Jim Patterson reminds everyone he called the T-Mobile Binge On agreement with YouTube, and writes 3 headlines for Q1 broadband earnings

This week, we’ll dive into three headlines that will impact first quarter (and 2016) earnings. But first, a quick look at the latest development with T-Mobile US’ Binge On product.

T-Mobile and YouTube Binge On together

Last week, the telecom and Internet worlds came together with the announcement T-Mobile US’ Binge On service would now support YouTube. Specifically, T-Mobile US announced they would allow content providers to opt in or out of which video streaming feed they used on an individual case basis.

As most of you know, T-Mobile US (including MetroPCS) and Google have had a long-standing relationship. When Google was not announced as an initial Binge On partner, many were surprised, but we commented “bringing YouTube into the Binge On catalogue was a matter of time.”

T-Mobile US did this by smartly changing their policies. First, they will allow any video service provider to opt out of the service and will publish this list on their website. Second, they will allow content providers to self manage their own video streams and optimizations.

This is a big deal, and it’s hard to believe others will not adopt these policies. As we discussed with T-Mobile US a few weeks ago, they received a one-time 10% to 15% capacity improvement with the change to Binge On, and the total traffic growth should be lower than their unoptimized competitors. Another good move for T-Mobile US and a catch-up opportunity for the rest of the industry.

3 headlines that will impact Q1 broadband earnings

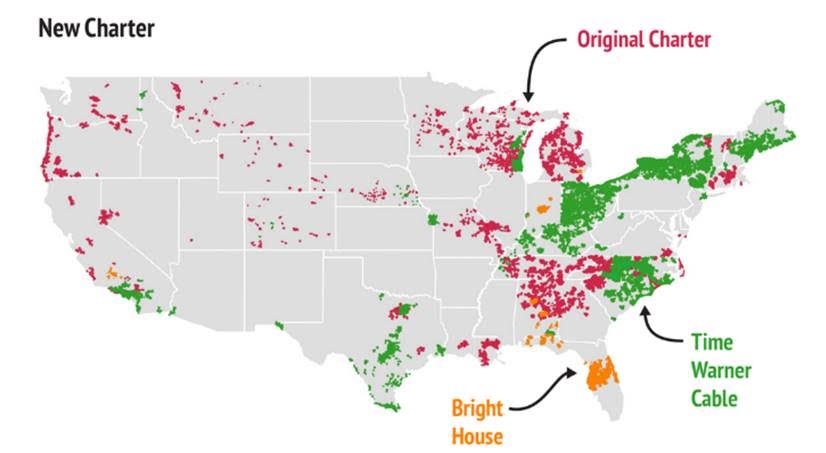

Charter’s merger with Time Warner Cable and Bright House Networks is approved

This almost seems inevitable with reports last week that the Federal Communications Commission is circulating a draft of a conditional approval. According to an article in The Wall Street Journal (see here; paid subscription required), it appears that newest concession would bar Charter from “including clauses in its pay-TV contracts that restrict a content company’s ability to offer its programming online or to new entrants.” While it’s likely Charter would not prohibit the development of competitive over-the-top solutions, it’s equally unlikely they would abandon their volume-based per-subscriber pricing from content companies.

The most important item to get hammered out with the FCC is the compliance window. Charter agreed early on in the approval process to no data caps; waived interconnection fees with companies such as Netflix; and no paid prioritization and premium services designed to improve their content or services over others. But, they only agreed to this for the three-year period following approval. Assuming at least half of the 36-month term is taken up with broadband expansion, and building systems and processes to handle a prioritized, nonneutral business model, three years could go by pretty quickly. Longer than that could complicate things, especially if the courts rule against some or all of the FCC’s recent Open Internet Order (their decision is due within the next month).

An interesting article also appeared last week in Investor’s Business Daily suggesting Comcast and the new Charter could enter into a series of property exchanges to further improve their respective company economics after the transaction. While no specific properties were mentioned, there continues to be a lot of fragmentation in Connecticut, New Jersey, South Carolina, Louisiana and Kansas City (to pair with Charter’s St. Louis property). It’s even possible Cox Communications could enter the deal-making fray with a swap of their lucrative northern Virginia properties to build a stronger Midwest or California presence. It’s very unlikely any major properties will be swapped (except Maine), but a lot of incremental value can accrue to trading parties from these after-merger transactions.

After FCC approval, the California Public Utility Commission still needs to vote on the merger, scheduled for May 12, and, judging from the hearing held earlier this year, Charter appears willing to cut a deal to garner approval. New York City gave their approval on March 9, with moderate but reasonable concessions (see Bloomberg Business article here).

The opportunities created by the combined company (especially with some moderate reclustering) are going to be great. The new Charter will be a stronger competitor to AT&T in California and a stronger defender against a resurgent yet concentrated Verizon Communications FiOS footprint in the Northeast. And the new Charter is a few billion dollars of investment away from having very dense Wi-Fi coverage in their top 10 metropolitan markets (see Dallas coverage improvement article here), which is a lot cheaper than buying a wireless company or entering into a mobile virtual network operator agreement with Sprint or T-Mobile US.

