Jim Patterson digs into Verizon Q1 results, noting a potential zero-rated Go90 offerings; and questions the FCC moving the goal post on the cable industry

Verizon Communications reported first quarter earnings (link here) that generally met expectations. They have already completed several items on their 2016 “to do” list. Here’re some takeaways on their earnings release:

1. The Frontier transaction is closed. As a result, debt is being reduced and cost structure rationalization is continuing for the remaining wireline unit (Verizon reported the earnings before interest, taxes, depreciation and amortization margin for the wireline unit without the divested properties is 19% – see nearby chart). Realizing a lower cost structure has been a long-time initiative for Verizon, but the divestiture of a more profitable unit clearly brings the labor cost challenge into focus. Less debt, but more sales required in a geography that is growing more slowly than in the south and west. Reducing the cost structure is going to be a big challenge and the cost attribution to wireless and “5G” technology is likely how they will achieve it (see point No. 2 below).

2. The XO Communications acquisition is going to provide Verizon with a lot of intracity fiber. In discussing the Boston FiOS buildout, Verizon CFO Fran Shammo stated $300 million of incremental capital expenditures would be needed over the next five to six years to complete the footprint expansion. That’s a rounding error to Verizon’s overall annual expenditures, likely attributable to both 5G and FiOS, which should help Verizon’s ability to competitively price services in Boston (building out Baltimore and Virginia will likely require more new capital due to XO’s lack of fiber in these markets).

3. Wireless customers are holding on to their smart devices longer than they did during previous years. Verizon Wireless postpaid upgrade rate was 5.8%, down from 6.5% in Q1 2015, and lower than most analysts expected. This had a mixed benefit: fewer upgrades helped churn (0.96%, a strong figure), but fewer equipment installment plan upgrades lowers in-quarter revenue. Verizon also commented that more wireless subscribers renewed their devices on traditional subsidy based plans than they expected.

4. “The Tracfone brand is our prepaid product.” That’s a huge admission from Verizon and perhaps the first time they have been that bold and clear. Here’s the full quote from Shammo in response to a question about AT&T and T-Mobile US’ prepaid gains:

“Our retail prepaid is above market. We’re really not competitive in that environment for a whole host of reasons and it’s because we have to make sure that we don’t migrate our high-quality postpaid base over to a prepaid product. If you look at the competitive nature, they are doing it with sub brands. They are not really doing it with their brands. And quite honestly, we use the Tracfone brand as our prepaid product. Tracfone has been extremely successful for us. It’s not something that we disclose any more on reseller, but it continues to increase on the high-quality base of Tracfone, so that’s really where we use and go after the prepaid market. More to come on this during the year, but currently that’s how we operate under the prepaid model.”

This alliance makes a lot of sense. AT&T is likely to bundle Cricket Wireless with DirecTV in the (near) future, and T-Mobile US is using MetroPCS to take share from Boost Mobile/Virgin Mobile USA (Sprint) and Tracfone, so the opportunity to have a strong relationship with any particular carrier is limited. While not surprising to those who follow the wholesale wireless industry, it was a pretty big statement from Verizon. It will be interesting to see if America Movil, the parent company of Tracfone (and a direct competitor to AT&T Mexico), views the relationship in the same manner.

5. Verizon is aggressively pursuing new content acquisition. Their strategy, which involves investing in content creation companies with well-known media outlets such as Hearst, is in its infancy. But, Verizon is not playing for second place. On the conference call they announced they were focusing on leading mobile-first content that did not originate in the home. AwesomenessTV (Verizon now a 25% owner) is the No. 1 digital brand for females ages 12 to 24 with 160 million views and 53% growth, and Complex TV (acquired with Hearst) is the No. 1 digital brand for males aged 18 to 24 with 54 million monthly unique viewers and 300 million total views per month.

Since many teens do not watch content in the den or family room, this is a different, but wise strategy nonetheless. For most in this demographic, the screen in their pocket is their TV.

Here’s the rub: While available to all wireless subscribers, Go90 isn’t zero-rated unless you are a Verizon Wireless postpaid wireless customer. Perhaps the announcement to which Verizon was alluding in the quote above with Tracfone was a deal that zero-rates Go90 content. That would be a game changer.

