold (and it would be a significant one) in the United States? Or is it someone like Level 3 Communications, which would be able to use these assets as a competitive differentiator against Zayo and AT&T, particularly in the federal space? Or could it be an entirely different entity such as a systems integrator that orchestrates a rollup of data center and backbone assets to compete against Amazon and Microsoft?

The simple answer is that it depends on how these assets are being packaged. At the end of the process, Verizon Communications will be more domestically focused on expanding its leadership in wireless services. More capital for Verizon Communications means more spectrum and faster speeds. The company’s ability to build a bigger “moat” around its 111 million retail connections just got a lot better.

Sprint’s comeback (?)

From a casual view of Sprint’s third-quarter earnings report, another Kansas City comeback is in full swing (puns intended). They were able to hit very strong retail postpaid subscriber additions of 553,000, with tablets being 228,000 (41%), mobile hot spots and other connected devices being another 88,000 (16%) and converted retail prepaid subscribers totaling 199,000 (36%). This leaves a small – but positive – 38,000 subscriber gain, which can be largely attributed to Sprint’s aggressive iPhone 6s lease promotions (although many readers think there could have been additional positive movement from WiMAX to LTE transitions for data-centric devices and perhaps a few phone stragglers).

In addition to the positive postpaid phone additions, Sprint pitched very low monthly postpaid churn of 1.54% – likely due to its large base of 3.1 million tablets, which tend to have lower average revenue per user and churn, but also a testimony to the dust clearing from the Network Vision project. Without a doubt, churn is headed in the right direction. In addition, CEO Marcelo Claure stated the prime mix was the highest September quarter in seven years.

Sprint went on to tout several recent reports showing it to have improving network quality and data latency. The company now has 12 devices (11 smartphones) capable of carrying Sprint’s 20×20 megahertz 2.5 GHz network (iPhone 6s and 6s Plus are two, and the HTC M9, HTC One A9, LG G4, LG G Flex II, and Samsung Galaxy S6/S6 Edge/S6 Edge+/Note Edge/Note 5 round out the smartphone list). Sprint is introducing this faster network configuration to 80 markets by the end of the year and the results of initial testing have been very positive (if customers have a compatible device).

