Jim Patterson this week peers into Verizon earnings and look at three of their emerging businesses

There’s a lot to like about Verizon Communications’ earnings, and at the same time a lot to fear. Overall, things came in pretty much in line with expectations – 449,000 postpaid wireless phone net additions; 0.96% postpaid retail monthly churn; and strong cost discipline across the board helped Verizon beat most estimates. Analysts will argue over the accounting treatment for equipment installment plans (which inflate revenue growth in early years), but of all the carriers, Verizon is the most likely to be able to sustain yields due to their network quality.

Verizon is big and growth is steady, at least in wireless. The 0.96% monthly churn experienced in the fourth quarter equates to just over 1 million subscribers who leave Verizon Wireless monthly. Thirty-nine billion dollars in companywide operating cash flow in 2015 funded a lot of capital and spectrum expenditures (and reinforced their network quality message with $11 billion to $12 billion in additional wireless spending).

Around the core, however, are a series of initiatives. On the consumer side, Go90 continues to build awareness and increase downloads – Go90 is currently in the top 20 “entertainment” applications on iTunes (top 400 overall). It is faring even better as the No. 2 entertainment app on Google Play. Content keeps getting better with NFL playoff previews drawing a lot of interest. It’s clear Go90 is beginning to build a viewership thanks to content and AOL.

The Go90 comment community (which, admittedly can be negatively biased) is particularly sour on the app, however. Most of the recent comments are not about the content (in most cases the customer has a specific show in mind), but rather accessing it. There are many comments about phone restarts, buffering and jitter – generally things that would be associated with the network provider. When we looked at Go90 a few months back, network quality and the overall product were great. Are these random complaints, or could they be indicating a scaling issue? While Verizon has indicated Go90 is still very early in the lifecycle, it may be in major makeover mode by summer if customer feedback does not improve.

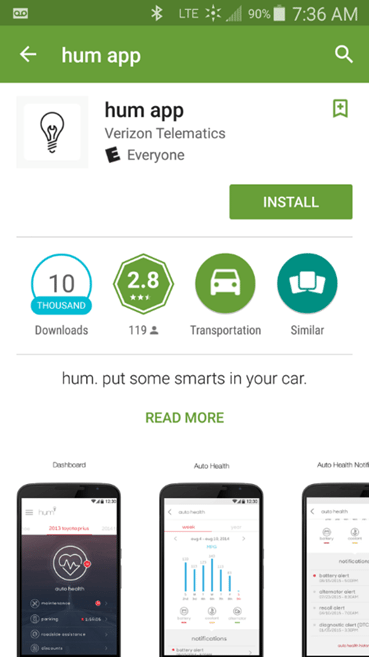

Secondly, there’s Hum, Verizon’s under the dash on-board diagnostic product they picked up with the Hughes acquisition (and the closest in product features to General Motors’ OnStar service). Another product seemingly full of promise, until you look at the number of Google Play downloads (10,000 to 50,000; see nearby picture). Hardly a number to be proud of given Hum has been on the market for nearly six months and Verizon has a very strong Android user base.

Verizon is currently competing against three other products (Zubie, Automatic and Vinli) who do not charge a monthly fee for an OBD service (Vinli offers in-car LTE as a premium service, however). While one trip to the mechanic could consume an entire year’s worth of $15 monthly service fees, there’s the perception Verizon is a more expensive (and less valuable) service. On top of product concerns, Verizon stated on its latest conference call they had distribution issues (lack of in-store stock) in the fourth quarter, which may have stunted sales.

Hum is a bundle-ready product capable of being distributed to Verizon’s 100 million-plus retail postpaid customers. Why is Verizon making the first few months of their launch so difficult?

Finally, Verizon has done more to market skinny bundles to their Internet base than any other provider. This “everyday low pricing” strategy is working, perhaps a little too well. Verizon disclosed on the conference call that one-third of their video sales are coming from their Custom TV packages.

For those of you unfamiliar with Verizon’s Custom TV, it carries a $55 per month price tag (with no contract), which includes a baseline of local and other channels plus two channel packages (pick from Lifestyle, Entertainment, News and Info, Pop Culture, Kids, Sports and Sports Premium). Custom TV, when combined with Netflix or HBO Go builds a different sort of entertainment package than Verizon’s Preferred HD tier and costs the same. This means one could have a cable package without ESPN (or CNBC, or We TV). No wonder ESPN is suing Verizon over their offer.

Leading with Custom TV makes sense. While Verizon has added more than 700,000 net new FiOS video subscribers over the past year, their penetration has fallen. Customers are very willing to take FiOS Internet (at 50 megabits per second and higher speeds), but not as willing to step up to a $75 to $100 per month video package (FiOS Internet penetration is now at 41.8% of homes passed vs. 35.3% for video, and this gap has doubled in just over two years). With Amazon.com, HBO, Netflix and others actively competing for the next $20 in average revenue per user, Verizon should be making it easier to create custom bundles and integrate into wireless. Currently, the bundle offer and package interoperability are disjointed if they exist at all.

Can a start-up grow within Verizon (or any other similarly sized company) without being suffocated by the core? The simple answer is yes, but it will require daily executive support from Verizon’s senior team (even when times get tough). Leave the management of the business to Go90, Hum and Custom TV. Give the teams system and process interfaces to make high growth targets attainable (but understand that $40 million to $50 million in growth might be the best Hum can do in 2016). Focus on how to use these products to grow market share against AT&T, Google and cable.

The “start-in” world is new for Verizon and the odds are against all three succeeding. The products need to stay competitively fresh and there needs to be some patience for a quarter or two of pivoting (all common things if they were stand-alone startups). Most importantly, fighting the internal inertia of “core priorities” is the job of executive management – they ultimately determine whether these saplings grow into trees or get cut down for kindling.

CableCard recent developments and implications

CableCard development has inspired a lot of letter writing and public relations activity this January. Specifically, a group led by Common Cause, Free Press, Public Knowledge and others are lobbying the Federal Communications Commission to update the current set-top box standards and make them more open (see their letter here). This would allow consumers’ electronic programming guides to display Hulu, Netflix, Crackle, HBO Go and other third-party programming services. Combined with products like Verizon’s Custom TV (see more below), the video experience could move beyond selecting “favorites” from your remote control into a truly personalized experience.

For those of you who are not video programming experts, the EPG is the closest representation of the video brand that exists. Companies like Comcast have spent hundreds of millions of dollars building user-friendly interfaces (which have dramatically improved over the last five years). This has included redesigning set-top box hardware that is rented to millions of customers per month (a recent study shows $232 is spent per subscriber per year on set-top box rentals, although cable companies have been increasingly accepting of Roku, PlayStation and other third-party equipment as substitutes). Changing the EPG user interface is a new horizon and a very big deal.

The next step is likely an FCC Notice of Proposed Rulemaking on the topic. This could be an interesting “parting shot” for FCC Chairman Tom Wheeler.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.