Jim Patterson looks at the current set-top box proceeding from the FCC

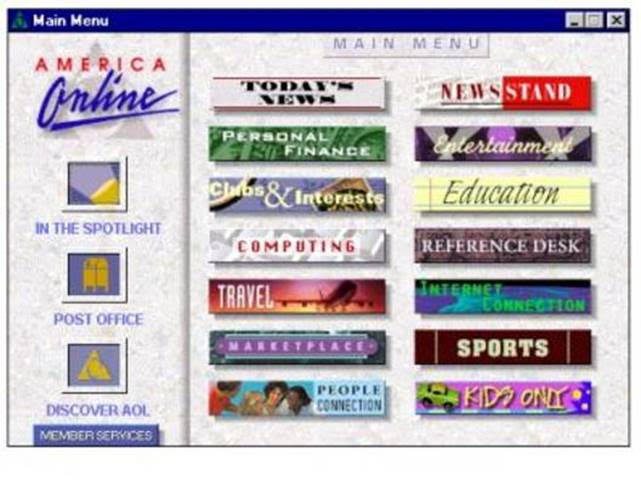

Fresh off the one-year anniversary of enacting net neutrality rules, the Federal Communications Commission turned its attention to Section 629 of the Telecom Act of 1996. Yes, the STB has been clinging to the same rules and regulations that we had before Yahoo, YouTube, Twitter and the iPhone existed. Innovation at that time was best captured by America Online.

It’s hard to argue that the rules shouldn’t be refreshed, but what should they encompass? The current NPRM objective (full link here) is as follows (note: MVPD stands for multichannel video programming distributor, a.k.a. a cable/satellite/fiber provider):

…Consumers should be able to have the choice of accessing programming through the MVPD-provided interface on a pay-TV set-top box or app, or through devices such as a tablet or smart TV using a competitive app or software. MVPDs and competitors should be able to differentiate themselves and compete based on the experience they offer users, including the quality of the user interface and additional features like suggested content, integration with home entertainment systems, caller ID and future innovations.

It’s important to realize the ramifications of the FCC’s decision. First, the FCC is mandating change that has broad implications to several industries. This should come as no surprise to anyone who has dealt with this FCC, which issues regulatory mandates to counteract the inability of the legislative branch to revise what’s now a 20-year-old-technology focused law. The FCC would like to have a “[World Wide] Web” look and feel to the first screen, which incorporates as many options as possible. This could include “recently watched” or “Facebook friends recommend” or even “sponsored programming” (let’s not forget that high-speed Internet caps are going to become more prevalent over the next decade). A more sophisticated box could have biometric (fingerprint) detection, which would personalize the electronic programming guide for each member of the family. Choices would proliferate, and more opportunities lead to more competition, higher quality content and a better customer experience.

This all sounds good, but is the problem one of content availability or one of content organization? Is the FCC trying to get rid of broadcast channels (and their scheduling/organization model) through this process? That would appear to be the likely outcome – an interesting “back door” regulation whereby the FCC alters the structure of set-top box provider, MVPD and broadcasting industries with one rulemaking (for an excellent read on this ruling’s effect on minorities, see this Los Angeles Times article).

Second, the FCC is mandating change when voluntary options currently exist to solve the problem. Before making this proposal, the FCC should have asked “Why has TiVo faltered (see stock price chart here)?” TiVo’s new TiVo Bolt is beautiful and does everything the FCC wants it to do (see specs here). But it costs $299 for the first year, plus $12.50 per month after the first year (this is in addition to cable package costs). To TiVo’s credit, if the customer has multiple TVs, they could save money versus buying a whole home DVR system, but there’s still the high cash outlay. While this is worth it to TiVo’s current base of 6.6 million users worldwide, is the extra cost worth it to 50 million, 60 million or even 70 million homes? Someone needs to ask the FCC why TiVo (a company started out of the 1996 Act) has faltered and how these new rules will change the equation.

