VC investments and M&A activity topped $600 million across NFV and SDN space last year

Venture capital funding is increasingly finding its way into the virtualized software space, with firms specializing in network functions virtualization and software-defined networking garnering hundreds of millions of dollars in capital over the past year.

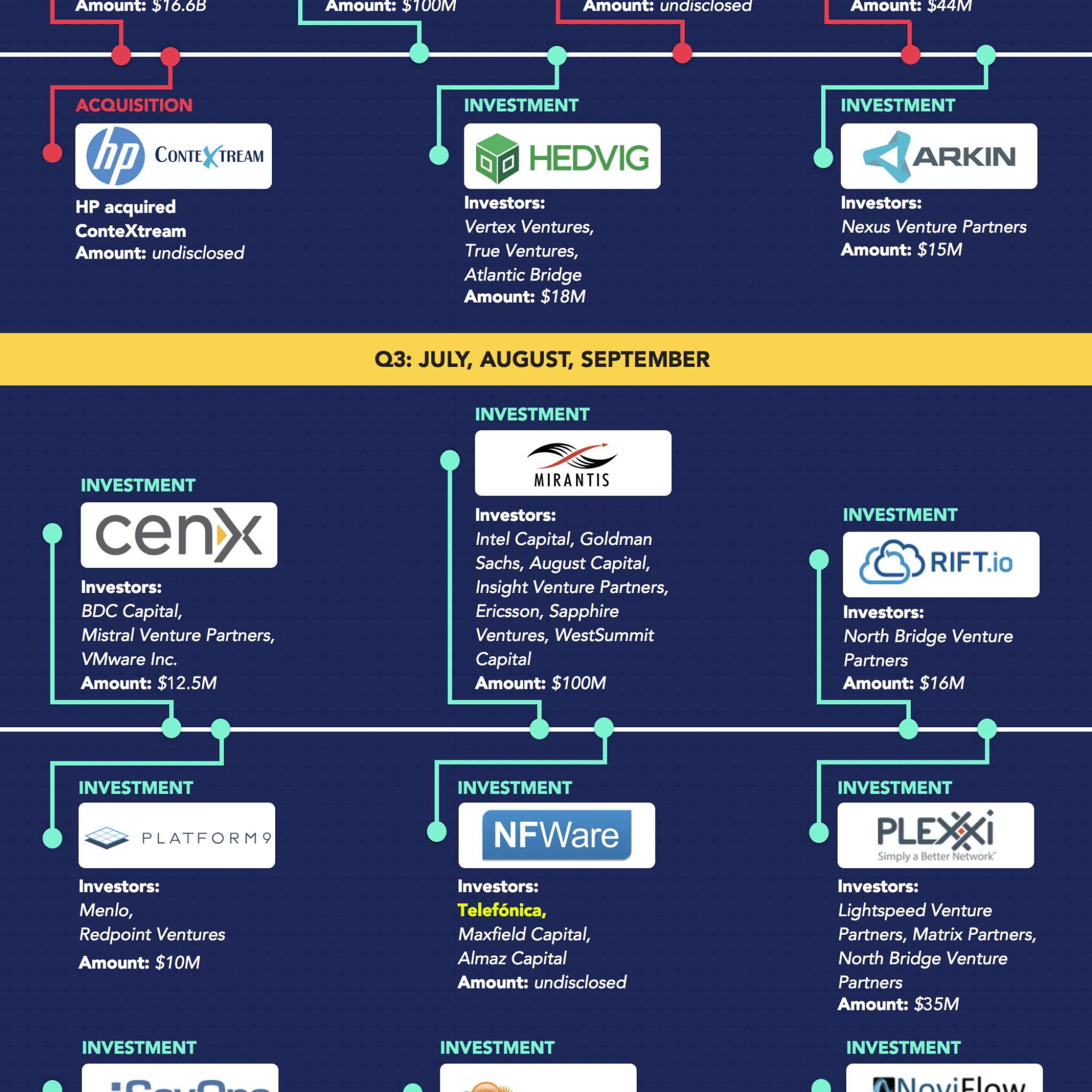

According to information from vendor NFWare, more than $600 million was invested last year in SDN and NFV startups. The market also began to witness consolidation efforts that are further reshaping the market.

Some of the larger reported investments included $110 million into CloudFlare, from the likes of Google, Microsoft and Baidu; $100 million into Illumio, which provides security solutions targeting data centers and cloud deployments; and $100 million into Mirantis from investors Intel Capital, Goldman Sachs and Ericsson, among others.

In terms of mergers and acquisitions, Hewlett-Packard last year snapped up ConteXtream for an undisclosed amount in a move to bolster its NFV focus; Cisco purchased Embrane, a lifecycle management platform for application-centric network services such as firewalls/VPNs and load balancers; and Fortinet acquired Meru Networks for $44 million.

Market activity has continued this year, with ADVA last week announcing plans to acquire Overture Networks for an undisclosed amount. The deal is set to boost ADVA’s cloud and NFV business, and combines two of the market’s largest carrier Ethernet access equipment makers, with Overture’s assets bolstering ADVA’s FSP 150 product line with an Ethernet-over-copper solution, a programmable white-box network interface device, a virtualized NID and an end-to-end orchestration solution.

Bored? Why not follow me on Twitter