Sprint customers can again select a subsidized price on a new device, though a dinged for higher access charges

Just months after ditching the practice, Sprint has revived two-year service contracts for customers looking to score a subsidized price on a device.

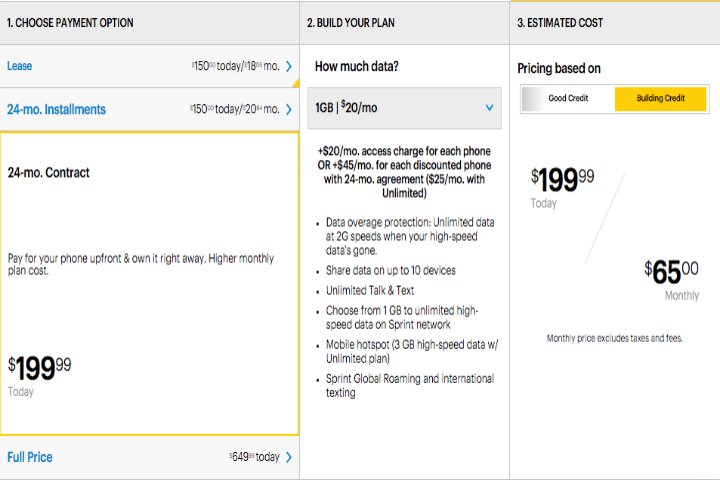

As reported by Fierce Wireless, the carrier slipped the two-year contract option back into its various device purchasing options allowing customers to pay a lower flat-rate price on a device in exchange for paying higher monthly access charges. Customers, for instance, can now select to pay $200 up front for an Apple iPhone 6s, but are then required to pay an additional $25 per month in extra data access charges compared with selecting one of the carrier’s payment or lease options.

Customers can avoid the additional access charge by selecting the carrier’s “unlimited” data package, which is priced at $75 per month, or avoid all access charges by choosing to pay the full price on the device up front.

Sprint earlier this year removed the two-year contract option from its lineup, noting most of its customers were selecting to either lease or make monthly payments on devices. The carrier boosted the take rate for such options by dropping the monthly access charge per device for customers on shared data plans.

Sprint joined rivals T-Mobile US, Verizon Wireless and AT&T Mobility in removing the device subsidy option for customers.

The move towards device leasing and monthly payment plans last week drew a stinging rebuke from one financial analyst firm, which questioned the industry – and Sprint specifically – in how they account for such financial dealings.

According to Craig Moffett of MoffettNathanson, Sprint sourced 71% of its earnings before interest, taxes and depreciation from “accounting distortions” during the fourth quarter of 2015. Moffett said the accounting distortions started when carriers moved to device financing instead of subsidized pricing, and Sprint’s financials became even further divorced from reality when the carrier started leasing devices.

“Things really went off the rails when Sprint started doing leasing and I wouldn’t be surprised to see others start doing leasing because of the distortion, or benefit, that Sprint has gotten,” said Moffett. “On an as-reported basis, Sprint looks like it’s growing [earnings before interest, taxes, depreciation and amortization] at just under 30% and it looks like it’s trading at 5.7-times EBITDA, not an unreasonable number. But if you adjust for all the accounting nonsense, Sprint is actually growing EBITDA at negative 30% and it’s actually trading at 12-times EBITDA.”

Bored? Why not follow me on Twitter