Then there is the issue of existing equipment like Roku, an over-the-top streaming service providing nearly every streaming option possible (including access to Time Warner Cable TV and Spectrum (Charter) TV). Roku offers very affordable hardware and their relationship with both TWC and Charter is strong. While Roku does not provide Web content that could be delivered from a search (or Google Now recommendation), isn’t a Roku solution also solving most of the objectives laid out by the FCC (with over 10 million devices sold in the U.S.)?

Finally, the FCC’s mandate will likely drive up prices for consumers who have little interest in expanding their television horizons. To use the original picture in this section as an example, the FCC thinks we are living under the same limitations as “America Online” provided to dial up users. If we had a browser and the Web connected to our televisions, things would be better. To many viewers, the ability to watch college basketball in February/March, opening day of the baseball season in April, the Masters in May, the Olympics over the summer, the opening of college and professional football in September and the World Series in October is enough. Those sports fans might watch college baseball, but they are not going to search for episode nine of “Curling Night in America.”

To be fair, there are many other user viewing segments that could benefit from the FCC’s proposal. Education channels could emerge that teach children other languages and incorporate those lessons into actual broadcasts (kind of an enhanced Khan Academy). America’s cooking skills could improve through a mix of traditional broadcast media and Web-based supplemental data. And Amazon.com could launch a “channel” that would sit next to QVC and other shopping channels providing alternative (cheaper?) options to those they are viewing.

These options sound appealing, but will television viewers make the switch from their ESPN/CBS/NBC/ABC/Fox/Fox News habits to this new mode? If not, will the costs of the mandate exceed the benefits? If my box has issues, who gets the call – Comcast, the EPG developer, Wal-Mart/BestBuy or the hardware maker? And, since the FCC chairman has promised there will be no ad inserts or wrap-around advertising permitted by Google or others, how will the new entrants make money?

Bottom line: The FCC’s proposal sounds good, and no one points to their set-top box as the paragon of technological development (except for the latest version of Comcast’s Xfinity X1, or TiVo,or perhaps the Roku). But replacing today’s equipment and EPG with new models is going to cost customers more money than $8 per month unless the customer sacrifices its privacy (to improve Google’s profile). The FCC should say to communications providers: “Treat your set-top box the same way you treat your cable modems, and make each model available at mass retailers such as Amazon and Wal-Mart.”

However, if the FCC were to move forward with their current proposal, they should mandate that customers of these new devices are allowed to opt out of data collection at any time with no ramifications (including pricing), and to require the opt-out option to be clearly and uniquely presented each year thereafter. This would remove the current perception that the FCC is in Google’s back pocket.

5 you may have missed

1. California’s Office of Ratepayer Advocates weighed in last week against the Time Warner Cable/Charter/Bright House Networks merger. Their arguments against the merger largely mirror those of Dish Networks. This will likely have a minimal effect on the public utility commission’s decision, but some of the conditions they are attaching up the ante considerably.

2. Wall Street research analyst Craig Moffett sent a note out detailing Google Fiber’s video customer count (obtained through the Copyright Office). (Note: high-speed data customer counts and home penetration rates are expected to be higher). Of special note is the Provo, Utah, market has grown a whopping 65 customers over the past six months. While Moffett’s analysis is not public, there were several articles on his work including here.

3. Amazon reverses course and says the next version of the Fire operating system will have an encrypted data option. While we have decided not to weigh in on the current legal activities between Apple and the Justice Department, it is interesting that one of Apple’s biggest supporters admitted this week they are dropping device encryption support in their latest OS release. An Amazon spokesperson wrote to TechCrunch that “we will return the option for full disk encryption with a Fire OS update coming this spring.” More on the admission and Amazon’s change here.

4. Sprint replaced the last of the Dan Hesse operating team with the hiring of Robert Hackyl to lead customer experience and service functions. Hackyl comes from Vodafone, but also formed T-Mobile US’s channel strategy “from scratch” during his work there from 2010-2013. More about the change (from “Bob” Johnson to “Robert” Hackly) in this release.

5. Sprint has quietly brought back subsidized devices. More in this recent article from FierceWireless.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.