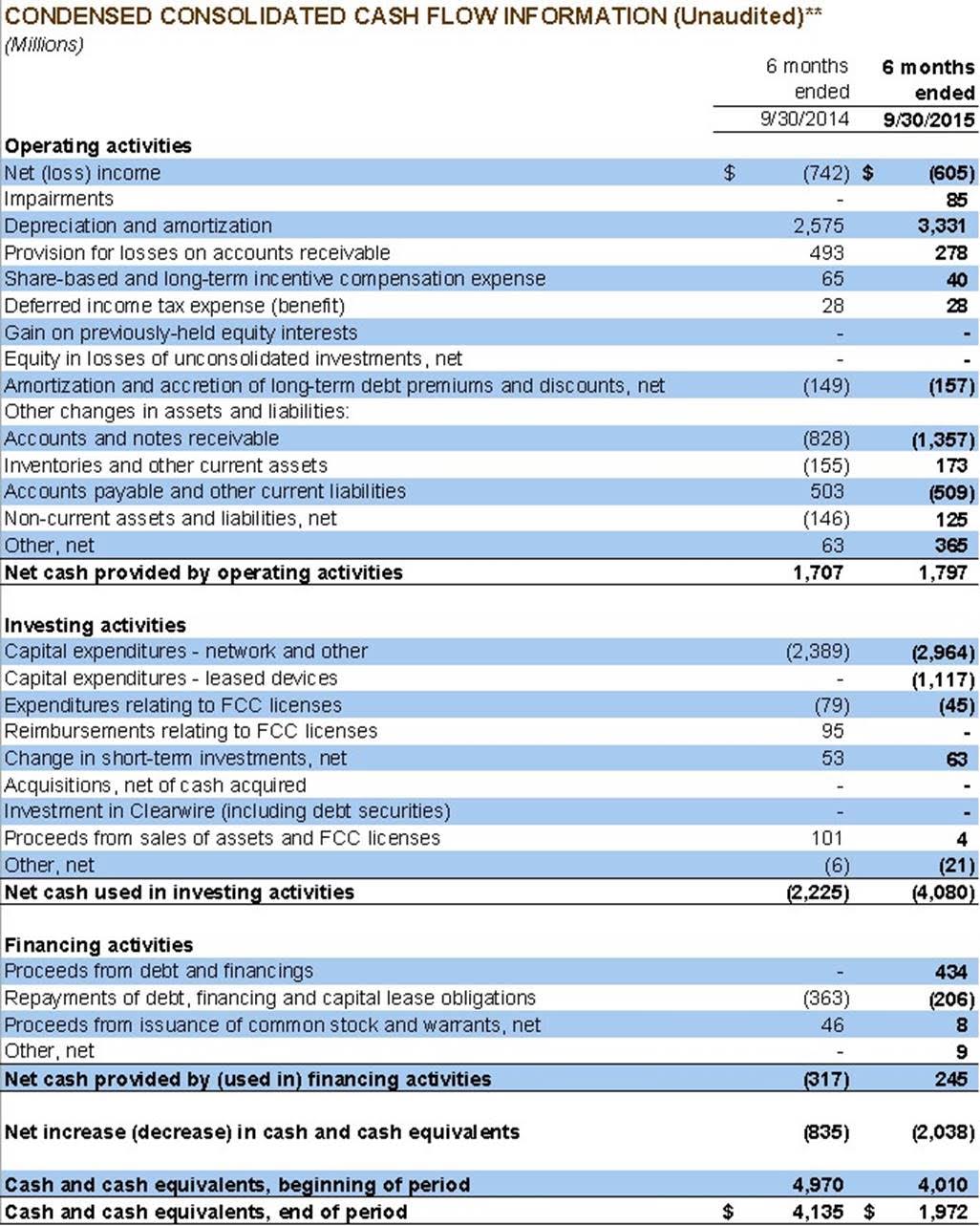

Positive phone net additions plus lower churn plus network progress. Is this enough “small ball” to tie the game in the ninth and send it into extra innings? Two schedules tell the tale. First, because of the myriad of accounting treatments as a result of changes in device financing, it’s necessary to look at the statement of cash flows (Sprint includes this in their detailed financial schedules). Here’s the roster of progress over the past six months compared to the same period in 2014 (when they were finishing up their Network Vision upgrade):

The storyline is mixed at best from the statement of cash flows analysis shown above. Cash provided by operating activities barely grew, even with $1.5 billion in operating expense reductions that started last fall. The effect of the leasing program is clearly seen in the $1.1 billion leased devices investment (re: this is a six-month figure – the 12-month figure is $1.7 billion). And net debt rose a few hundred million dollars as a result.

The net result of several years of 2014/2015 activity would be a juggling act composed of expense reduction, metro-focused network expansion and net additions if Sprint did not carry $34 billion-plus in total debt and $542 million in quarterly interest payments. It’s a hard slog, but a winnable equation if it weren’t for those bondholders.

