Jim Patterson looks at T-Mobile Q1 results in terms of what could slow down the carrier moving forward

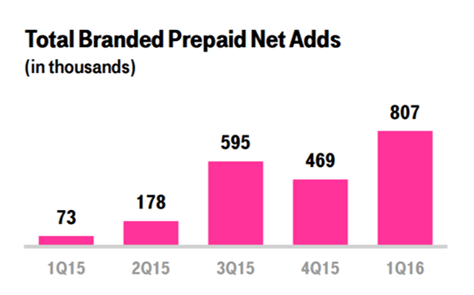

T-Mobile US announced earnings last week, and the results were strong across the board. Prepaid was especially strong (807,000 net adds; 3.84% monthly churn), as MetroPCS took share from Sprint (retail as well as Boost Mobile/Virgin Mobile) and other smaller brands. T-Mobile US’ opportunities continue to expand as their LTE and 700 MHz (Band 12) networks grow.

Rather than a straight dive into their earnings or comparing their progress to the “to do” list we built after the first quarter release, I thought it might be beneficial to talk about three factors that would cause T-Mobile US’ momentum to be derailed. Their metrics were good and sensing the possible headwinds is not easy to do, but here’re a few thoughts about what could derail their three-year winning streak:

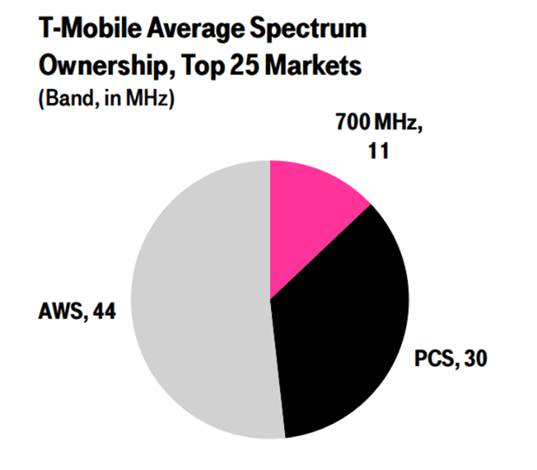

1. They could run out of spectrum (or the cost to densify the existing spectrum could be too steep). T-Mobile US has made it clear for a long time that they needed 600 MHz capacity to meet data needs (50% annual growth adds up after a few years). On the earnings call, they were quick to describe their $7 billion to $8 billion trove available for the auction.

One of the important announcements surrounding spectrum available came last Friday, when the Federal Communications Commission announced 126 megahertz of spectrum would be available (the amount by market varies, but the vast majority of markets have 10 blocks of 10 megahertz spectrum available with minimal interference). The bottom line of this announcement is that there will be plenty of spectrum for bidders to purchase.

Could Comcast, NTT DoCoMo, America Movil and other spectrum speculators bid up reserve allocation (30 megahertz) auction and make the spectrum too expensive for T-Mobile US? It’s technically possible, but the likelihood is remote, especially since they could purchase spectrum in the remaining 90-plus megahertz that’s available to all bidders (including Verizon Communications and AT&T). Could the FCC have generously qualified some spectrum as being “unimpaired” that takes years if not a decade to clear? Perhaps, but again, the chance is very remote.

After the FCC’s announcement, the exact opposite scenario becomes more likely: T-Mobile US shows up at the auction and bids $8 billion for a large swath of spectrum (30 megahertz the best case), which sets the company up for capacity for the next decade.

2. T-Mobile US could face a formidable challenge from Comcast following the auction. As we reported previously, Comcast is the largest cable provider yet the least leveraged (even after they buy Dreamworks SKG for $3.8 billion). If no one shows up to the 600 MHz auction, Comcast could see this as a rare buying opportunity and deploy the spectrum as a defensive measure against Verizon Wireless and AT&T Mobility. This would represent a pivot of sorts from their current relationship with Verizon Wireless (Pivot was the name of the product that Comcast, Cox, Time Warner Cable and Bright House Networks formed with Sprint a decade ago).

There’re a lot of “ifs” in the previous paragraph. Comcast would have to pay $5 billion or so for spectrum covering their territory, and another $5 billion or so to have a robust nationwide network (even with the ample supply described above, which should keep overall bid levels in check). While they would have a distinct advantage with owner’s economics on the bandwidth going to each tower, they would not have a competitive advantage when it comes to constructing, operating and maintaining tower assets.

On top of this, Comcast lacks the retail distribution network to distribute traditional smartphones. With enough promotional money, Best Buy or Wal-Mart could provide that network, but it’s unlikely Comcast would be able to avoid the store requirements (people, capital, inventory, etc.). Because smartphones are critical to daily lives, the thought of shipping devices through Amazon.com will not work – stores will be required. T-Mobile US has an extensive exclusive dealer network and has the process of operating and maintaining a store down to a science.

