Jim Patterson looks at his top 10 events across the telecom space in 2015

Last week, we highlighted the following top five events (in no particular order):

1. FCC approves the Open Internet Order

2. Verizon buys AOL and launches Go90

3. AT&T expands into Mexico

4. T-Mobile US’ unstoppable success

5. Nokia buys Alcatel-Lucent for $16.6 billion

The only real news update that relates to these five events is that Alphabet (aka Google) used The Wall Street Journal to voice their displeasure over YouTube’s Binge On treatment of their video streams (article here). At the heart of the issue is the question of T-Mobile US’ default treatment of Binge On data traffic to a 480p standard. Existing customers can opt out of this standard by logging into their My T-Mobile account and turning a clearly identifiable “on/off” switch to “off.” The “opt out vs. opt in” argument was reinforced by The Internet Association, whose members include Facebook, Google, Amazon.com and Netflix.

T-Mobile US has remained relatively tight-lipped on the issue other than to say there is a “technical problem” with the YouTube feeds. What they might think about saying is to some extent YouTube engages in throttling the customer experience already through their “auto” setting for video display. Although many/most feeds (e.g., the popular online show “Between Two Ferns”) are available at higher quality video feeds (1080p is a common speed), YouTube consistently shows videos at lower speeds (see screenshot from my Sprint phone of a “Between Two Ferns” episode. This was taken during an off-peak hour over Time Warner Cable’s network in Kansas City. Similar results were achieved over Sprint’s LTE network). Bottom line: YouTube (and other video streaming services) also engage in network throttling optimization practices before video streams reach the wireless carrier’s cell tower. Hopefully the Federal Communications Commission will see this issue in the same light and ask YouTube for the full details of their optimization practices and a customer impact assessment.

What this issue highlights is the fact wireless carriers continue to control the last mile. When one carrier seeks to create market differentiation using innovative transmission techniques and invites all video partners to be a part of the solution, they should participate. Google Music, which has substantially less market share for their category than YouTube does for video, did exactly that for T-Mobile US’ Music Freedom offering, and YouTube should embrace the money-saving solution that Binge On provides. In turn, both parties should work together to enable “on the fly” overrides for those times when 480p just won’t cut it.

Back to the list!

Comcast/Time Warner merger collapse triggers cable consolidation

The $45 billion merger collapse seems like a distant memory, but Comcast lobbyists continued to press for passage with restrictions up to the FCC announcement of a “hearing designation” in mid-April. With all indications pointing to a protracted fight with an administration/commission willing to use redefinition (e.g., redefining broadband speeds from 4 to 25 megabits per second) to achieve their desired ends, Comcast threw in the towel (see announcement here).

Both companies thrived throughout the merger period and in the months since the announcement of the breakup. Over the 18 months from Q2 2014 (merger announcement in Feb. 2014) to Q3 2015, Comcast has grown 1.6 million residential high-speed Internet customers, or an incremental 200 basis points of penetration of homes passed. Time Warner Cable, thanks to their MAXX rollouts in New York City and Los Angeles, has grown 260 basis points or 1.05 million customers over the same period. Meanwhile, Verizon Communications has gained 192,000 customers and AT&T has lost 670,000 broadband subscribers over the same six-quarter interval. Mergers usually result in weakness and the need for transformation – in the case of TWC and Comcast, they mourned for a day and moved on.

Slightly more than a month after one merger was called off, another was announced. This time, it was Charter’s turn to assemble a challenger to Comcast. Originally thought to close in 2015, it now appears likely it will come together in Q2 2016 (see this article from the Denver Business Journal on California Public Utility Commission hearings).

In addition to the Charter/Time Warner Cable/Bright House Networks merger, a foreign buyer in the form of Altice Communications appeared for both Suddenlink Communications and Cablevision. While the Suddenlink transaction was approved by the FCC with minimal revisions, recent reports indicate state and local approvals for the Cablevision acquisition are going to be harder and take longer than originally expected.