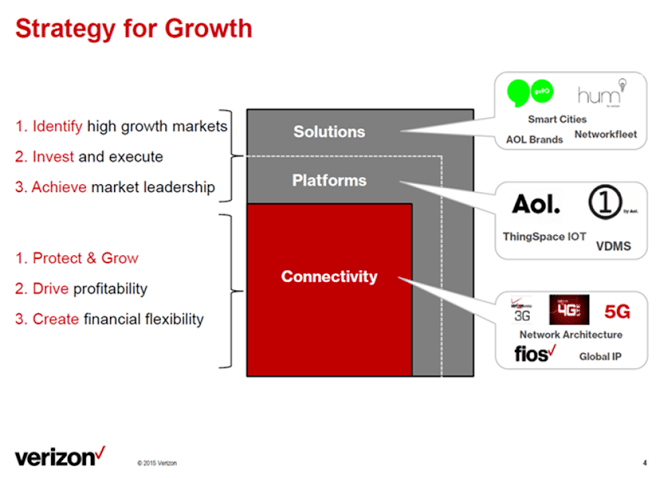

Verizon is changing. They led off their investor presentation with the nearby chart. While this may seem like déjà vu for those of us who remember the AOL/Time Warner merger, it is different. Mobile advertising and targeting did not exist, and Time Warner Cable did not have a national wireless footprint capable of distributing zero-rated content to 100 million existing customers. Verizon has the unique opportunity to create a vertically integrated entertainment company, and, unlike AT&T, will emerge as a focused challenger.

History is not kind to transformations like the one Verizon is pursuing. Regulations change (although Title II freedom from the anticipated court ruling would be a plus to this strategy), organizational catharsis sets in and cost challenges tend to take these ambitious efforts off track. As soon as Verizon shows signs that their content strategy is impacting their wireless gross additions, we will become believers. There are many risks to this strategy, however, and we remain skeptical.

Comcast’s Xfinity Partner Program announcement and the FCC’s reaction

Last week, Comcast announced an alternative to the Federal Communications Commission’s set-top box mandate: the development of the Xfinity TV Partner Program (and App). This enables Comcast subscribers to access their programming from Roku boxes, Samsung Smart TVs, and other devices that enable access (Comcast even committed to customizing their app for devices that do not support HTML5).

In the aforementioned blog post, Comcast has an interesting reference to its search feature:

“As part of the Xfinity TV Partner Program, Comcast is prepared to provide consumers with a capability to search through Comcast’s video assets from a device’s user interface with playback of a selected asset via the Xfinity TV Partner app. However, in order to provide a cohesive customer experience, such integrated search needs to include more than just this app; it must also include similar data from other video apps as well.”

Comcast appears from this paragraph to not only be providing an alternative to the $230 per year annual expense many pay for set-top boxes, but also appears very open to allowing other video content to be shown alongside their app.

In a related announcement, Comcast and Roku (see nearby picture) joined forces to bring the Xfinity TV app to the Roku player and Roku TV.

As we discussed in a previous column on the topic, Roku has a meaningful market share in the streaming device market alongside Amazon.com, Apple and Google. Enabling each of their devices with Comcast’s app will reduce the number of Xfinity set-top box rentals that are needed. This also might allow expansion of existing video services to rooms where set-top boxes do not exist (Time Warner Cable used this tactic when launching their Roku partnership in 2013, and has a very unique trial going on with Roku in the New York City area described here).

Comcast enabling Xfinity without a cable box; Time Warner trialing plans that include free Roku equipment instead of a traditional cable box; Suddenlink actively offering TiVo in lieu of their cable boxes. All of these innovations should make the FCC happy, right? Their regulatory initiative forced Comcast’s hand and now consumers will have a choice between a cable box and more innovative solutions. Here was the FCC’s comment on the Comcast announcement to electronics publisher CNet:

“While we do not know all of the details of this announcement, it appears to offer only a proprietary, Comcast-controlled user interface and seems to allow only Comcast content on different devices, rather than allowing those devices to integrate or search across Comcast content as well as other content consumers subscribe to.”

This seems to indicate a “goal post move” by the FCC. President Obama clearly stated the FCC was trying to solve the $230 per year set-top box rental problem in his recent weekly radio address (device competition is the basis of section 629 of the 1996 Communications Act, which gives the FCC the authority to issue the Notice of Proposed Rulemaking). Now that Comcast has announced their willingness to allow Xfinity content in a manner that is not tied to owning/renting a Comcast box, but the FCC has redefined the problem to be unintegrated content and the lack of comingled choices. Simply put, the FCC does not believe that Comcast, Time Warner Cable, Charter or their partners Tivo or Roku solve the content organization problem, which has replaced the set-top box affordability problem.

Bottom line: Comcast’s actions are a step in the right direction. The FCC is wrong to move the goal posts and it’s highly unlikely they have the authority to define how electronic programming guide content is organized. They should let the market determine how channels are presented (if you do not have a Roku or Tivo box I would urge you to find a friend who does, look at their experience and imagine a Comcast TV channel alongside the current pay and free choices).

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.