Is Sprint device leasing arrangement a competitive advantage?

Last Friday, Sprint announced a new leasing structure, which could provide the company with a global competitive advantage. Here’re the highlights of the structure:

1. Customers lease the latest and greatest phones from Sprint. Depending on the device and term, the lease could run $12 per month cheaper than a conventional equipment installment plan.

2. Sprint enters into a sale/leaseback agreement with to new company called Mobile Leasing Solutions. Part of the proceeds are held in reserve to cover nonpayment and other items (in the case of this transaction, it’s approximately 7.7% of the entire facility). This company is partially owned by Softbank, who also owns Sprint. Brightstar, also owned by Softbank, assisted in staffing and providing systems to Mobile Leasing Solutions.

3. Brightstar has the contract to distribute and remarket devices as they come off lease. Brightstar will keep the first $XX of profits (an unknown, but important number) per device remarketed. All profits above this number will go back to Sprint.

4. Foxconn (not owned by Softbank) has entered into an agreement with Brightstar to purchase the leased devices (note: Foxconn’s purchase price, as we will discuss below, is not necessarily the difference between the device’s original manufacturers suggested retail price and the cumulative payments. It is likely a fraction of this figure).

5. Using a third party in the lease transaction prevents Sprint from using a lease structure to improve their earnings before interest, taxes, interest and depreciation.

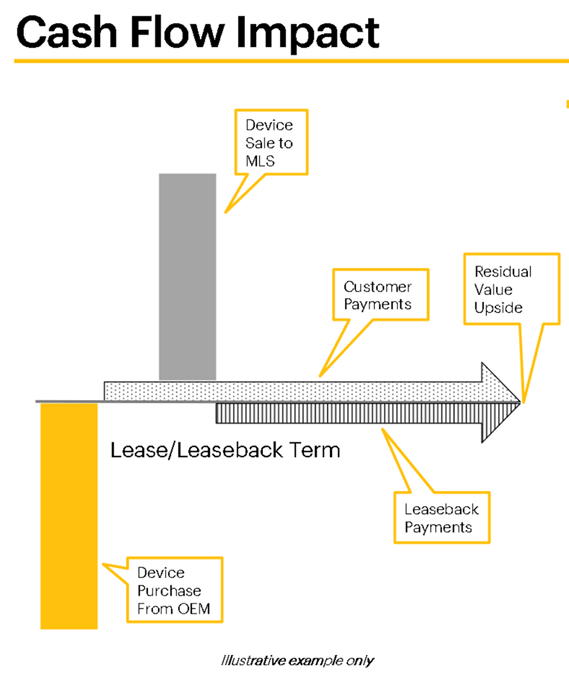

6. Most importantly, Sprint can use this financing structure to improve their short-term cash flow. Phone purchases represent the largest single cash expenditure for Sprint.

The question posed by many after the announcement was “how will this structure impact overall profitability (in this case, operating margin)?” Here’s an example to help you think through the transaction.

Example: Customer leases an Apple iPhone 6s for $15 per month for 22 months (regular lease price is $22 per month; total cost of phone is $650). The residual value of the device is $166 ($650 less 22 payments of $22). A traditional EIP option is also available at $27.09 per month for 24 months.

· If the contract were sold on the day the customer signed up and assuming the current terms of the contract were used ($1.3 billion in phone value, $1.1 billion immediate cash proceeds, $1.2 billion including holdbacks and other considerations), Sprint would have sold the device to MLS for roughly $600 (92.2% of $650). Another $50 or so would be held by MLS in abeyance until (some portion of) the lease payments have been made by the customer. Mobile Leasing Solutions now owns the device.

· Brightstar purchases the phone trade-in from Sprint for a pre-determined amount (this would be consistent with the commercial rates between the two companies). For purposes of this example, let’s assume that the purchase price is $154. Sprint receives cash and Brightstar receives all of the risk (and reward) of repurposing the trade-in. Sprint should have a deferred asset (prepaid expense) account for the difference between the lease and the sale price just as they do for their EIP (see next bullet point).

· Sprint passes on a $22 lease payment to MLS each month. Sprint records this as an equipment revenue with an offsetting lease expense. Sprint should have already recorded the discount between the $22 lease payment and the $15 sale price as a deferred asset when the trade-in was sold to Brightstar.

· Up to this point and throughout the lease payment process, there’s a $5.09 per month ($27.09 EIP price less $22 lease rate) advantage to the customer (and competitively for Sprint) from this financing vehicle versus a traditional EIP. The only time Sprint would enjoy an additional competitive advantage is when Verizon Wireless or AT&T Mobility’s receivables rate is lower than 7.7% (and the 7.7% assumes everything is paid on time).

· After the 22 months have passed, the customer could do several things. The most likely situation is that they exit the lease and enter a new lease on another device. At this point, MLS redistributes the device globally to the highest bigger through Brightstar (backed up by Foxconn if there are no buyers). Once this has happened, the lease facility can be replaced by another lease. Again, Sprint has no recourse at this point – the residual value risk is solely borne by MLS and Brightstar. Sprint does, however, have upside if the device value exceeds a certain rate.

· If the customer decides to buy the phone after the lease period has ended, MLS would take payment and neither Brightstar nor Foxconn would have any additional activities.

· If the customer continues to pay lease payments (presumably at $22 per month), the residual value would reflect the new total.

This financing structure works for devices where the projected residual value of the device is high. There are only a few devices that Sprint will offer for lease at any given time. For example, the iPhone 6, 6 Plus, and 5s are not available for lease today – only EIP. Same for the HTC M9 and Samsung Galaxy S5.

