How did we end up here? A history lesson

In the beginning, there were six global wireless radio access network equipment vendors: Alcatel, Ericsson, Lucent Technologies, Motorola, Nokia and Nortel Networks. Subsequently in the mid-2000s, the emergence of the Chinese vendors to support TD-SCDMA for China Mobile added several players to the mix including Huawei Technologies, ZTE and Datang Telecom. Samsung Electronics also began to expand its reach outside its native market of South Korea for 3G W-CDMA base stations. The world was getting crowded and the domestic Chinese market was given to the Chinese OEMs.

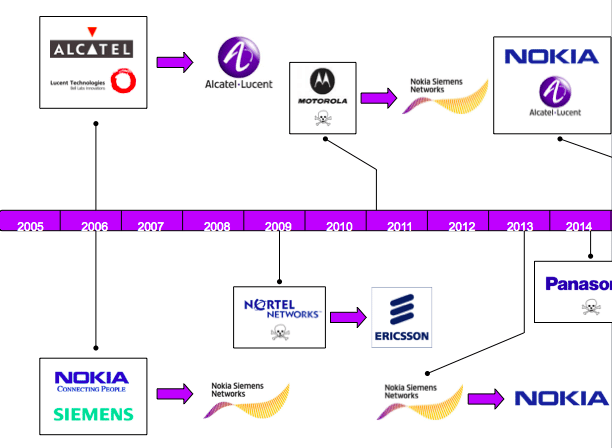

2006 was the year of the “great telecom consolidation” event, which saw four multinational telecom equipment suppliers merge into two. The announcements of both Alcatel S.A. merging with Lucent Technologies and Nokia Networks merging with Siemen’s telecom networks business were watershed events within the industry. There wasn’t enough business and profits to keep all of the players alive. The wireless OEM landscape was beginning to shrink.

Additionally, the emergence of WiMAX in 2001 started the drive towards the development of “4G” technology and the battle between the WiMAX and LTE standards. It is obvious who won the battle. However, some of the above mentioned companies made a strategic mistake in betting on WiMAX and not also in LTE. Those decisions essentially wiped out their global wireless telecom footprints. These companies were Alcatel-Lucent, Motorola and Nortel Networks. To be fair, Huawei Technologies and ZTE also chose to support WiMAX, but in parallel developed LTE.

By 2009, Nortel Networks became the first casualty, declaring bankruptcy and ending 115 years of operations for the company. Ericsson performed a coup by beating out Nokia Siemens Networks to gain control of Nortel’s GSM and CDMA businesses. By 2011, Motorola became the next casualty as its wireless networking group was acquired by Nokia Siemens Networks, reducing the field of players to five major OEMs. In 2013, Nokia bought out the remaining portion of Nokia Siemens Networks from Siemens and changed the name back to its original Nokia Networks. In 2014, Nokia again was involved in consolidating the market by purchasing the wireless network business from Panasonic System Networks Co. The shopping spree has culminated with the purchase of Alcatel-Lucent, announced in 2015, which has effectively joined the wireless networking businesses of six OEMs over the past 10 years.

Wireless Network OEM Consolidation Timeline

Source: EJL Wireless Research LLC (January 2016)

From a wireless perspective, what can the market expect from the “new” Nokia? The three areas of interest are:

Mobile backhaul

Mobile base stations

Mobile core network

From the Alcatel-Lucent side, the microwave packet radios product segment is part of the IP Transport Group while the mobile base stations and core networking product segments are under the Access Group. The small cells product portfolio is also embedded within the Access Group.

From the Nokia Networks side, the microwave group was acquired by DragonWave in 2011. The mobile base station and core network products are the two product segments within Nokia Networks.

So what does the combination of these assets look like in three to five years?

Given Nokia’s divestiture of the microwave business in 2011, it is plausible that the microwave business acquired from Alcatel-Lucent will also be divested. The issue is to who or by whom?

It is our opinion that DragonWave is financially unable to raise funds or to issue stock that would cover the potential acquisition price of the microwave radio business. The current Nokia Microwave Transport Partner Ecosystem includes Alcatel-Lucent, NEC, SIAE Microelettronica and Tarana Wireless. Given that the Alcatel-Lucent portfolio will now be owned by Nokia Networks, the only logical conclusion would be that one of the remaining transport partners buys the Alcatel-Lucent product line with a term period commitment to purchase products. Or Nokia could divest the product line to a private equity firm.

Should an ecosystem partner step up to the plate, we believe that it would be either NEC or SIAE Microelettronica as Tarana Wireless is still a startup company. SIAE purchased the research and development activity for the 1850 TSS product family of optical multi-service node platforms in 2014. It is possible that SIAE could come up with the funds to purchase the microwave transport group but the valuation remains undetermined. NEC Corporation is financially much larger than SIAE and could afford to purchase the group, but again the valuation and price would be a key factor. Since both NEC and SIAE are top five microwave radio transport suppliers, the addition of the Alcatel-Lucent microwave business would provide a significant bump in market share. With 2014 revenues of $461 million and nine month 2015 revenues of $250 million (down 23% year-over-year), we would expect a valuation of 1x revenues to be a starting point for negotiations.

For the radio access side, the Nokia Networks Flexi Multiradio 10 Base Station platform is a market leading solution and the only solution supporting a three sector remote radio unit architecture. The equivalent Alcatel-Lucent 9xxx base station platform brings some innovative features, but its market share and geographical footprint isn’t large enough for Nokia to eject its Flexi product and go with the 9xxx platform. We believe Nokia will slowly merge the features of the 9xxx into its next-generation Multiradio solution and replace/upgrade existing 9xxx mobile operator customers with the solution. The timeline for such a convergence will be much longer than the timeline for the microwave radio transport business.

For the wireless evolved packet core network segment, we believe Alcatel-Lucent’s technology and portfolio would integrate well into the existing EPC offered by Nokia. Given the significant wins in North America by Alcatel-Lucent for the EPC slot, it would be difficult to end of life the solution in the near term. The convergence of the EPC portfolios is also going to be a long road ahead.

For small cells and in-building solutions, even though the Nokia Picocell solution offers macrocell capacity, Alcatel-Lucent’s LightRadio and Metrocell products have garnered a larger footprint. We believe that the Picocell solution will either be a casualty or will be merged into the current LightRadio portfolio.

EJL Wireless Research recently published a market analysis and forecast on the global macro BTS antenna industry. The overall market grew 49% in revenues to $4 billion in 2014, with Tier 1 suppliers commanding a 41% market share.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.