As most of you will agree, 2015 was a mixed year at best for the telecom industry. Wireless subscriber growth (especially for higher average revenue per user smartphones) slowed, but housing showed signs of recovery, which increased homes passed and high-speed Internet connection opportunities. The scope of regulatory reach was much smaller than most anticipated, yet uncertainty remains for businesses and carriers alike. The stock market was flat, but so was the cost of borrowing. Mixed just seems like the right word.

This week’s column will touch on two topics – public company equity value creation, and the upcoming Consumer Electronics Show. In other words, a look back and also a (long) look forward.

Who created value in 2016 (and why)?

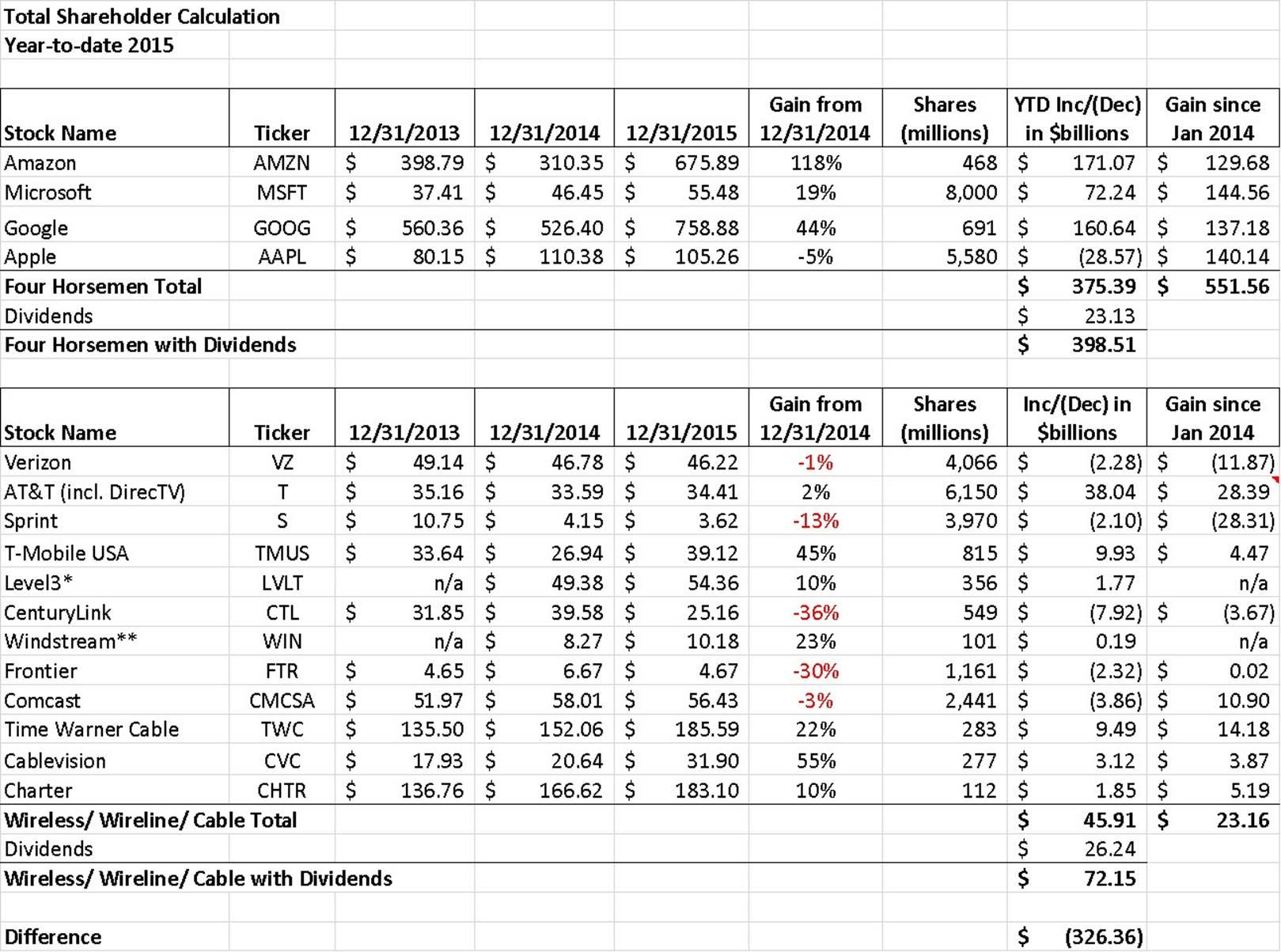

Below is the chart we have been using for some time to track who is creating value. While the purpose of this chart is not to precisely identify the exact amounts of value created, it does provide some indication about who is headed in which direction. Here’s the latest snapshot:

Of biggest note is Apple’s decline in overall market value in 2015. This loss is somewhat offset by Apple’s dividend ($12 billion), but also could have been worse had Apple not repurchased approximately $13 billion (120 million shares) in stock. Investors need not worry about Apple’s liquidity, however, as they still have around $150 billion in negative net debt (total debt less cash and marketable securities).

While Apple was marking time, Amazon.com, Microsoft and Google/Alphabet were racing to grow their presence in cloud services. Amazon appeared to have been the big winner in 2015, with total equity value up 118% and an ending market capitalization of $317 billion (Amazon’s equity market cap is now $120 billion more than Wal-Mart and $180 billion more than IBM). While many will argue Amazon’s logistical improvements are driving increased value in the stock, last year’s gain was more than likely due to the gains made from Amazon Web Service.