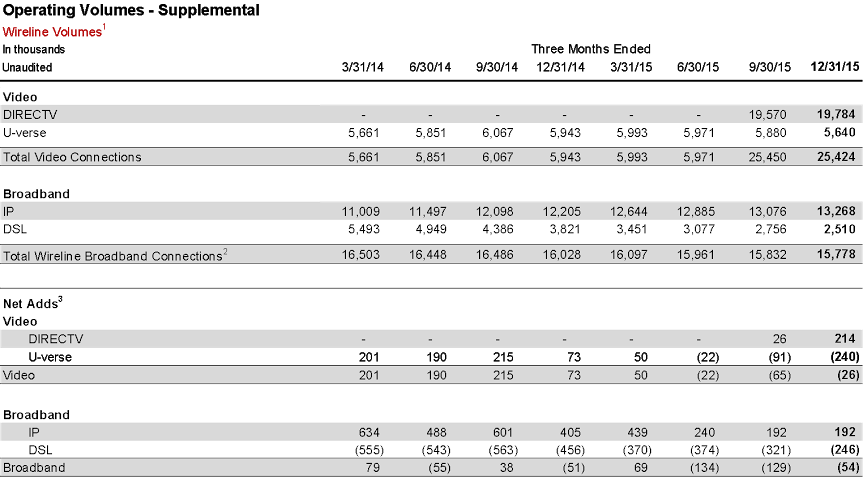

AT&T loses broadband customers

I hope this headline is wrong and that AT&T will report moderate to significant gains because of their Velocity IP investments (which were great). However, there’s no indication from CFO John Stephens’ latest investor presentation that this headline will take place in the first quarter. Here’s the eight-quarter trend from AT&T’s last earnings report:

The issue with AT&T is attraction, not conversion. It no surprise the DSL platform is shrinking, but one would expect if AT&T’s broadband platform were valuable and attractive, net additions would exceed DSL losses. However, AT&T’s IP broadband net additions slowed significantly in the last three quarters of 2016, down 51% in Q2, 68% in Q3 and 53% in Q4. As a result, the company lost 200,000 more broadband connections in the last three quarters of 2015 than the last three of 2014. The new product is selling to some existing customers, but is not wooing existing cable customers away.

To be net add positive for broadband customers in the first quarter, AT&T will need to grow at least 290,000 to 310,000 IP broadband subscribers and keep DSL losses on their downward trajectory. Nothing in AT&T’s latest commentary (specifically Stephens’ comments at the Deutsche Bank conference on March 10) would lead investors to believe consumer broadband revenue growth is a strategic priority for the company (or that it’s even a priority).

When asked about competitive capabilities, Stephens cited the 14 million home fiber build out as an FCC “commitment” and he quickly shifted from making home broadband profitability a priority to the value of having a common shared fiber infrastructure (which their cable competitors have been putting into place for close to a decade). There is no doubt a local fiber presence will help in comparison to Sprint and T-Mobile US (or even Verizon in AT&T’s region), but does AT&T face diseconomies of scale because they have underinvested in building a residential broadband brand? Can a residential strategy be complete without including broadband?

Stephens’ comments create a stark contrast to cable: AT&T is focused on everything but broadband (Mexico, DirecTV integration with wireless, cost synergy achievement, enterprise growth), while cable companies, CenturyLink and Frontier Communications are singularly focused (or nearly so) on broadband. That should give investors pause: the prospects of slow/no broadband growth in what has historically been a strong quarter for AT&T sets the stage for a rocky 2016 growth picture. More broadband focus (including some soul searching on what will drive competitive advantage versus cable, Google Fiber and other third-party over builders) is needed.

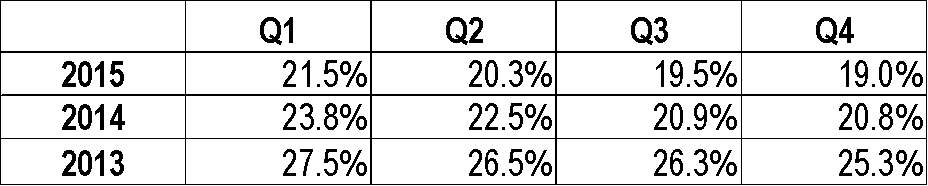

Comcast Business posts 20% growth

It’s hard not to read one of these columns that does not include something about the commercial services growth, but in case you are not aware, Comcast and much of the cable industry has been growing commercial services revenues like a weed for the past seven years and Comcast now has $5 billion in annualized run rate revenues (still five-times smaller than AT&T, three-times smaller than Verizon and about 50% smaller than CenturyLink, but a strong showing nonetheless).

In particular, the year-over-year revenue growth for Comcast Business Services has been very consistent and robust over the past eight quarters:

To no one’s surprise, the first quarter tends to be the strongest as projects get kicked off, budgets are approved and weather improves. What is incredible, however, is the growth rate through the subsequent quarters. With more capital being allocated within Comcast to medium and enterprise services, the opportunity to consistently grow at 20% rates should exist for the next three years (if they hit it, the result is an $8.7 billion unit in 2018, and might be the largest provider in many/most of their service footprint). By contrast, the prospects for business services revenue declines of 2% to 4% at AT&T and 3% to 6% at Verizon for the next three to five years.

As Comcast CEO Brian Roberts indicated earlier this month at an investor conference, Business Services is very accretive to earnings and has attractive payback periods. The value proposition is based on fast connectivity at affordable rates and tends to carry 24- to 36-month terms. As was seen at the recent Channel Partners Show, they are definitely investing in distribution. Provided that cooperation continues with their cable peers to provide a national footprint, high-growth rates should continue for Comcast Business Services for the foreseeable future.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.