Frontier emerges as a wireline contender

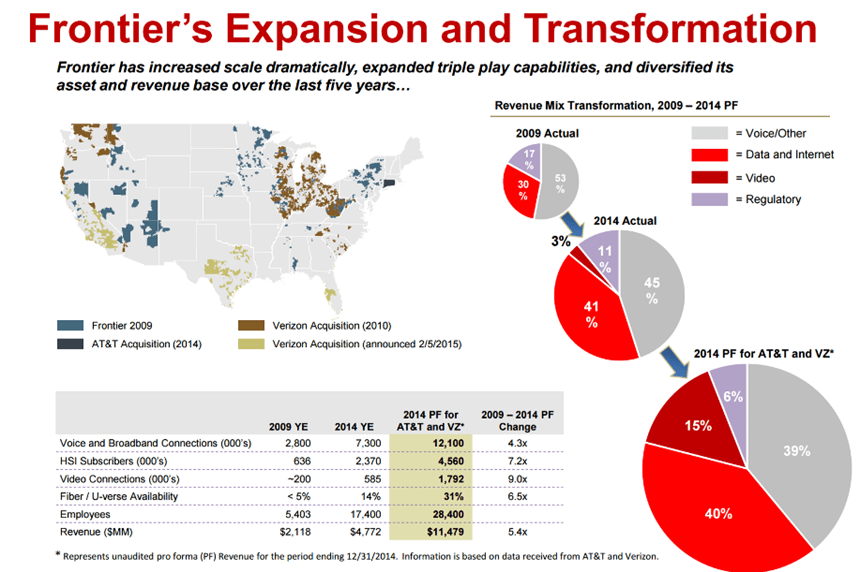

After looking at the previously mentioned high-speed Internet growth statistics (cable vs. DSL), many wonder whether anyone can challenge the cable industry on a broad scale. In 2015, Frontier Communications took additional steps to improve their position as a challenger when they announced they would double their size by buying Verizon’s California, Florida and Texas markets. This transaction was approved by the FCC in just over seven months.

Frontier’s footprint has expanded rapidly over the past decade, as the nearby picture shows. They have had healthy growth since acquiring AT&T’s Connecticut operations (57,000 high-speed Internet customers over the past two quarters; Frontier has had net additions for 11 consecutive quarters), largely as a result of more competitive pricing. As of the third quarter, the legacy (non-CT Frontier) HSI revenues were growing at a 2.7% clip, far from Comcast’s 10.2% or Time Warner Cable’s 9.8% growth rates, but higher than some others of their telco peers. They have accomplished this in the middle of a CEO change and a tougher AT&T Connecticut transition than anyone expected.

Frontier takes a more aggressive approach to incremental bandwidth pricing than most of their telco peers and this has helped them grow market share. Their approach to fiber-based services as a result of the Verizon properties acquisition establishes the company as a bandwidth-focused challenger. Look for increased capital deployments focused on growing broadband market share in 2016.

Apple’s iPhone 6s/6s Plus launch

Apple’s September announcement was significant in several ways. First, the 6s (Plus) represented a major upgrade to their 6 (Plus) predecessor without the “7” designation. As we detailed, and as Apple’s advertisements indicate, there were substantive changes to video and picture functionality. Second, these new models included significant network enhancements compared to T-Mobile US’ (700 MHz Band 12 inclusion) and Sprint’s (LTE 2.5 GHz/1.9 GHz/800 MHz carrier aggregation) networks. These changes continue to drive leasing and other promotional activity.

These two changes are important to Apple’s competitiveness within the current U.S. wireless carrier market. However, as we highlighted in the link above, the biggest change was Apple’s lease offer. Apple includes Apple Care and an annual upgrade in their lease.

Given the high degree of iPhone promotional activity by at least three of the four national wireless carriers in the fourth quarter (the latest being AT&T’s “buy one/give one” iPhone offer), it will be difficult to see the immediate impact of Apple’s “carrier neutral” offer. After the promotions have ended, the Apple offer will still be in place and their carrier neutrality will be attractive to many customers (and likely helpful to Sprint and T-Mobile US with lower market shares). It’s one of many 2016 trends we will be watching.

