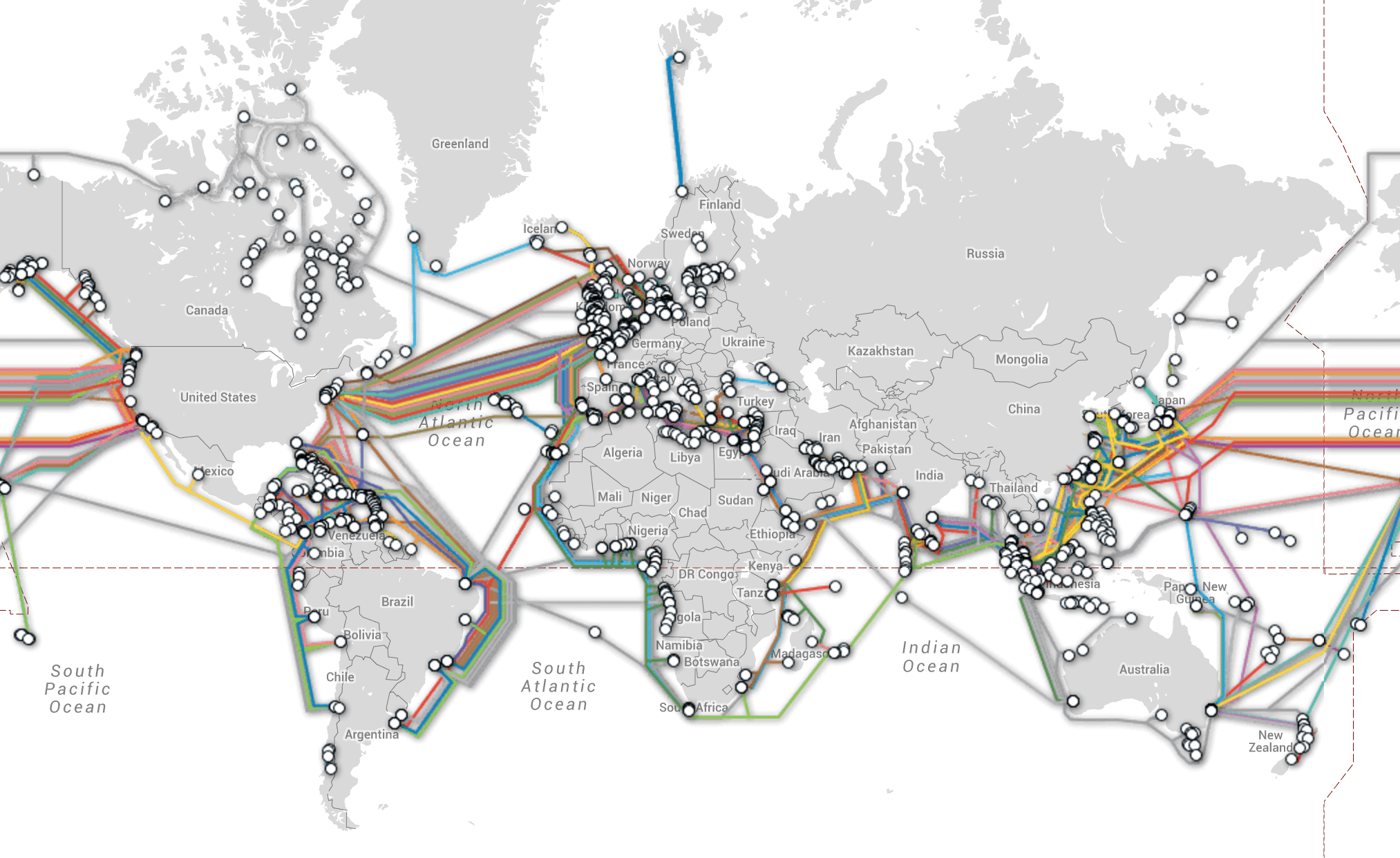

Continents, cultures linked by subsea fiber optic networks

The world is becoming an increasingly connected place. In this wireless world it’s easy to forget all these connections require hundreds of thousands of kilometers of fiber optic cable to carry terabytes of data across the world’s oceans. Subsea fiber optic networks are responsible for the transmission of 90% of the world’s international data. These underwater fiber optic cables traverse terrain as deep as Mount Everest to deliver valuable information between countries and continents.

The past and present

The period between the late 1980s and 2014 saw $57.2 billion invested in 1.275 million kilometers of fiber optic submarine networks, according to a 2104 Submarine Telecoms Industry Report authored by Terabit Consulting. During that time the industry experienced its ups and downs, but remained profitable. In the quarter-century since the advent of transoceanic fiber optic systems, the market has averaged 50,000 kilometers of fiber deployed and $2.2 billion in investments each year.

The subsea fiber optic network industry had its most volatile period during the dot-com bubble days, expanding and eventually bursting with the rest of the tech industry. From 1999 to 2002, the industry exploded, reaching its peak in 2001 in which it was worth nearly $12 billion; that is more than double any other year. After the dot-com bubble burst, the industry saw a period of dormancy, averaging less than $1 billion in investments from 2003 to 2007. The industry began its recovery in 2008 and has hovered around the $2 billion mark since.

