Retail and logistics industries most aggressive

A survey of more than 500 hundred global companies across 17 industries found more than one-third either have deployed small cells or plan to do so this year. The research, conducted by Nemertes for the Small Cell Forum, showed 14% of respondents already using small cells, with another 31% planning to deploy this year.

Companies in the travel and transportation industries expressed the highest level of interest in small cells, but when it came to actual deployments or plans to deploy, other industries ranked much higher. The logistics and distribution industries had the most deployments and/or plans to deploy. Retail, construction and electric utilities also scored high marks for actual deployments.

The companies surveyed said the No. 1 reason for deploying small cells is to support a mobile-first workplace where employees often use their own devices. For this reason, multicarrier support was very important to the survey respondents. The companies said voice remains a key driver of small cell interest, but they also expressed a strong interest in voice over Wi-Fi.

More than half the survey respondents said they would prefer to work with a mobile network operator that offers small cells and 63% said they would pay more for improved quality of service. Small cell developer SpiderCloud Wireless sees more companies stepping up to pay for all or part of their equipment.

“The breakthrough from service provider to enterprise is gradually happening as operators certify gear for the network and willing buyers are showing up,” said SpiderCloud director of enterprise Art King, who joined the company from a multi-national where he was tired of working in offices without cell service. “There is evolution in thinking about spectrum management and controls, but it will still be a journey as the mobile operator, at end of day, has total control of what to allow onto their spectrum.”

King said SpiderCloud typically serves larger enterprises, which can save money by managing mobile services for employees because they can pay bulk rates for minutes and data. In these companies, seamless unified communications is the primary motivator for small cells, King said.

“There are a ton of IT people who have tried and failed to do UC and enterprise integration on mobile with Wi-Fi and [over-the-top] apps, now they just want the device to work everywhere without anyone calling them,” King said, adding he also sees strong demand for building owners who cannot lease their properties without a good indoor signal from at least one major carrier.

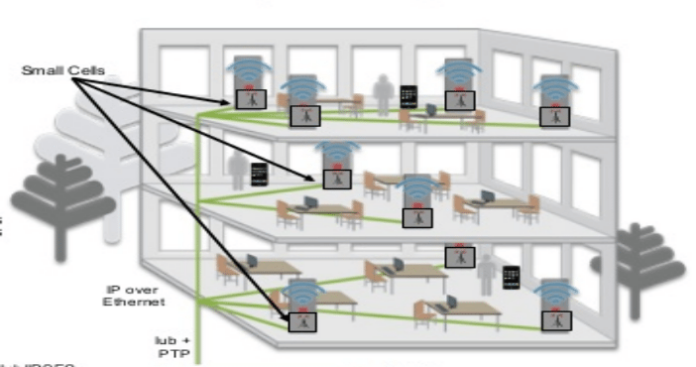

“[The] real estate community is seeking [a] cost effective tool to make at least one of the two major U.S. enterprise mobile operators be awesome in-building,” King said. “We are also seeing third-party riser owners installing ‘host neutral Ethernet’ and inviting above-ceiling small cell installations to solve the cellular problem for smaller buildings where the fixed costs of legacy solutions are too much to bear.”

Follow me on Twitter.