Bottom line: Sprint’s new leasing vehicle is interesting and definitely takes advantage of Softbank’s value chain ownership. It also provides Sprint some short-term incremental cash, both from the sale of the new phone contract and the value of the trade-in. It becomes a competitive advantage if Sprint can extend this construct to the broader line-up of devices (which seems highly risky); if Sprint can use the lease payment as a promotional tool (e.g., lower or no lease payments for the first three months); or if Sprint can improve the rate it receives for the lease contracts from 7.7%.

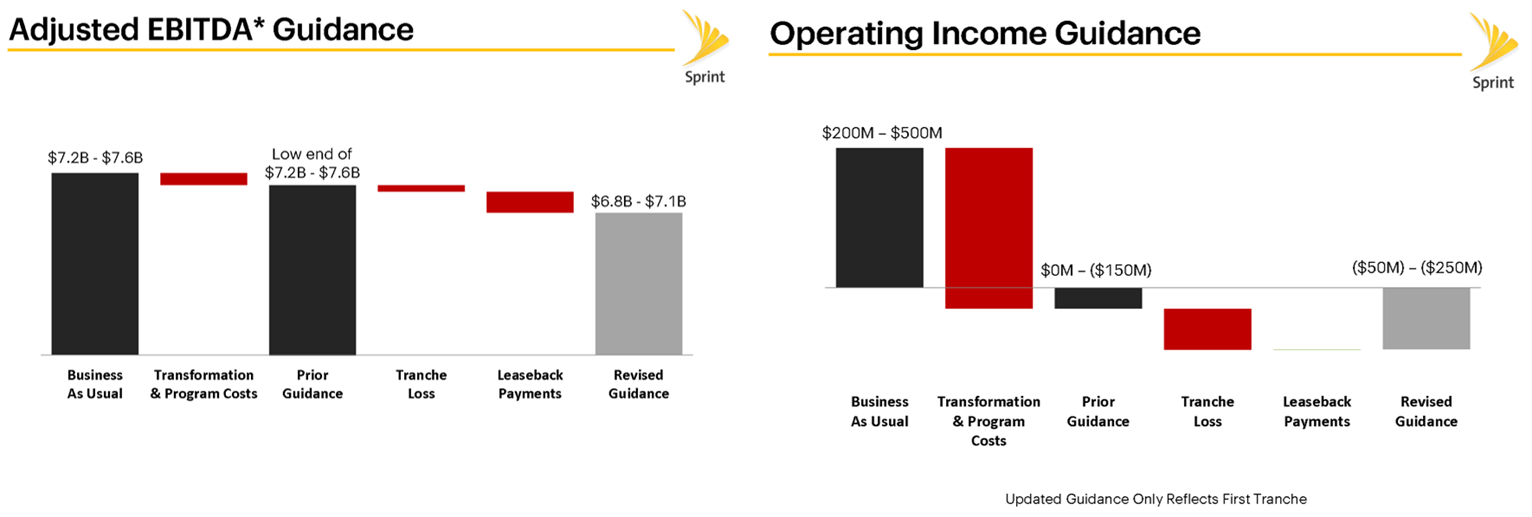

Of greater interest (pun intended) than the lease payment was the disclosure of the transformation costs and their effect on 2015 EBITDA and operating income. The charts below show the impact to earnings guidance:

Based on these charts, it appears that transformation and program costs will be in the $400 million to $450 million range. Not all of this is headcount, but if 60% of this figure is related to severance payments (of approximately $80,000 per separated employee), this appears to be a 3,000- to 3,400-person reduction in force. As we have stated in previous columns, the surgical removal of this amount of employees on the back of nearly eight years of cost containment under CEO Dan Hesse and CFOs Bob Brust/Joe Euteneuer is going to be very difficult (5-star Sudoku level). Inevitably, Sprint’s dealer relationships, front line retail relationships and customer service are going to be impacted. It’s also possible that there are some workforce responsibility changes/alignments as Sprint moves on to its next task: structuring its network leases.

Meanwhile, T-Mobile US continues to Binge On, Verizon Wireless continues its aggressive win-back/switching campaigns and AT&T bundles everything it can with DirecTV. The incentive auctions are just around the corner and 2016 is a Presidential election year. Sprint is involved in a dynamic industry in its quest to create a competitive advantage, and time is running out.

Four you may have missed

1. iPad Pro repositioning: it’s not a laptop substitute. There’s a lot of things going on with the iPad Pro launch and none of them are good. First, this article from CNet covering the supply chain constraints for the iPad Pro launch (a lot to read and absorb here). Second, while the tablet is generally available (32 GB Wi-Fi version with only a few days of backlog), the accompanying Apple Pencil and Apple Keyboard are delayed 4-5 weeks(!). Finally, reviews are mixed (see this one from Wired and this one from Engadget, which declares the latest device “not a laptop substitute”). It’s unclear what effect this will have on other iPad sales (likely little), but the iPad Pro is not off to a good start.

2. Binge On news continues. Computerworld ran a great article on how T-Mobile US’ adaptive bitrate technology works. We also recommend this Bloomberg article where Federal Communications Commission Chairman praises Binge On as “highly innovative and highly competitive.”

3. Great article on the formation of Verizon Wireless’ Go90 from Fierce Wireless. Caution: it’s lengthy, but terrific insights into the formation of their video service.

4. Our interview with Dan Meyer at RCR Wireless News. Part if our continuing effort to assist those suffering from insomnia. Full interview here – full dosage kicks in at 13:30.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.