A merged Comcast/Sprint (post-bankruptcy) presents an entirely different competitor. We’ll know more about Sprint’s overall health and the prospect of paying their long-term debts after they announce earnings next week, but if Comcast could receive regulatory approval, a Sprint combination would erase the problems described above. If Comcast had 600 MHz and Sprint brings 2.5 GHz (and minimal indebtedness), the resulting fiber-dense, data-focused, content-capable entity that would result could threaten T-Mobile US … in five to seven years.

The chances of Comcast receiving regulatory approval for the acquisition of any telecommunications asset without giving up a lot in the process is practically zero unless the new FCC Chairman Tom Wheeler is a former Comcast employee (or cable executive). While matchmaking dreams create theoretical possibilities, T-Mobile US’ greatest competitive threat will likely come from an America Movil partnership with Sprint or Verizon, not from Comcast.

3. Regulations (including those tied to merger and acquisition activity) could fetter T-Mobile US’ ability to expand. This scenario does not entirely stop T-Mobile US’ progress, but merely stunts their growth. The worst-case scenario (without M&A activity) goes as follows:

a. The FCC retains the right to regulate wireless carriers as utilities (a.k.a., “full Title II”). Note: Appeals Court analysts believe if anything gets thrown overboard in their ruling, it’s the FCC’s ability to regulate wireless carriers as utilities. What’s important to remember is the Wheeler FCC will continue to press for increased regulation so long as they believe competition will be helped. They feel vindicated from their decision to disallow the Sprint/T-Mobile US merger.

b. Using their newfound rights, the FCC establishes a rule disallowing any sort of metered/slowed content distribution, including Binge On, sponsored data efforts like Verizon Wireless’ FreeBee and the like. Also, the FCC rules that offering products that inherently operate at slower speeds than their underlying networks/devices allow (a four-cylinder governor on an eight-cylinder engine) is also illegal. This would eliminate the practice of data precedence and potentially make the MetroPCS product less competitive.

c. Also, Congress, in conjunction with the FCC, could move to unbundle wireless access (perhaps as a part of a broader unbundling of broadband), forcing T-Mobile US and the rest of the industry to provide would-be competitors wireless access at long-run incremental costs (a TSLRIC for wireless). While this might make some content providers salivate, the probability the FCC and Congress would extend Title II into full unbundling is about as probable as a Bernie Sanders administration receiving Republican support for their tax proposals.

Of course, the FCC could discover plenty of ways to reduce pricing competitiveness short of full price regulation (which is extremely unlikely). They could also open up even larger swaths of unlicensed (Wi-Fi) spectrum at lower 900 MHz spectrum bands (industrial, scientific and medical) and create an effective competitor to 600 MHz, 700 MHz and 800 MHz carrier-owned frequencies. This possibility received a real boost when the Wi-Fi Alliance announced the HaLow band at this year’s Consumer Electronics Show. Cable companies would likely support more 900 MHz Wi-Fi as it would increase the value and reach of their cable Wi-Fi footprint for both out-of-home consumer web browsing and small business customers.

None of the regulatory scenarios described above consider additional FCC conditions attached to a proposed merger, either with Sprint or another carrier (e.g. US Cellular might be a good fit in the north-central U.S., but the complex ownership structure with parent TDS would need to be resolved). Any Sprint acquisition concessions, even under a friendly scenario, could hurt T-Mobile US’ current growth trajectory (although they would be acquiring a large base of customers).

While spectrum concerns, new entrants and increased government regulation could possibly thwart T-Mobile US’ momentum, it would require a cocktail of all three, plus an economic downturn plus the collapse of global credit markets to derail their locomotive. The current $650 porting/switching incentives from Verizon Wireless and AT&T Mobility implemented during the first quarter have not worked. Claims of an inferior network have not worked (especially as T-Mobile US’ network is expanding). Denigrating their metropolitan focus with racially/ethnically charged word association games has not worked. And thoughts that management would grow complacent and “take a breather” is a pipe dream.

Bottom line: It will take a lot of factors, working in tandem, to slow T-Mobile US’ progress. Anything is possible, but as of now, spectrum supply, handset supply, relatively low tablet churn exposure and improved network quality make continued growth the most likely scenario.

Special announcement

I am pleased to announce that I’ll be joining the ranks of full-time employment starting in early June. I’ll be running the North American wireless business for ACN, a Charlotte, North Carolina,-based direct marketer/mobile virtual network operator with three wireless carriers as networks and strong growth potential. ACN has been a client for over three years and their management team is exceptionally strong. Distribution and handsets are two of the important factors when running an MVNO; ACN excels in the former with more than 81,000 sales makers in the United States and growing operations across 23 additional countries.

Many of you understand my love for the Tar Heel state, and especially my alma mater, Davidson College. It’ll be good to re-root there after a 24-year absence. As a result of my new job, my columns will cease publication after the June 6 issue. I’ll be suggesting other interesting blogs and news outlets for you to peruse, and we’ll keep www.mysundaybrief.com up and running (with better indexing) for the next year or so. I’ll still surface as a guest writer, panelist and speaker periodically, but the weekly written column is going to disappear into the summer breezes. If you need more than that, you’ll have to swing by Charlotte and try for a special luncheon edition (or coffee, or happy hour, or … ).

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.