With dividends, the “Four Horsemen” added just under $400 billion in value last year (as a reminder, the Dow Industrial Average and S&P 500 were both down in 2015). Including the “Fifth Horseman” (Facebook was not public in 2010 when we started tracking value creation), they are closer to $460 billion … in one year.

Meanwhile, the telecom industry had a flat to down year for equity values. Most of AT&T’s value creation came from issuing new shares to acquire DirecTV in August (around $34 billion). Without this share issuance and T-Mobile US’ gain, which came as a result of organic growth and outstanding management, the industry as a whole would have been close to negative ($44 billion of the $46 billion in equity market value increase was due to these two events).

Interestingly, Time Warner Cable, who is in the process of being acquired by Comcast Charter, continued to increase in value, rising another 22% or $9.5 billion in value. While many of us scratched our heads when John Malone’s Liberty Media Group took a 27% stake in Charter Communications at $95.50 per share in March 2013, it has turned out to be one of the best investments of this decade, having produced a paper gain of over $2.6 billion for Liberty in less than three years.

Meanwhile, CenturyLink and Sprint combined for close to $10 billion in equity losses in 2015 and $32 billion over the past two years. While most expect Sprint to operationally recover in 2016, financial (balance sheet) recovery may take considerably longer as the company works through some hefty debt repayments.

The traditional telecom industry (and their partners such as IBM and Accenture) is losing to new entrants at a rapid rate – first in applications, then in voice-over-Internet protocol and managed hosting, and now in cloud services. This is not a one-time event, but a multi-year run as many long-time readers can attest. Wireless services have produced tens of billions of dollars in value, but that pales in comparison to the value created over the last decade by Facebook, WhatsApp, Skype, YouTube, Chrome, Android, iOS and iTunes. Verizon Communications is trying to stem the flow through Go90 (see milestone achievement here), but there need to be many more innovations to reverse the current trend.

Why CES is (still) important

I have talked to many of you about attending CES this year, and to my surprise have found some regular attendees choosing to stay home and monitor the event through social media. While it’s a logistical challenge, CES is still very relevant to those in the telecom and Internet industries. Here’s why:

The best conversations (both on and off the floor) happen at CES

I have had more meaningful conversations about the future of the telecom industry at CES than at the Cable Show or CTIA – combined. Cost/scale points, product feasibility and customer demand all come together at CES. The topic could be e-readers (is there room for more than one Kindle provider?), or adoption of 3D TV technology (with or without glasses), or app-enabling automobiles (can the on-board diagnostic port be used to power an in-car Wi-Fi system?), or even extending battery lives in all electronics (multiple radios, application optimization, lower power chipset timelines, etc.). All of these conversations have taken place at CES.

You will always learn something new at CES, if you plan

I spend a lot of time reading up on who will be speaking and exhibiting at CES. Last year I learned a lot about drone technology. This year I want to learn more about speech recognition and its effect on robotic movements. If I had the time and energy I could probably learn a lot about the buying habits of expectant mothers as “baby _______” meets the “Internet of Things” (see my friends at VersaMe for a good example of where that’s headed). But you have to plan – the show is too big to count on a spontaneous epiphany.

CES provides a glimpse into the intersection of networks and devices like no other show

If you go to www.mysundaybrief.com (the full archive of my “Sunday Brief” articles), the masthead reads “Connecting technology, communications and the Internet.” Understanding how things interface with each other is critical. Two quick points to think about:

–Attendees will learn a lot more about a derivative 4K broadcast transmission standard called Ultra HD. It took a long time for UHD to establish itself as the standard, but this is the year. Combine UHD with the display of high dynamic range content, and picture quality and richness improves with the same reactions as when high definition was first introduced. More on the standards in an easy to understand format from Techradar here, and good video explaining the benefits of HDR is found at the bottom of this article.

–Interconnection within the home is still searching for a standard. Bluetooth Low Energy, Wi-Fi, ZWave and Zigbee are all competing to be the transmission standard from appliances and other “Internet of home” devices. One of the drawbacks of Bluetooth was its low range (any of us with fitness bands and smartphones in nearby rooms can attest to that). The standards group over at Bluetooth is seeking to remedy this in their upcoming Bluetooth 4.0+ standard (a.k.a., Bluetooth Smart or Bluetooth Low Energy) with more than four times the reach of the current version. More reach and a bit more intelligence could also enable mesh networking, allowing some IoH devices the ability to serve as access points for compatible Bluetooth 4.0 transmissions. More hubs equals greater reach equals greater competitiveness against Wi-Fi.

For those of us who like to look and touch what’s new, but don’t necessarily have the money (or space) to buy, CES provides the ultimate playground. Beyond the sizzle and flair, however, there are big bets being placed on companies and standards that exhibit at CES. Because this first-of-the-year trade show draws broad audiences, which in turn stimulate broader conversations, it should not be missed.

That said, here’re five questions I am hoping to see answered at the show:

1. What is GoPro going to do with drones? See GoPro Dronecopter footage here.

2. Will Netflix CEO Reed Hastings tip his hat on 4K transmission plans in his keynote address?

3. Electric cars are now cool. Can China make them even cooler (and cheaper)? More here.

4. Can more real-time information help infant development (and can it be drool proof)? Expect to see a lot of baby tech at this year’s show (here’s a link to one of the many panels on the topic).

5. Who will win the smart home controller market – Samsung (through the TV – more here), Google (through their Wi-Fi router called OnHub – more here), LG (new controller here), or Apple? Does this matter?

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.