Verizon Wireless’ plan simplification

In August, Verizon Wireless announced they were scrapping contracts and phone subsidies and moving to a simplified pricing plan structure. Using a “S/M/L/XL/XXL” structure (each having increasingly larger data allocations) and a flat $20 fee per smartphone for unlimited voice and text, the plans were accompanied by easy to understand advertising (see nearby fruit size visual).

One might have expected some disruption with such a major change. To the surprise of many, however, Verizon Wireless actually posted higher gross and net additions as well as lower churn on a year-over-year basis in their third quarter results.

Their new structure leaves open many promotional levers (monthly phone payment, additional data allocations, even free/sponsored app usage) without creating a lot of confusion with store employees and authorized agents. Given the size of Verizon Wireless’ customer base, their retail pivot is top 10 worthy.

Sprint’s transformation

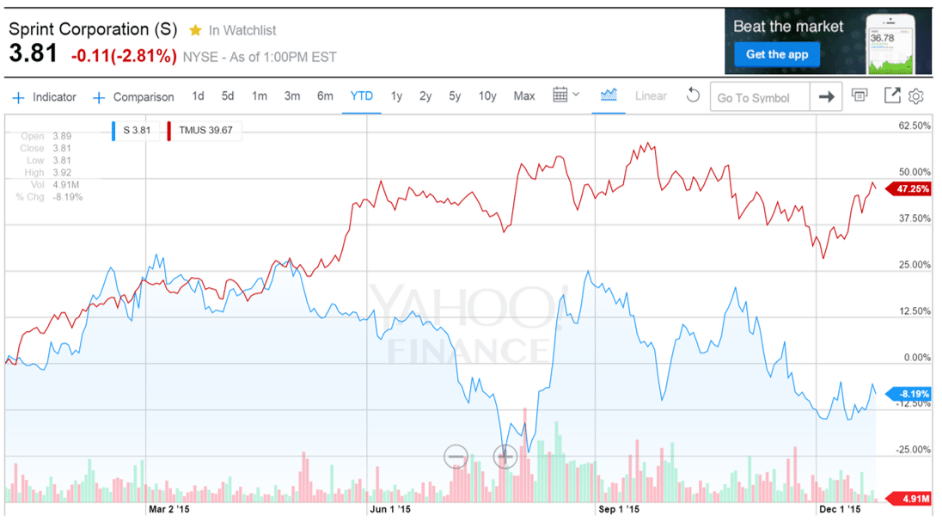

Although the nearby stock price comparison (to T-Mobile US) does not reflect Sprint’s anticipated fourth quarter net add improvements, the Kansas City-based company is eager to let everyone know they are on the mend and a contender. Postpaid monthly churn has fallen year-over-year from 2.18% to 1.54%. Total retail postpaid net additions have grown by just over 1.1 million (nearly all of this is tablets).

With greater revenue and customer stability in hand, Sprint’s immediate focus is to cut $2 billion (or more) in costs by the end of 2016. Driving this is the need to repay $4.3 billion in debt by August 2017 (a good summary of their debt schedule courtesy of Morningstar can be found here). How Sprint will cut costs remains unclear – in a recent investor Q&A, CFO Tarek Robbiati implied they would be balanced between headcount and operating costs such as roaming (it is unclear how Sprint would balance inevitable churn increases with a shrunken footprint and/or longer wait times to resolve customer service issues).

What is clear is Sprint’s upgraded voice and text networks are as strong as ever thanks to increased deployment of 800 MHz spectrum and network adjustments made in 2014 and 2015 in conjunction with Network Vision. Whether a strong voice and text core will rejuvenate phone gross additions is unknown, but Sprint has an opportunity to combine the benefits of carrier aggregation and voice quality to achieve market share gains in 2016.

Their competition is not standing still, however, and Sprint cannot achieve their profitability objectives with a perpetual “half off” sale. Verizon Wireless and AT&T Mobility are also cutting costs, and T-Mobile US has adopted Sprint’s leasing plan. This is Sprint’s year to build customer, employee and investor confidence, and success cannot come soon enough.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.