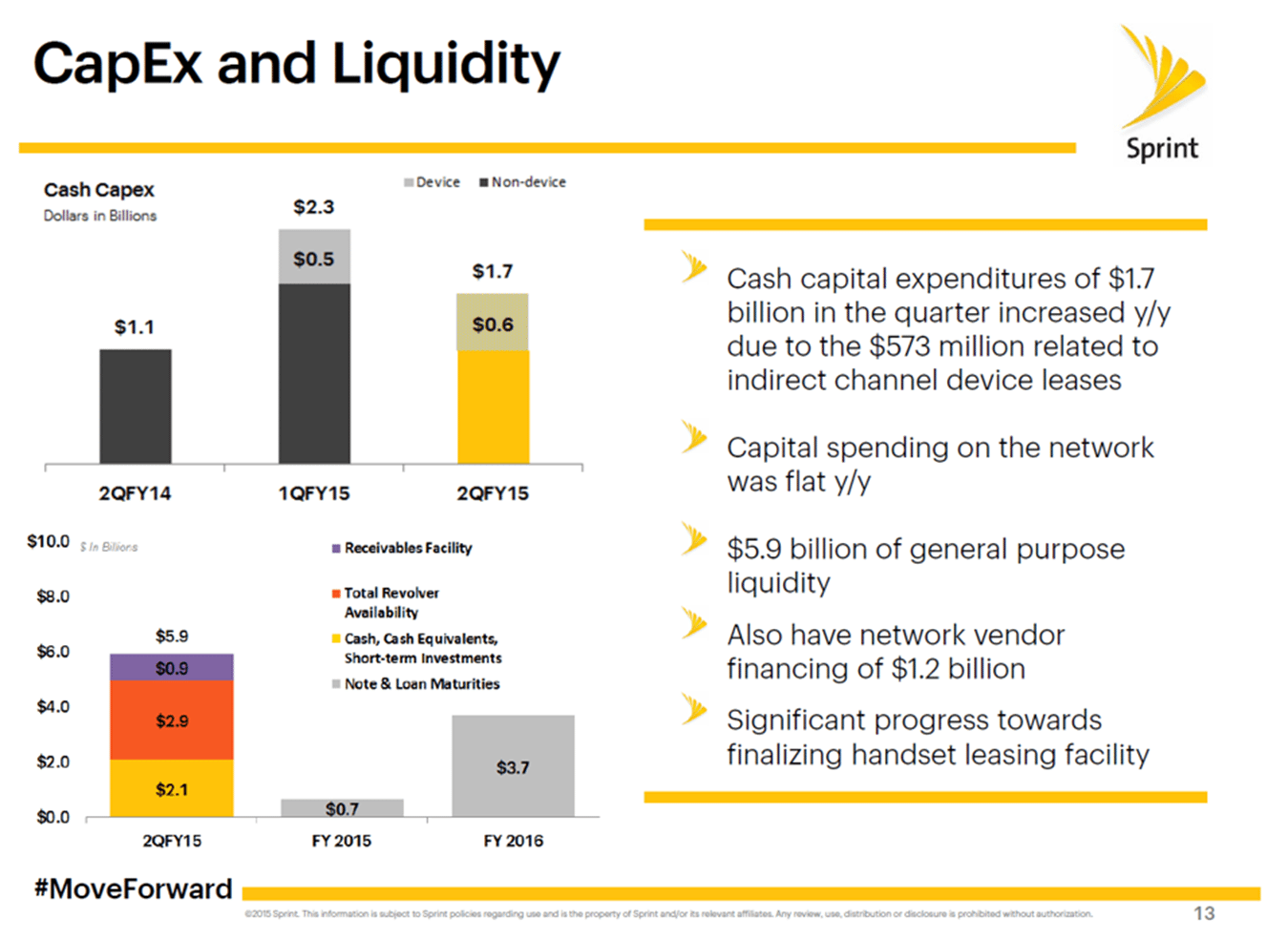

Sprint is not a debt-free company however, as the purchase of the Sprint and Nextel affiliates along with the costs of the Network Vision upgrade added over $18 billion of debt over the past decade (more here – see selected financial data on page 33). Sprint disclosed its near-term debt obligations in its earnings discussion. Over the next six months, $700 million of debt will either be repaid or refinanced. That figure jumps to $3.7 billion in fiscal-year 2016:

As he was presenting this slide, CFO Tarek Robbiati indicated the December quarter would likely involve a similar use of cash as the June quarter, when the company consumed $2 billion to further growth plans. If the expected leasing facility is delayed by more than a few weeks, Sprint’s near-term liquidity issues will reach an acute level just as customers enter its new stores for black Friday specials.

There is no doubt Sprint has made a lot of progress over the past year. Several questions remain, however, that challenge whether Sprint has any intrinsic equity value:

1. Can Sprint repay or refinance $4.4 billion worth of debt, pay $1.2 billion in restructuring costs and continue to grow the business? If it refinances, how will total cash interest be affected and what additional covenants will be placed on the company? How and/or will these covenants affect the forthcoming lease facility?

2. Will the (roughly $12) monthly payment difference between phone leasing and equipment installment plan purchasing attract customers away from Verizon Wireless and AT&T Mobility (see the differences in last month’s “Android World” write-up)?

3. How will Sprint market its carrier-aggregated network (except through Reddit posts like the one found here)? WWJLD (JL are the initials for T-Mobile US CEO John Legere)?

4. Can a “match T-Mobile US” strategy reduce Sprint’s total marketing spending? In the third quarter, Sprint introduced elimination of overages on family plans (throttling back to 2G speeds), incorporation of unlimited streaming music into select Virgin Mobile plans, Mexico/Canada calling plans, and the establishment and aggressive marketing of a 1 gigabyte high-speed level with extra data purchase options or throttling after that. Whether Sprint can ride T-Mobile US’ “Un-carrier X” wake is yet to be seen.

5. Can Sprint eliminate in-city or area roaming and retain high call quality? See here for Sprint’s Scranton and Harrisburg, Pa.; Ann Arbor, Mich.; and Madison, Wisc., second-half 2015 RootMetrics reports. Without voice roaming (on Verizon Wireless), can Sprint hold its call quality ratings? If not, does Sprint face greater concentration risk in larger metropolitan areas and in essence reduce itself to become a regional/metro-only carrier?

Theoretically, the value of any company equals the present value of total projected after-tax discounted cash flows (on a long-term basis) plus a terminal value (based on competitive differentiation and overall industry growth) minus the value of debt. Given Sprint’s current market value of $18 billion (and debt of $34 billion), the market (and the analysts who support institutional buyers) is currently assuming $52 billion of after-tax cash flows from Sprint. Even with rosy estimates, I cannot get close to this figure and will gladly open up this column to someone who can rationally explain a $52 billion case.

Sprint has new owners, a new “general manager” and an entirely new lineup, but it has fallen in the standings and is behind. Given four quarters of positive trajectory, can it turn base runners into runs? It will require a miracle not seen since the Kansas City Royals Game 4 division win against the Astros or 2014’s miracle hit in the wild card game against the Oakland Athletics. And, even if it wins more games (and I expect Sprint will post strong fourth-quarter results), can it win the series? If it can, it will overshadow the Royals comebacks of the past two seasons and draw a significant fan base of customers.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.