Is it three or two?

With the acquisition of Alcatel-Lucent now completed at Nokia, we believe that a review of the RAN market share for the combined new company is in order. We will have our updated 2015 radio transceiver (TRx) and base station market share analysis updated over the next few months.

Note: We define a base station as a BTS for 2G (GSM), NodeB for 3G (W-CDMA) and eNodeB for 4G (LTE). We define a radio transceiver (TRx) as being a transmit/receive path combination. A remote radio unit (RRU) contains multiple radio transceivers (TRx) in different MIMO configurations, typically with 1T2R, 2T2R, 2T4R, 4T4R or 8T8R for 3G and 4G multi-mode systems.

Base Station Market Share Analysis

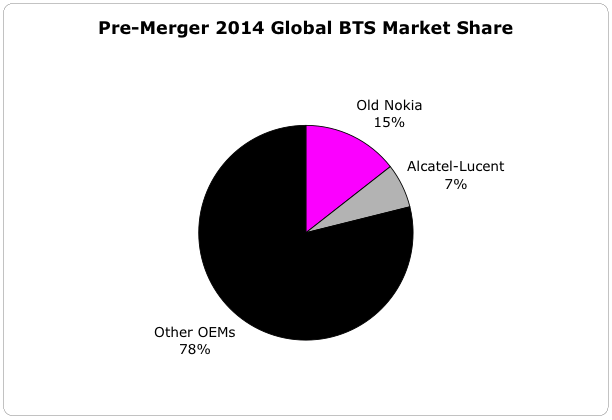

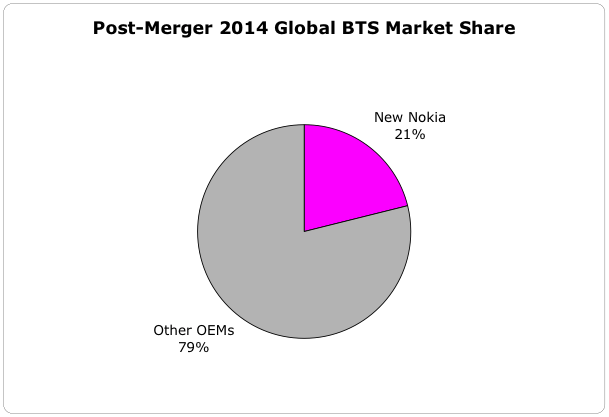

On a stand-alone basis, Nokia was ranked fourth globally for base stations shipped in 2014 and Alcatel-Lucent was ranked fifth. The combined company would have moved up to third worldwide in our rankings for 2014. With respect to LTE technology (TDD+FDD), Nokia was ranked fourth worldwide and Alcatel-Lucent was ranked sixth with the combined company again moving up to third overall in 2014.

Source: EJL Wireless Research, January 2016

Source: EJL Wireless Research, January 2016

Radio Transceiver Market Analysis

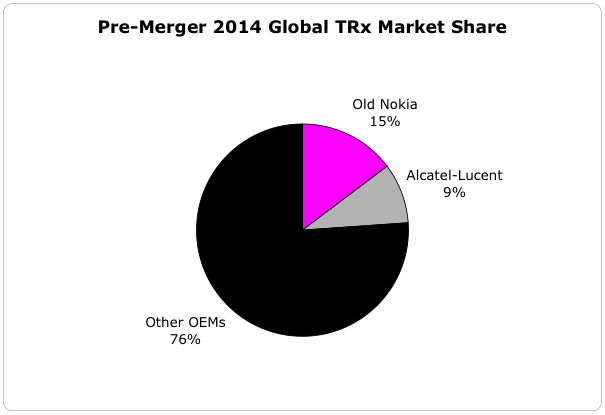

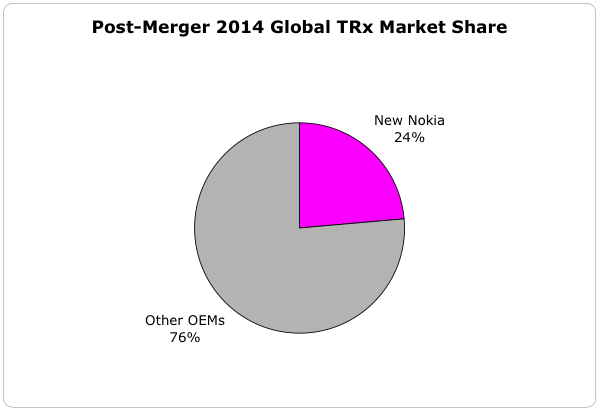

On a stand-alone basis, Nokia was ranked third globally for radio transceivers shipped in 2014 and Alcatel-Lucent was ranked fifth. The combined company would have moved up to second worldwide in our rankings for 2014. With respect to LTE technology (TDD+FDD), Nokia was ranked third worldwide and Alcatel-Lucent was ranked fifth with the combined company again moving up to second overall in 2014.

Source: EJL Wireless Research, January 2016

Source: EJL Wireless Research, January 2016

North American Mobile Operator Market Share

Historically, Nokia has been weak in North America. It is a supplier for RAN equipment to Sprint, T-Mobile and US Cellular but not to either AT&T Wireless or Verizon Wireless. With Alcatel-Lucent being a supplier to AT&T Wireless, Verizon Wireless and Sprint, the completion of the merger changes this and elevates Nokia as a major supplier with substantial market share at with all four national mobile operators in the United States. For Canada, Nokia has been a supplier to both Bell Mobility and TELUS while Alcatel-Lucent is a supplier to TELUS. The combination also increases Nokia’s RAN market share in Canada.

China Mobile Operator Market Share

Given the fact that Alcatel-Lucent Shanghai Bell (ASB) is a domestic Chinese entity, it has been a major supplier for LTE network deployments to all three mobile operators in China and has captured more market share than its foreign OEM competitors (Ericsson, Nokia, and Samsung). The acquisition of Alcatel-Lucent by Nokia only increases the domestic Chinese market share opportunity for the company. This does not mean it would overtake Huawei Technologies or ZTE within the domestic Chinese wireless market but would allow the company to remain a strong number three or four in the market, battling for share against Datang Telecom.

Market Share Shifts in 2016?

We are not expecting any substantial BTS or TRx market share shifts for 2015 vs. 2014 given the situation for continued LTE network deployments in China. We expect the BTS and TRx market to favor the Chinese OEMs in 2016 with continued focus on China but 2017 may be a completely different story once the LTE rollouts are completed in China and Huawei Technologies and ZTE will need to look elsewhere to maintain market share. This may lead to another potential pricing bloodbath in the market.

EJL Wireless Research recently published a market analysis and forecast on the global macro BTS antenna industry. The overall market grew 49% in revenues to $4 billion in 2014, with Tier 1 suppliers commanding a 41% market share.