Over the lifetime of the industry, carriers or consortiums of carriers have led the way with regards to investment. From 1987 to 2014, carriers and consortiums made up 73% of overall investments with private investors accounting for 21%. Between 2010 and 2014, carriers and consortiums increased their dominance, providing 83% of industry investment. Over this same time period, private investment has decreased greatly, losing one-third of its market share while government and bank investment grew from 1% to 9%.

Historically, the subsea fiber optic supplier market has been dominated by three groups: Alcatel-Lucent and its predecessors TE SubCom, and the Japanese supply community. From 2004 to 2014, Alcatel-Lucent supplied 47% of the fiber for new systems, TE SubCom accounted for 30% and NEC owned a 12% market share. Other major companies supplying the rest of the new fiber optic systems include Hitachi, Huawei and Ericsson.

In 2008, Huawei Marine Networks burst on the scene with a new technology, fueling growth and disrupting the industry.

“The company’s initial entry into the market was aggressive and it was accused of ‘buying market share’ by submitting low-cost bids for new projects,” the report said. “Huawei’s development of repeater technology positioned it as a viable competitor against the established suppliers, but its dependence on others for the manufacture of fiber optic cable has proven to be a significant challenge.”

The Asia-Pacific region is also seeing a different kind of investment directly from Internet companies.

“Unlike the transatlantic route where Internet giants have for the most part refrained from direct investment in infrastructure and instead chosen to purchase capacity from operators, the Asia-Pacific region is increasingly becoming a target for direct investment in submarine infrastructure by the likes of Google, Facebook and Microsoft,” the Submarine Telecoms Industry Report said. China Telecom and China Mobile are also major investors in the region, helping grow capacity by 35.4% from 2007 to 2013. Chinese bandwidth alone has grown by 62% over a 10 year period from 2003 to 2013.

A main driver of growth for the industry continues to be technology and capacity upgrades, particularly in the transatlantic region, which is generally where new technology is first implemented. The study claims “the major drivers of transatlantic cables’ longevity have been advancements in upgrade technology, which correspond precisely to the 6,500-kilometer range of transatlantic spans, combined with extremely competitive pricing of both transatlantic capacity and managed bandwidth products, both of which have thus far eliminated any incentive for operators and content providers to opt for building over buying.”

The first transatlantic fiber optic cable networks were made up of the TAT-8 cable, which is compromised of three pairs of fiber, two of which move in opposite directions while the other is used as a backup. These early cables were only able to carry 20 megabits per second across the network. The most recent iteration of fiber optic cable technology is the 100G cable, which in 2014 reached 7.2 terabits per second in a field trial conducted by Alcatel-Lucent and Apollo.

The future

While the industry will probably never reach its $10 billion peak again, the future still looks bright for investors, operators, manufacturers and customers. The Terabit Consulting report identified 160 new projects with a total value of $22.6 billion slated for 2015 and beyond.

“Having learned from the not-so-distant past, the submarine communications industry is one that is well-informed, innovative and versatile, implementing practical solutions in a marketplace that has proven to be increasingly demanding in terms of connectivity, reliability and cost-effectiveness,” the report concluded.

Continued advancements in fiber optic technology with a focus on capacity and affordability is expected to play a vital role in the future growth of the industry. The report says, “with the industry in the process of implementing 100-gigabit wavelengths across nearly all of its transoceanic routes, a new era of connectivity-based development may be imminent.”

The 100G cable is a good jumping off point given its cost effectiveness and 8 to 10 terabyte capacity, but that is just the beginning. According to Terabit Consulting, “successful trials of long-haul 400G wavelengths were held in 2014, and most suppliers expect terabit wavelengths to be commercially available within a few years.”

Beyond that, researchers are already working on the next generation of fiber optic technology. Extreme Tech reported in October 2014 a group of researchers smashed the world speed record for a fiber network pushing 255 terabits per second down a single strand of glass fiber.

But is there still room for growth with only 15 of the world’s countries and territories still lacking international fiber connections? Even if new builds stop, upgrades and repairs will continue. Submarine cables are predicted to have a life expectancy of approximately 25 years before they can no longer keep up with capacity, which means there will always be a need for replacement and repairs.

In recent years, the industry has made strides in the expensive and complicated process of subsea fiber repair. Companies are now using specialized robots for shallow water repairs and specially designed “grapnels” to hoist cable during deep sea repairs.

Another issue the industry faces moving forward is spying. Tapping of undersea cables has become a common practice of intelligence gathering organizations. The cables are also vulnerable to network sabotage. Those looking to wipe out international communications can damage the line to wreak havoc on network performance. In 2013, divers near Egypt snipped the South-East-Asia-Middle-East-West-Europe 4 cable, which runs 12,500 miles and connects three continents, causing a 60% decrease in Internet speeds.

In September 2015, the Federal Communication Commission passed regulations to “help safeguard this critical communications infrastructure and promote reliable communications for businesses and consumers.” The new rules established a outage reporting system to help regulators take action to prevent outages that could be a public-safety hazard, or a threat to national security.

For more information, check out this list of 10 facts about subsea fiber optic networks.